Jewellers of Kyrgyzstan Granted Tax Benefits and Moratorium on Inspections, - GNS

The amendments were introduced by the Law of the Kyrgyz Republic "On Amendments to Certain Legislative Acts in the Field of Taxation, Social Insurance, and Non-Tax Revenues," which came into effect on December 31, 2025.

According to the new provisions, equipment, technologies, reagents, and semi-finished products used in jewelry production and imported into Kyrgyzstan are exempt from value-added tax, as stated in the official announcement.

Additionally, the tax service noted that the new law provides for the legalization of stocks of jewelry made from precious metals that were imported or produced earlier. This process will take place over two months, during which a moratorium on inspections by tax authorities will be in effect.

Domestic jewelry manufacturers have also been given the opportunity to voluntarily test and mark their products with their own hallmark confirming the assay, excluding the state assay hallmark.

The changes also affected the Code of the Kyrgyz Republic on Offenses, where liability for activities involving jewelry without special accounting was introduced. Fines amount to 5000 soms for individuals and 13,000 soms for legal entities.

The STS emphasized that these measures are aimed at supporting the jewelry industry, reducing production costs, increasing its competitiveness, as well as accelerating the modernization of production and the introduction of modern technologies that allow for the production of products that meet international standards.

Historical Context

Previously, according to the Law of the Kyrgyz Republic dated July 31, 2025, a single tax rate of 0.25% was established for manufacturers and sellers of jewelry, whereas earlier rates ranged from 2% to 4%.

Read also:

Kyrgyz Republic - This is Our Land

The Kyrgyz Republic is a country of Heavenly Mountains, stunning nature, and hospitable,...

Asian Cup (U-23): Official Training of the Kyrgyzstan National Team Before the Match Against Saudi Arabia

Today, January 6, the youth national team of Kyrgyzstan in football begins its participation in the...

Asia Cup (U-23): Official training of the Kyrgyzstan national team before the match against Vietnam. Photos

As part of the preparation for the second round match of the Asian Cup in Saudi Arabia, the youth...

Asian Cup (U-23): Official training of the Kyrgyzstan national team before the match against Jordan. Photos

Before the match against Jordan, the Kyrgyzstan U-23 national football team held an official...

Asian Cup: How did the Kyrgyzstan national team perform in the first rounds? Results

Today, January 6, the youth national team of Kyrgyzstan in football begins its participation in the...

Vladimir Ivanovich Nifadyov

Nifadyov Vladimir Ivanovich (1947), Doctor of Technical Sciences (1993), Professor (1995),...

The Financial Supervisory Authority of Kyrgyzstan informs the non-bank financial market about the update of the list of high-risk countries.

The Financial Supervisory Authority informs participants of the non-banking financial market that...

Kurmanbek Nurlanbekov — the first goalkeeper from Kyrgyzstan to save a penalty in the Asian Cup

On January 6, a match of the first round took place in Jeddah, where the youth national team of...

The Kyrgyzstan National Team (U-23) continues preparation for the Asian Cup. Video

The youth national football team of Kyrgyzstan (U-23) is actively preparing for the final stage of...

Composition of the Kyrgyzstan National Team (U-23) for the Tournament in Manas

The composition of the Kyrgyzstan national football team (U-23) has been announced, which will be...

How the Kyrgyzstan National Team (U-23) Snatched Victory from Iran. Match Review

At the international tournament in Manas, the youth football team of Kyrgyzstan (U-23) achieved...

Asian Cup (U-23): Schedule of Matches for the Kyrgyzstan National Team

On January 6, the youth national team of Kyrgyzstan will begin its participation in the Asian Cup...

Manas Cup: How Kyrgyzstan Defeated Bahrain. Match Review

The youth national team of Kyrgyzstan has successfully started its participation in the "Manas...

World Championship: Omar Livaza Came Face to Face with His Final Opponent. Video

Today, December 12, an event called Face To Face took place in the United Arab Emirates, where the...

