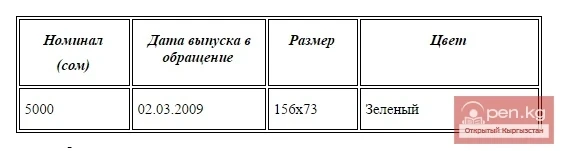

Banknotes with a denomination of 5000 som

The 5000 som banknote of the 2009 series is made of white paper measuring 156x73 mm. The predominant color of the banknote is green. The paper contains colorless fibers that fluoresce under UV light. It has a local watermark that repeats the portrait depicted on the front side of the banknote, as well as a watermark in the form of the banknote's denomination. A windowed metallic security thread with microtext "5000 СОМ" is embedded in the paper. The security thread changes color