Kaktus.media has gathered expert opinions on the future situation in the currency market in 2026.

Som Exchange Rate Forecast

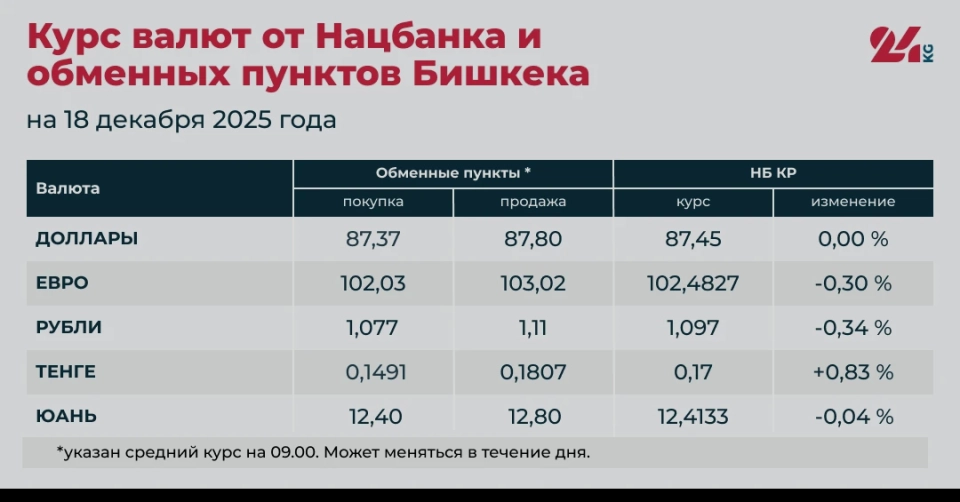

According to economists from the Eurasian Development Bank, by 2026, the som exchange rate will fluctuate within the range of 87-90 soms per 1 dollar. Experts do not see grounds for sharp changes in the value of the national currency.According to the EDB's analysis, the increasing volume of imports may raise demand for foreign currency, which will create pressure on the som exchange rate. However, the inflow of currency into the country through remittances will help mitigate this pressure and support exchange rate stability.

The National Bank of Kyrgyzstan usually does not provide specific forecasts regarding the som exchange rate against the US dollar. The regulator notes that the exchange rate is formed freely in the domestic currency market and depends on supply and demand.

A multitude of factors influences the balance of supply and demand in the currency market, including the economic situation in the republic, the state of the trade balance, inflation expectations, and remittances from labor migrants.

Ruble Exchange Rate Forecast

According to forecasts, the ruble exchange rate against the dollar will average around 94 rubles per dollar in 2026, as experts from the Eurasian Development Bank believe. The exchange rate is expected to moderately weaken amid a decrease in the current account surplus and lower oil prices compared to the previous three years. The decline in the yield of ruble-denominated assets due to lower interest rates will also exert pressure on the ruble.Additionally, in 2026, the quasi-state sector's obligation to sell 50% of export earnings will continue, creating additional supply of foreign currency in the domestic market.

According to Bloomberg's consensus forecast, the DXY dollar index may decrease by another 3% by the end of 2026, with the dollar weakening against the euro, Japanese yen, and British pound amid declining Federal Reserve rates. Morgan Stanley expects the dollar index to reach a low of around 94.0 in the first half of the year, with a recovery by the end; Deutsche Bank and Goldman Sachs predict a decrease in demand for the American currency due to sales of US Treasuries, while JPMorgan and Citi anticipate a short-term rebound of the dollar (the EUR/USD exchange rate may drop to 1.10), although the overall trend of DXY weakening will remain around 90.0.

As for the euro, Reuters polls confirm the trend towards its strengthening, although short-term risks remain due to US policies.