The rise in fuel prices has intensified inflationary processes in Kyrgyzstan, - Ministry of Economy

The average annual inflation rate (January-September 2025 compared to the same period in 2024) was 107.8%.

The agency reports that the rise in consumer prices and tariffs over the first nine months of the current year (compared to December 2024) is observed in all regions of the country.

Price changes in 2025 are a result of both domestic demand and external factors, such as global food inflation and rising world logistics prices.

Key factors influencing price dynamics:

- The increase in food prices is primarily related to seasonal fluctuations in the prices of fruits and vegetables;

- The dependence of the domestic market on food imports (flour, vegetable oil, cereals, etc.) and general global trends (due to rising prices for vegetable oil, meat, sugar, supported by high import demand). The FAO food price index in September 2025 was 128.8 points, which is 4.2 points (3.4%) higher than the level in September 2024. In September, meat prices reached a record 127.8 points, which is 6.6% higher than last year's figure;

- The increase in fuel prices from January to September 2025 (gasoline - by 8.8%, diesel - by 6.3%) is associated with seasonal demand and export restrictions to the Russian Federation (Russia has imposed bans on the export of certain petroleum products until the end of 2025 to avoid shortages within the country, which also affects import prices, even though Kyrgyzstan participates in special agreements);

- The increase in housing and construction material prices (+8-12%) is due to rising demand and the rising cost of construction materials, including imported ones;

- A significant increase in lending volumes: from January to August 2025, the volume of consumer loans increased by 51.6%, and compared to 2023, it increased 2.7 times, which creates additional pressure on prices;

- The persistence of high inflation expectations among the population.

Read also:

Oil and Natural Gas Production in Kyrgyzstan Decreased by an Average of 9%

- From January to August 2025, Kyrgyzstan registered a decrease in oil and natural gas production...

Increase in electricity tariffs by 23.8% in May boosted inflation in Kyrgyzstan, - EFSR

- The analysis of the reasons for the inflation increase in Kyrgyzstan for June 2025 was presented...

In a year, flour production increased by 8%, totaling 182.3 thousand tons

- From January to August 2025, Kyrgyzstan recorded an increase in the production volumes of several...

In Kyrgyzstan, the production of key types of construction materials has increased by an average of 50%

- From January to August 2025, there has been an increase in the extraction of key construction...

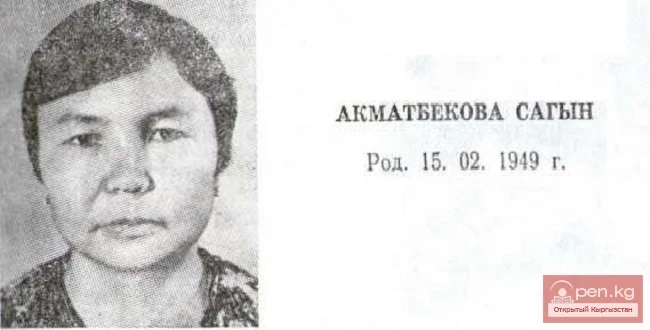

The Poet Sagyn Akmatbekova

Poet S. Akmatbekova was born in the village of Orto-Aryk in the Panfilov district of the Kyrgyz...

Brown coal production increased by 23.7% over 8 months, reaching 2.04 million tons

- From January to August 2025, various dynamics in coal production were observed in Kyrgyzstan....

Kyrgyzstan Increases Production of Construction Materials, Pharmaceuticals, and Food Products in 9 Months

- According to data from the Ministry of Economy and Commerce, the gross output produced by...

Prose Writer, Critic Dairbek Kazakbaev

Prose writer and critic D. Kazakbaev was born on June 20, 1940, in the village of Dzhan-Talap,...

In Kyrgyzstan, 400 deposits are being developed

Over 1,000 deposits registered in the republic Currently, more than 1,000 deposits belonging to 51...

The Poet Baidilda Sarnogoev

Poet B. Sarnogoev was born on January 14, 1932, in the village of Budenovka, Talas District, Talas...

Types of Insects Listed in the 2004 IUCN RLTS Not Included in the Red Book of Kyrgyzstan

Insect species listed in the 2004 IUCN RLTS, not included in the Red Book of Kyrgyzstan 1....

Poet, Prose Writer Tash Miyashev

Poet and prose writer T. Miyashev was born in the village of Papai in the Karasuu district of the...

Investments in fixed assets of Kyrgyzstan increased by 18.8% over 9 months, totaling 206 billion soms

- According to the Ministry of Economy, in the first nine months of 2025, the volume of investments...

Kyrgyzstan Awarded Gold Medal at the World Expo 2025 in Osaka

The Pavilion of the Kyrgyz Republic was recognized by the international jury for its outstanding...

