Demand for auto loans is growing, mortgage loans are losing popularity in Kazakhstan

According to bank data, in the third quarter of 2025, there is a decrease in the volume of mortgage lending, while the demand for auto loans has sharply increased. Consumer loans, both secured and unsecured, remained at the same level despite changes in mortgage lending, including a reduction in the annual effective rate from 25% to 20%. =AT3SWSqBh8u2jThbRNMV0RHNgEXqwI41GQcdimKBk6zW9tm555YHmUrkUwBnXBhI6Tt-0MmVNYHeV-vbI6jSsywwKuyrZJS1tffkR_oAXnCq1F6VJhbolPLGzz2tGEMKzThCSIVppAIfsW9X0eNqQnNcUGPGEki-bPUAc7GVIXAAQwc6IPR2rTfZdazjORhYcp_f5WjE-zj3gdWomJeNC2Bv2CjM8Ng] reports Exclusive.kz.

Nevertheless, the total number of mortgage loan applications increased by 19% compared to the previous quarter, reaching 288 thousand, while the average loan amount rose by 21% to 21 million tenge.

As for secured consumer loans, their demand did not change compared to the second quarter. However, the number of applications submitted increased by 94% due to the launch of a new digital service by one of the banks. The average size of applications, however, decreased by 21% to 12 million tenge.

In the segment of unsecured lending, stable demand is also observed. However, banks have tightened their lending requirements: the loan term has been reduced to five years, additional conditions have been introduced for borrowers under 21 and over 55 years old, as well as mandatory personal presence for borrowers without a credit history. This led to a decrease in the total number of applications by 6% to 17.2 thousand, despite an increase in the average loan amount by 7% to 1.05 million tenge.

The demand for auto loans continues to grow thanks to subsidized programs from car dealerships that were launched in the first half of 2025. The number of applications remained at 1.52 million, while the average loan amount decreased by 5% to 6.9 million tenge.

At the same time, the approval rates for mortgage loan applications fell by 6 percentage points to 23%, for secured consumer loans by 23 points to 22%, for auto loans by 2 points to 17%, while the approval rates for unsecured loans remained at 32%.

Read also:

The average consumer loan rate in Kyrgyzstan for 8 months was 21.5%, - EDB

In Kyrgyzstan, there is a continuing increase in the volume of lending by commercial banks,...

One Type of Lending is Gaining Popularity in Kyrgyzstan

According to data presented by the National Bank, the volume of financing based on Islamic...

In September, more than half of the volume of bank loans in Kyrgyzstan were issued for a term of over 3 years

- In September 2025, more than half of the volume of bank loans in Kyrgyzstan was issued for a term...

In the first nine months of 2025, 51 people died in industrial accidents in Kyrgyzstan

In the third quarter of this year, there has been an increase in the number of accidents and...

What Are the Most Common Loans in Kyrgyzstan? The Numbers

As of August 31, 2025, the total volume of the credit portfolio of banks in Kyrgyzstan reached...

After the National Bank's intervention, the som has slightly appreciated. Exchange rates as of November 12.

Photo from the internet. Until the recent intervention by the National Bank, the exchange rate of...

Consumer Loans Reimagined: 0.08 Percent Daily Limit and No Penalties for Early Closure

Sadyr Japarov, the president of the country, has signed a new law "On Consumer Credit,"...

The law regulating the procedure for providing consumer loans has been signed

This law is designed to enhance the protection of borrowers' rights and create more...

The Bank of Russia has lowered the key rate to 16.5% per annum

At the meeting held on October 24, 2025, the Board of Directors of the Bank of Russia made the...

In Kazakhstan, teachers, doctors, and social workers are being attracted to the regions with a 1% mortgage.

In Kazakhstan, the start of the application process for the "To the Village with a...

Industrial enterprises in 2025 rely less on bank loans

According to the data from the National Bank of Kyrgyzstan, by 2025, industrial companies in the...

The Cabinet expanded preferential lending for seed-growing and nursery enterprises

- The Cabinet of Ministers has expanded the program of preferential lending for seed-growing and...

The Russian Ministry of Energy explained the reasons for the rise in fuel prices on the exchange.

Sergey Tsivilev In his explanation, Tsivilev specified that the rise in prices on the exchange is...

The "Eco-Transport" Credit Program Launched in Kyrgyzstan

A new credit program called "Ecotransport" has started operating in Kyrgyzstan. This was...

Catfish has become cheaper against the ruble, tenge, and euro. Exchange rates as of November 10.

Photo from the internet. The Russian ruble has started to recover after a recent decline According...

In September, banks issued consumer loans totaling 22.3 billion soms

According to information provided by the NBKR, in September 2025, the volume of consumer loans...

Euro and Russian Ruble Have Appreciated. Currency Rates for October 27

According to the National Bank of Kyrgyzstan and exchange points in Bishkek, the rates of the...

