The tax authority and banks discussed the transaction tax

A recent meeting took place between representatives of the banking sector, the State Tax Service, and the Union of Banks of Kyrgyzstan.

The discussion addressed several issues, including changes in tax legislation, the introduction of a special tax regime "Transaction Tax," and the reduction of this tax rate from 0.2% to 0.1%, which became possible due to the Law of the Kyrgyz Republic adopted on December 31, 2025.

Additionally, issues of joint work on the implementation of automated interaction services and simplifying the administration of the transaction tax were discussed.

It is important to note that according to the current tax legislation, the bank where the account is opened acts as a tax agent, withholding and transferring this tax to the budget when transactions are conducted.

Entities conducting transactions can only use the special tax regime "Transaction Tax," and any other activities on the territory of the Kyrgyz Republic are prohibited.

Taxpayers engaged in transactions must submit an application for transitioning to the special tax regime by February 1, 2026, at their place of tax registration.

Read also:

The official visit of President Sadyr Japarov to Egypt has concluded

Official visit of the President of the Kyrgyz Republic, Sadyr Japarov, to Egypt concluded on...

The working visit of President Sadyr Japarov to Turkmenistan has concluded

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Photo report from the IV People's Kurultai

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

The state visit of President Sadyr Japarov to Pakistan has concluded.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

President: The State Pays Special Attention to Improving the Infrastructure of Schools, Kindergartens, and Medical Institutions

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Sadyr Japarov visited the building of the National Television and Radio Corporation after major reconstruction

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

In Kyrgyzstan, more than 80,000 mortgage apartments are being built - president

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The presentation of the Museum of the Center for Islamic Civilization took place in Tashkent.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The winter tourist season opened near Bishkek

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Presidential Christmas Tree. Happy Moments of Children in Photographs

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

"Ay-Pery" has transformed into an international business center — photo report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Exhibition "Valley of Winds": How Children from Batken Region Saw Their Reality

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Championship of Kyrgyzstan in Greco-Roman Wrestling is Taking Place in Bishkek – Photo Report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Winter Fairy Tale. Captivating Views of Ala-Archa Park - Photo Report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Tashiev congratulated police officers on the upcoming professional holiday

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The main New Year tree of the country was lit up in Ala-Too Square in Bishkek.

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

Sadyr Japarov opened a training and educational center of the State Committee for National Security in the Jalal-Abad region

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Tashiev opened a new building for the special forces "Alpha" and launched the construction of a sports complex

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

An official meeting ceremony between Sadyr Japarov and the Prime Minister of Pakistan took place in Islamabad.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Sadyr Japarov launched the first solar power plant with a capacity of 100 megawatts in Kemin

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Sadyr Japarov launched the "Kara-Kul" hydroelectric power station in the Jalal-Abad region.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Sadyr Japarov visited the Center for Islamic Civilization in Tashkent

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

Tashiev opened a new building for the border post "Zhany-Zher"

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

Sadyr Japarov signed the updated edition of the constitutional law "On the National Bank"

- President Sadyr Japarov approved a new edition of the constitutional law "On the National...

In Bishkek, the CEO of "MBE Group" was detained, the founder has been put on the wanted list.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

How the Reconstruction of Manas Airport is Progressing - Photo Report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The IV People's Kurultai has Concluded – Photo Report

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

The GNS reminded about the reduction of tax on transactions through foreign banks.

In accordance with the changes made to the Tax Code of the Kyrgyz Republic, the tax rate on...

Adylbek Kasymaliev presented special equipment and buses to the city of Naryn

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

Ibraev proposed to the Chinese to invest in the construction of the power lines "Kemin-Torugart" and "Barskoon-Bedel"

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

White Symphony of Winter – Photo Report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Large-scale investment projects are changing the architectural appearance of Bishkek – Kasymaliev

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The working visit of President Sadyr Japarov to Uzbekistan has concluded

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Sadyr Japarov: The updated "Manas Ordo" will become the heart of the spiritual culture of the Kyrgyz people

On November 13, President of Kyrgyzstan Sadyr Japarov participated in the ceremony of laying the...

The working visit of President Sadyr Japarov to Russia has concluded

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Sadyr Japarov participated in an informal meeting of the heads of states - participants of the CIS in St. Petersburg

On December 22, the President of Kyrgyzstan, Sadyr Japarov, participated in an informal meeting of...

Sadyr Japarov visited the Pyramids of Giza and the Grand Egyptian Museum in Cairo

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

The exhibition "Kyrgyzstan EXPO 2025" started today in Bishkek.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Celebration of the New Year Took Place at Ala-Too Square in Bishkek - Photo Report

The grand event dedicated to the celebration of the New Year 2026 took place at Ala-Too Square, as...

Employees of the State Committee for National Security conducted mass arrests of participants in economic smuggling.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Mass Arrests of Economic Smuggling Participants Conducted by the State Committee for National Security of the Kyrgyz Republic

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

A Gypsum Board Plant Has Opened in the Suzak District

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

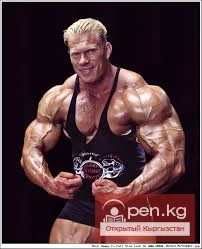

Dennis Wolf - a native of Kyrgyzstan

Strangely enough, the athlete Dennis Wolf, competing under the German flag, can be considered a...