Under the terms of the agreements, Silvercorp is acquiring 70% of the shares of Chaarat ZAAV, which holds a mining license for an area of about 7 square kilometers. This includes fully permitted projects "Tulkubash" and "Kyzylbash," as well as exploration licenses covering an area of 27.42 square kilometers, encompassing the gold-bearing zones of Karator and Ishakuld in the Tian Shan. The total deal amount is 162 million USD.

Additionally, through its subsidiaries, Silvercorp has signed a share purchase agreement and a shareholders' agreement with Kyrgyzaltyn OJSC. As a result of the deal's completion, Chaarat ZAAV will become a joint venture between Silvercorp and Kyrgyzaltyn, where Silvercorp will own 70% and act as the operator, while Kyrgyzaltyn will receive 30% without financing obligations.

The National Investment Agency will receive 70 million USD from Silvercorp in two stages:

The first payment — 60 million USD, which will be made after the government of Kyrgyzstan renounces its legal rights to the projects and extends the mining license of the joint venture from June 25, 2032, to June 25, 2062.

The second payment — 10 million USD, which will be paid after certain milestones in the project are achieved.

According to the share purchase agreement, Chaarat will receive 92 million USD from Silvercorp, contingent upon the Kyrgyz government renouncing its rights to the projects.

The cooperation agreement and shareholders' agreement outline a two-phase development program for the "Tulkubash" and "Kyzylbash" projects.

Phase One — Development of Tulkubash (2026-2028)

Silvercorp plans to invest 150 million USD in the construction of an open-pit mine and the installation of a heap leaching system with a capacity of 4 million tons of ore per year for processing oxidized gold ores. The launch is expected in 2027-2028, with an estimated production of 110,000 ounces of gold per year for three to four years. Additionally, if the Karator license is converted to a mining license in 2026, the operational period of the mine could be extended by at least two years.

Phase Two — Development of Kyzylbash (2028-2031)

Investments of around 400 million USD are planned for the development of the Kyzylbash sulfide deposit, including the creation of an open-pit and underground mine with a capacity of 3-4 million tons of ore per year, as well as processing facilities using flotation, bacterial oxidation (BIOX), and cyanidation (CIL). It is expected that after reaching industrial production starting in 2031, the output will be 190,000-230,000 ounces of gold per year for over 18 years.

“We are excited to develop these projects, which are the largest undeveloped gold deposits in the Western Tian Shan. All parties agree on the plans to bring the projects to the stage of industrial production. With our 20 years of experience in the mining industry and a strong financial base, we are confident that Silvercorp, together with the experienced team at Chaarat and our Kyrgyz partners, will advance the projects and unlock their value for all stakeholders,” noted Rui Feng, Chairman of the Board and CEO of Silvercorp.

The company emphasized that the inclusion of the "Tulkubash" and "Kyzylbash" projects in Silvercorp's portfolio aligns with its strategy of diversification and asset expansion, as well as taking advantage of favorable market conditions for gold.

Reference 24.kg

Silvercorp Metals Inc. is a Canadian mining company founded in 1991 and headquartered in Vancouver. The company's shares are traded on the Toronto Stock Exchange and NYSE American under the ticker SVM.

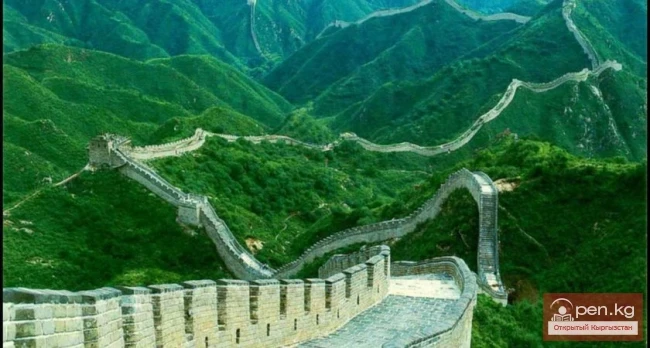

The main assets of Silvercorp are located in China, where the company is engaged in the mining of silver and associated metals such as lead, zinc, and gold. Silvercorp is considered one of the leading foreign producers of silver in the PRC.