The modern economy of any state represents a widely branched network of complex relationships among millions of economic entities involved and a constant circulation of goods and money. One of the main links in these interconnections is the execution of various transactions, as a result of which mutual claims and obligations are satisfied through payments and settlements. In this context, the payment system occupies a key place in the country's economy, ensuring effective monetary circulation, the realization of economic opportunities for economic entities, and serving as a key instrument for the implementation of the state’s monetary and credit policy.

Today, the Kyrgyz Republic is at the stage of transitioning to a market economy and integrating into the global economy. The process of globalization of the world economy and the associated changes in the payment systems and settlement systems of developed countries directly affect the financial and credit system of our republic. The establishment and development of new economic mechanisms in the country predetermine the increasing role of the banking sector in the economy and the special role of the National Bank of the Kyrgyz Republic.

The payment system of the country is a historically established element of the national economic system. It can be defined as an orderly aggregate of financial and credit institutions that provide the possibility of settling and repaying obligations of economic entities when they acquire material, intangible, and financial resources, as well as the legislation regulating the activities of these organizations and defining the nature of legal relations between financial and credit institutions and their clients.

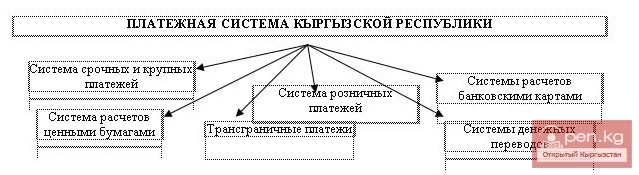

The payment system of the republic currently looks as follows:

The evolution of the payment systems of the republic can be traced back to the establishment of the National Bank in March 1992. Its organizational structure included 5 regional offices and a head office in Bishkek, which also served the Chui region. In order to process all existing payment documents at that time and to compile accounting and statistical reports via computer communication channels on the same day they were created, the first computers were installed in all regional offices of the NBKR, and the corresponding software was set up and configured.

Starting in May 1993, a system of direct correspondent relationships was organized for conducting payments and settlements, and the banking system of the country received a complex cumbersome system of decentralized correspondent accounts, manual processing of paper payment documents, and a huge number of non-payments due to insufficient funds in correspondent accounts. Faced with a difficult situation, commercial banks made separate scattered attempts to create their own automated complexes for processing payment documents, which, however, did not yield significant results. There arose a need to reorganize the payment system, which was unfit for functioning in a market economy.

At the end of 1993, due to the collapse of the USSR and the transition to direct correspondent relationships between the central banks of the CIS countries for conducting intergovernmental settlements, the software in the NBKR was adapted so that all settlements were carried out on the principle of the independence of the monetary units of the central banks of the CIS countries, which were considered as independent currencies. This approach ensured an unchanged technology for conducting intergovernmental payments in correspondent banks in the case of the introduction of national currencies and stimulated the establishment of direct correspondent relationships between the commercial banks of the republic and foreign banks, as is customary in global practice.

Meanwhile, it was necessary to solve problems related to organizing domestic payments. In 1994-1996, the National Bank conducted targeted work to create a radically new payment and settlement system, which included centralized maintenance of correspondent accounts of commercial banks in the NBKR and the creation of a clearing payment system based on paper payment documents. The technology for conducting payments based on clearing was recognized as the most acceptable in the conditions of a developing market economy and suited to the geographical and economic characteristics of our republic. In July 1996, the creation of a unified nationwide clearing system that met the requirements of international financial institutions at that time and allowed for the centralized conduct of all payments in the republic was fully completed. The clearing payment system played a positive role in the development of the payment system of the republic. It minimized the time for processing payments based on paper payment documents, resolved issues of non-payments, and allowed commercial banks to free up significant funds previously required to ensure settlements on direct correspondent accounts, thus providing a powerful impetus for the development of interbank monetary, currency, and securities markets.

The steady growth in the number of payments and the need for "same-day" settlements indicated a demand for the rapid transfer of large sums of payments. Already in July 1997, a gross interbank settlement system based on paper payment documents was put into industrial operation. Since March 1, 1997, the National Bank transitioned to international accounting standards, so the gross system was immediately organically integrated with the accounting system and the data processing center for the clearing system. This event meant that the main settlement systems necessary for a state with a market economy were created in the banking system of the republic, providing commercial banks with the ability to conduct financial transactions and settle them immediately within the operational day. Of course, the gross system could not solve all problems due to its technological and geographical limitations, but its creation marked the beginning of a new stage in the development of the payment system.

At the same time, as part of the modernization of the clearing system based on paper payment documents, and in accordance with the project plan for creating an automated clearing system, hardware and software complexes were installed in the NBKR and all regional clearing centers throughout 1997, and the system was implemented in pilot operation. The pilot operation was planned in such a way as not to disrupt the operation of the existing clearing system based on paper payment documents. Its technology envisaged the simultaneous and parallel operation of both systems to verify the consistency of the results of the old and new clearing systems. However, the transition to electronic payment documents was postponed due to unresolved issues regarding the provision of information security for communication channels, authentication of electronic documents, and legal foundations. In this direction, work began on a draft law on electronic payment documents and a draft general concept for the security of information systems.

At the end of 1997, in connection with the introduction of the automated clearing system, a decision was made to create the National Automated Clearing House based on the former Computing Center of the NBKR. In February 1998, the automated clearing system was transferred to the National Automated Clearing House for operation.

