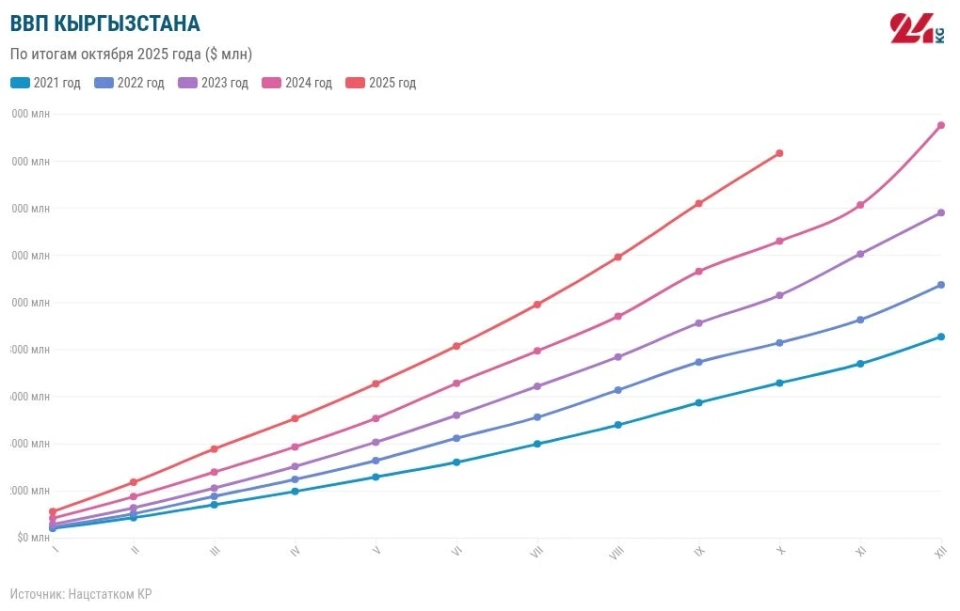

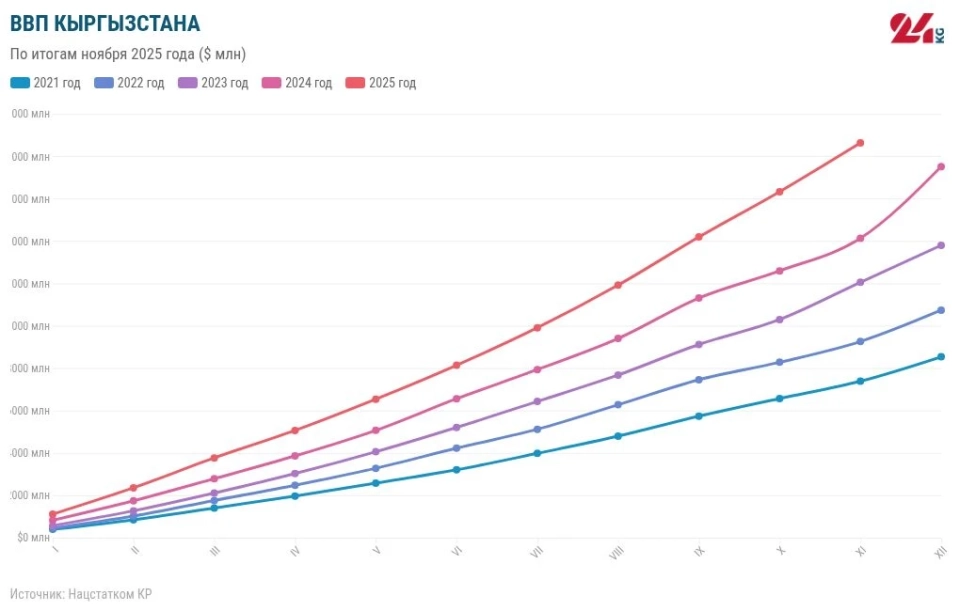

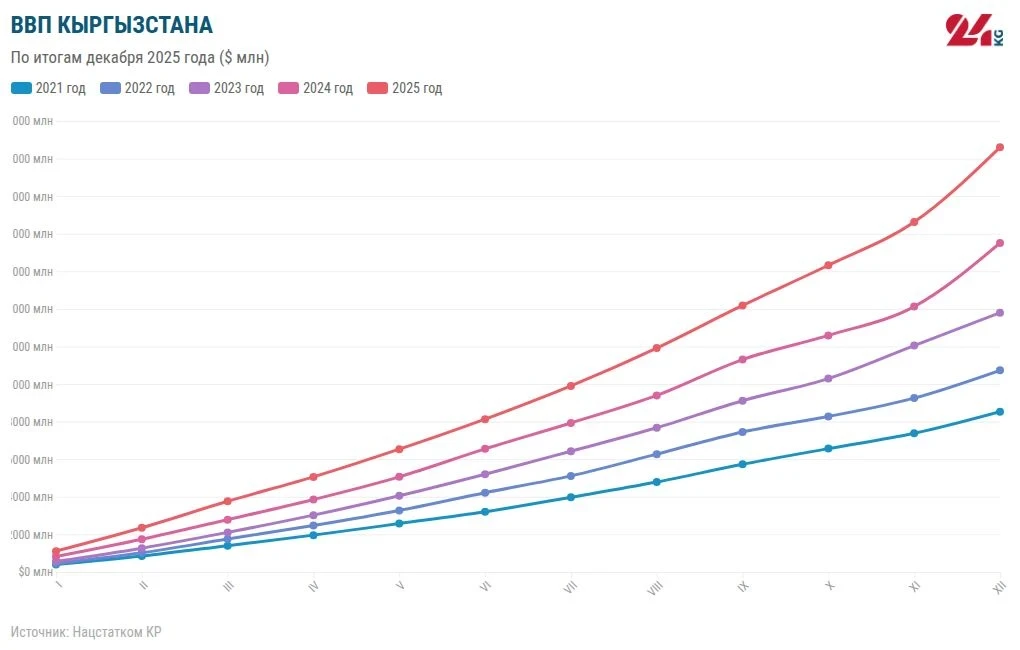

The main factors contributing to GDP growth were commodity production, services, and net taxes on products.

The leading role in the economy was played by the growth of pharmaceutical production (an increase of 1.7 times), as well as the increase in the production of rubber and plastic products, construction materials (by 35.7%), and printing products (by 30.5%).

When calculating GDP, various factors are taken into account, such as prices, production volumes, budget revenues, and government expenditures. Due to its dependence on imports, Kyrgyzstan's economic indicators are influenced by currency fluctuations, although this report uses official data in soms.

In the structure of GDP, the service sector accounted for 51.2%, commodity production for 34.4%, and net taxes on products for 14.4%.