In Kyrgyzstan, an increase in agricultural production has been recorded

According to the Eurasian Economic Commission, there is an increase in agricultural production...

Catfish has appreciated against all major currencies except the dollar. Exchange rate as of November 18.

Photo from the internet. The som began to strengthen after weakening. According to data from the...

Catfish has risen in price against all major currencies except the tenge. Exchange rate as of November 19.

Photo from the internet. The som continues to strengthen after some weakening According to data...

Banks provided loans to agriculture amounting to 31 billion soms in the first 9 months of 2025.

From January to September 2025, commercial banks provided loans amounting to 31.4 billion soms for...

The production of non-metallic products increased by 31.8% over 9 months

According to statistical data, from January to September 2025, there is a significant increase in...

Almost 264 billion soms in Kyrgyzstan are outside the banking system

As of October 1, 2025, the total amount of money in circulation reached 290 billion 191.1 million...

The ruble continues to depreciate against the som, the euro has started to appreciate. Currency exchange rates as of November 7.

Image from internet resources. The Russian ruble is under pressure after a recent rise According...

The som has depreciated against all major currencies except the euro. Exchange rate as of November 20.

Photo from the internet. The dollar, after a slight decrease, has stabilized again at 85.46 soms...

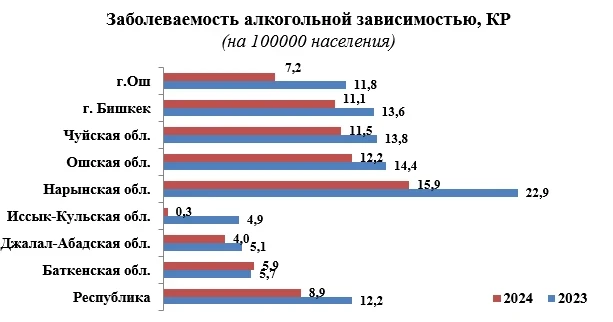

In Kyrgyzstan, Alcohol Dependency is Decreasing, with the Exception of Batken

In Kyrgyzstan, a significant decrease in cases of alcohol dependence is observed in 2024 — by 27...

A modern environmental monitoring laboratory will be built in Bishkek

The Ministry of Natural Resources, Ecology, and Technical Supervision of the Kyrgyz Republic has...

Demand for gasoline in China fell by 9% in October due to the rise in electric vehicles

According to Sublime China Information, the average daily gasoline consumption in October remained...

The trade turnover of Kyrgyzstan decreased by $1 billion due to a drop in exports.

From January to September 2025, the volume of foreign trade in Kyrgyzstan reached $11 billion...

NBKR updated lending rules: self-restriction on loans through the government portal will take effect on November 1

- The National Bank of Kyrgyzstan, according to resolution No. 2025-P-12/55-3-(NPA) dated October...

In October, Mongolia exported 7.76 million tons of coal to China

// PHOTO: AFP Coal imports from Mongolia to China increased by 20% in October compared to the same...

Sadyr Japarov signed a law on consumer credit aimed at protecting borrowers' rights and limiting debt burden

- President Sadyr Japarov has officially approved the Law "On Consumer Credit," which was...

In Kyrgyzstan, mineral resources worth 56.9 billion soms were extracted in 10 months

- According to statistical data, from January to October 2025, the republic extracted minerals...

In Kyrgyzstan, there are 13.6 thousand doctors and 33.7 thousand mid-level medical personnel.

According to data from the National Statistical Committee, as of 2024, there are 13,676 doctors in...

FAO: Global Food Prices Decreased in October

According to information presented in the press release from the Food and Agriculture Organization...

Unemployment Rate in Mongolia Decreased by 0.6% in the Third Quarter

According to information provided by the National Statistical Office of Mongolia on Wednesday, the...

The average wheat yield in the republic decreased by 28.8%, barley - by 28%

- As a result of the high temperatures observed during the summer of 2025, there has been a...

The Ruble and Euro Continue to Decrease in Value. Exchange Rates on October 24

Photo from the internet. The Russian ruble is experiencing instability — after a recent rise, it...

The Ministry of Construction recorded an increase in violations in the construction sector

In Kyrgyzstan, there is an increase in violations in the construction sector, according to data...

Which regions of Kyrgyzstan have become leaders in agricultural production?

- According to statistics, in the production of agricultural products in Kyrgyzstan for the first...

The rise in fuel prices has intensified inflationary processes in Kyrgyzstan, - Ministry of Economy

- According to information from the Ministry of Economy and Commerce, the consumer price index,...

More Beer is Being Imported to Kyrgyzstan

According to data from the National Statistical Committee, the volume of imported beer in...

Bicycle Tourism Routes by Difficulty Categories

2 difficulty categories...