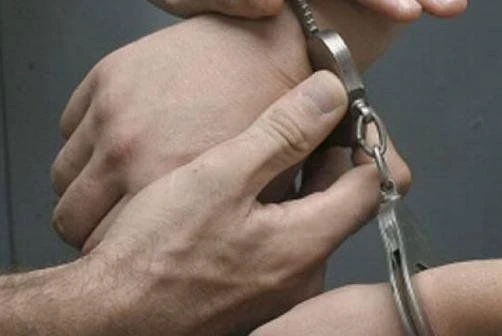

Former Deputy Head of the Jogorku Kenesh Apparatus Arrested for Extortion

During investigative and operational activities, the fact of receiving 200 thousand US dollars by...

Traffic Police: As a result of the "Training Transport" raid, 1328 violations were identified

In order to enhance road safety and reduce the number of traffic accidents, as well as to regulate...

Veterinary and Phytosanitary Inspectors at the Kyrgyzstan Border to be Equipped with Body Cameras

Body cameras will be used during inspections, searches, and interactions with business entities....

Kyrgyzstan Provided Humanitarian Aid to Ethnic Kyrgyz in Pamir, Afghanistan

During the trip led by the expedition team, measures taken by the authorities of Badakhshan to...

The Audit Chamber identified violations in the Ministry of Foreign Affairs amounting to 72.7 million soms

According to the press service, the Audit Chamber of the Kyrgyz Republic has completed an audit of...

The Minister of Foreign Affairs of Kyrgyzstan and the U.S. Ambassador discussed economic cooperation and visa issues

Key issues regarding cooperation between Kyrgyzstan and the USA, as well as interaction within the...

Searches conducted at the residences of members of "Hizb ut-Tahrir al-Islami" in the Talas region

On October 15, 2025, searches were conducted in the homes of members of the banned extremist group...

Zonal Training for Healthcare Workers Kicks Off in Kyrgyzstan as Part of the Catch-Up Immunization Campaign

As part of the training, healthcare workers will gain knowledge on how to effectively catch up on...

The Ministry of Labor of the Kyrgyz Republic reminds: November 7-8 are working days

According to the current labor legislation, despite the fact that November 7 and 8 are public...

Poet, Prose Writer Isabek Isakov

Poet and prose writer I. Isakov was born on September 1, 1933, in the village of Kochkorka,...

198 Kyrgyz citizens submitted applications expressing their intention to participate in the early elections for deputies of the Jogorku Kenesh of the Kyrgyz Republic.

The Central Commission for Elections and Referendums is accepting documents from those who wish to...

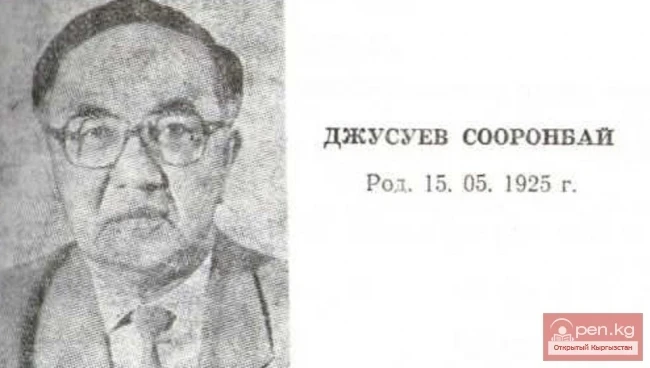

The Poet Sooronbay Jusuyev

Poet S. Dzhusuev was born in the wintering place Kyzyl-Dzhar in the current Soviet district of the...

Tourist Area Management Program

The project "USAID Business Development Initiative" (BGI), within the tourism...

In Bishkek, the national corporate race "Business Run KG 2025" took place.

On this day, the run took place in the format of a team relay over distances of 5 and 10 km. Each...

Residents of Kyrgyzstan Felt an Earthquake

The epicenter of the earthquake was recorded 20 km from the village of Toguz-Bulak Today, October...

Units of the NBC troops have begun exercises of the CSTO "Barrier-2025"

Joint training of the CBRN units has begun as part of the "Barrier-2025" exercise...

Camera Traps in the "Salkyn-Tor" Park: Which Wild Animals Were Captured on Camera

In the Naryn region, employees of the state natural park "Salkyn-Tor" conducted a...

Detained organizers of the fake lottery "Osh Sila"

During the investigation, it was revealed that the lottery organizers created fake drawings,...

Amendments Made to the Laws on Military and Emergency Situations

On September 25, the Jogorku Kenesh approved amendments...

Types of Higher Plants Listed in the "Red Book" of Kyrgyzstan (1985)

Species of higher plants removed from the "Red Book" of Kyrgyzstan (1985) Species of...

In Russia, the sharpest rise in gasoline prices in the last 15 years has been recorded. How are Russians coping with this? - Media

According to a survey conducted by the WEBBANKIR platform among 1,600 Russians, 74% of respondents...

Poet, Prose Writer Medetbek Seitaliev

Poet and prose writer M. Seitaliev was born in the village of Uch-Emchek in the Talas district of...

Tourism — a Great Business

There are grounds for such a statement. Everyone knows how profitable, for example, the automotive...