Industrial Sector

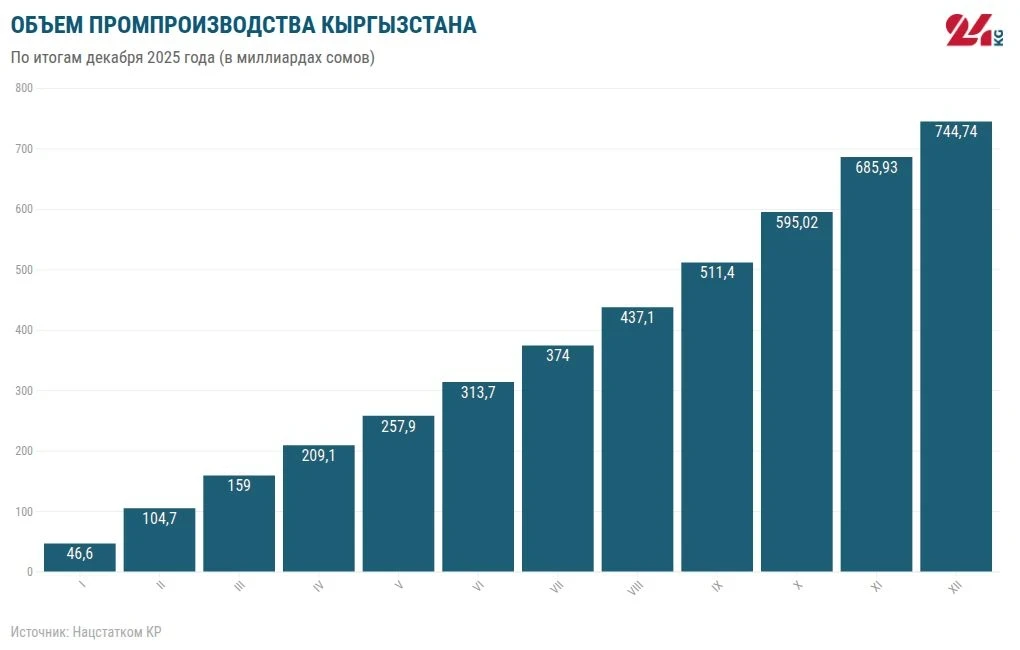

The volume of industrial production in 2025 amounted to 799 billion 740.6 million soms, which is 10.6% more than in 2024. This growth was achieved due to an increase in production volumes:

In construction, there was a growth of 21.1%, in wholesale and retail trade — 17.8%, in the hotel and restaurant business — 14.3%, and in freight transportation — 12.2%.

In the energy sector, the 12% growth was driven by an increase in electricity production and improvements in transmission and distribution.

The water supply and purification sectors showed a growth of 21.4%, mainly due to improvements in water collection and distribution.

Investments in Fixed Capital

Compared to 2024, the volume of investments in fixed capital increased by 18.1%, resulting from a 9% growth in domestic funding sources, while external investments grew by 3.8%. The total volume of investments for the year amounted to 283 billion 246.1 million soms.

Of this, about 85% of all investments were directed towards the construction of facilities in the mining, education, housing construction, manufacturing, transportation, and energy supply sectors (electricity, gas, steam, and air conditioning).

Economic Forecasts

According to forecasts from international financial organizations, in 2026, the economy of Kyrgyzstan will continue to demonstrate resilience, although growth rates may stabilize after sharp fluctuations in previous years.

Read more on the topic

The World Bank expects Kyrgyzstan's economy to grow by 6.5% in 2026

The International Monetary Fund (IMF) predicts that real GDP will grow by 4.5%, which aligns with medium-term expectations for the Central Asia region. The main drivers of growth will be in the services sector, construction, and industrial recovery.

The Asian Development Bank (ADB) forecasts that inflation this year will be 6-7%, and the tight monetary policy of the National Bank and the normalization of supply chains will help stabilize prices.

It is also expected that domestic consumer demand will remain high due to a steady flow of remittances, which the World Bank predicts will continue to grow.

In 2026, the implementation of major infrastructure projects will be an important factor for the economy.

The construction of the China-Kyrgyzstan-Uzbekistan railway and the Kambar-Ata-1 hydropower plant will create a multiplicative effect for related sectors.

These projects will facilitate the attraction of foreign investments and provide a foundation for transforming the country into a key transport and energy hub in the region.

The state budget will focus on social obligations and the digitalization of tax administration.

Read more on the topic

Digital water accounting: the system will be implemented in 2026

Further implementation of digital systems, such as the Unified Information System for Water, is planned, which will enhance efficiency in agriculture.

Analysts estimate the budget deficit at around 3% of GDP, which will require the government to take a cautious approach to external borrowing.

Nevertheless, risks remain, including high dependence on the external economic situation of key trading partners, fluctuations in gold prices, and climate factors affecting agriculture. To maintain stability, authorities need to continue structural reforms and improve the investment climate.