The adoption by the Legislative Assembly of the Jogorku Kenesh of the Kyrgyz Republic on October 15, 1999, of the law "On Electronic Payments" was an important step in the development of the banking system, allowing the use of the most progressive paperless technologies in the banking system for conducting payments and settlements. To ensure the security of the transmitted information over communication channels, a cryptographic protection system for interregional dedicated communication channels and channels between the NBKR and commercial banks was established. A hardware and software complex for generating digital signatures—guarantees of the authenticity of electronic payments—was developed and prepared for pilot operation.

During the development and establishment of the financial and banking system in the Kyrgyz Republic, international banking operations with foreign partners play an important role. For conducting international banking operations, the banks of the republic faced the issue of connecting to a reliable and operational network of banking telecommunications, SWIFT (Society for Worldwide Interbank Financial Telecommunications). In December 1999, all international payments of the National Bank were already conducted through the SWIFT system. The technology for connecting the National Bank to the SWIFT network is based on the installation of a technical central node with access to the SWIFT system, with the possibility of creating a collective use system. Commercial banks were given the opportunity to connect to the system through the central node of the National Bank, which significantly reduced the initial costs of independent connection. As a result of the work carried out, there are currently 21 banks in the Kyrgyz Republic that are members of SWIFT, of which 15 banks operate through the common interface of the SWIFT NBKR (including the NBKR), and 6 banks operate independently.

In recent years, the development of market relations in the economy has led to a rapid increase in the volume of payments. The total volume of cashless payments through interbank systems amounted to 293,912.85 soms in 2007, which is more than twice the size of the real GDP in 2007. As for the development of the banking payment card market, there is also significant progress, considering that this area in the development of national payment systems is relatively young in our republic compared to other countries. The total number of cards issued by banks amounted to 58,892 payment cards, of which 43,233 cards were issued under "salary" projects, meaning that only just over one percent of the population has payment cards.

The results of recent years have confirmed that the financial sector is rising to a qualitatively new level of development. However, the economy still faces the problem of the predominance of cash transactions. The indicators for the number of bank accounts remain extremely low, at about 7 percent per 100 residents: the population of the country is 5.1 million people, of which nearly a third live in cities, and the total number of bank accounts as of January 1, 2008, amounted to 358,677 accounts.

Payments of salaries, pensions, benefits, and budget revenues are usually made in cash, which negatively affects the development of the economy of the country as a whole. The predominance of cash is a sign of a low level of transparency in financial flows, a low level of the taxable base, which, in turn, affects the reliability and timeliness of budget revenues and expenditures of the state. The cost of producing cash is quite high for the state and increases over time, as it constantly has to address issues of transportation, cash collection, storage, and requires the use of special transport, personnel, significant time, and labor.

All this is one of the reasons for the insufficient level of internal investment potential due to the low level of the deposit base and the lack of resources for developing credit lines for banks and investments in the real sector of the economy.

Currently, to reduce the volume of cash transactions, the National Bank of the Kyrgyz Republic, together with ministries and departments, is conducting a comprehensive set of measures to implement the State Program. The main goal of the program is to increase transparency and optimize monetary circulation, ensuring free access for the population to banking services not only in cities but also in rural and remote areas of the republic. The key to success in achieving this goal is the coordinated and synchronized actions of the state, business, and the population.

The current stage of implementing the State Program and developing payment systems in the republic is characterized by the increasingly active introduction of new information and telecommunications technologies that contribute to enhancing the efficiency of the payment system, which is ultimately determined by security, low costs, and the time taken for payments. Thus, in 2006, a Batch Clearing System was created, which provides services to banks for the centralized processing of mass payments from clients for all bank obligations. In addition, the hardware and software complex "Unified Interbank Processing Center" was launched, which is a key link in the unified national interbank system "Elkart" for conducting cashless settlements using banking payment cards. The creation of a gross settlement system in real-time is nearing completion.

Relying on the experience of developing payment systems in economically developed countries, the payment system of the Kyrgyz Republic has gone through its development path significantly faster than similar systems in other countries, where the evolution of payment systems lasted several decades. Today, the infrastructure of the payment system is such that it can conduct all types of payments in cashless form within the economy. Nevertheless, much remains to be done. The process of modernizing and improving the existing payment system, taking into account new opportunities and new needs of the developing economy, is endless. It requires intense research work involving young promising specialists with modern and flexible thinking, the introduction of new payment instruments, innovative forms and methods of settlements. Having taken a worthy place among other countries, it is also necessary to participate in the process of international integration of payment systems. The development of the payment system has raised many new questions, tasks, and problems that require solutions.

On the path to the establishment and development of the payment system of the Kyrgyz Republic, there have been many ups and downs, successes and failures, romance and drama, but the most significant achievement of all this work is the renewed thinking of the people involved in this process. It is time to look back, summarize the results, and make plans for the future. Of course, this article could not encompass all the details of the work carried out, and only its most important and significant moments were mentioned. Throughout the work, numerous meetings and consultations were held, various materials were collected and studied, the experience of other central banks was analyzed, and many legal and organizational issues were resolved. All this was precisely the backdrop against which all events unfolded, the backdrop of the business atmosphere characteristic of the National Bank of the Kyrgyz Republic.

Meerim Akulueva,

leading specialist of the Payment Systems Department of the NBKR

(published in the newspaper "Public Rating"

No. 16 (385) dated April 24, 2008)

leading specialist of the Payment Systems Department of the NBKR

(published in the newspaper "Public Rating"

No. 16 (385) dated April 24, 2008)