The Kyrgyzstan National Team (U-23) lost to China in a friendly match

The youth national football team of Kyrgyzstan is actively preparing for the final part of the...

AFC U-23 Cup: Kyrgyzstan National Team's Locker Room Before the Match Against Jordan. Photo

Today, January 12, the youth team of Kyrgyzstan in football (U-23) will play their third match at...

AFC U-23 Cup: Kyrgyzstan - Saudi Arabia. Full match video

The Asian Football Confederation (AFC) has released the full video of the match that took place...

Asia Cup (U-23): Match Review Kyrgyzstan - Jordan. Video

In the match of the youth national football team of Kyrgyzstan (U-23) against the team of Jordan,...

In the city of Manas, the international tournament "Manas Cup" will take place.

An international football tournament will take place in Manas, featuring the youth national team of...

Who made it to the extended roster of the Kyrgyzstan national team (U-23) for preparation for the Asian Cup? List

The list of players of the Kyrgyzstan U-23 national football team has been published, who will go...

The Kyrgyzstan National Team (U-23) crushed the team of the former Liverpool player

The youth team of Kyrgyzstan in football (U-23) completed their preparation for the final stage of...

The Kyrgyzstan National Team (U-23) held their first training session after the defeat to Saudi Arabia. Photos

The youth national team of Kyrgyzstan in football (U-23) held a recovery training session after the...

AFC Challenge League: "Abdysh-Ata" Was 45 Seconds Short of Victory

The football club "Abdysh-Ata" from Kant has completed its participation in the AFC...

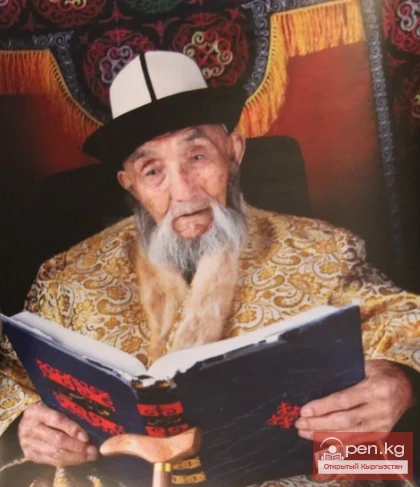

Hero of the Kyrgyz Republic Jusup Mamai

Jusup Mamai, the Great Narrator of the Epic "Manas" He was born on May 4, 1918, in the...

Asian Cup (U-17): Kyrgyzstan - Yemen. ONLINE

Today, November 22, the youth national team of Kyrgyzstan (U-17) will face the team of Yemen. This...

Tagai Bi (Muhammed Kyrgyz)

In the history of the 16th century, Tagay Bi was celebrated under the name of the great figure...

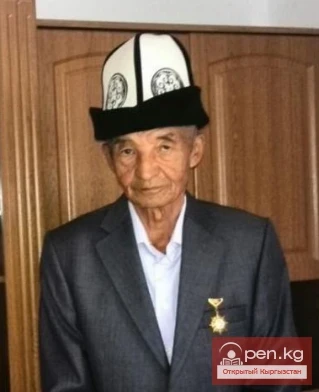

Hero of the Kyrgyz Republic Arikov Kurmanbek

Kurmanbek Arykov, installer of steel and reinforced concrete structures at JSC...

AFC U-23 Cup: Who has been included in the extended squad of the team? Names

The composition of the youth football team of Kyrgyzstan, which is preparing to participate in the...

Mamitov Abakir

Mamyotov Abakir (1954), Doctor of Pedagogical Sciences (1999), Professor (1993) Kyrgyz. Born in...

Asian Cup (U-23): Kyrgyzstan takes 3rd place after the first round. Table

The youth national football team of Kyrgyzstan (U-23) finished the first round of the group stage...

Hero of the Kyrgyz Republic Akmatov Tashtanbek Akmatovich

Tashtanbek Akmatovich Akmatov — Kyrgyz state and political figure. He was born in September 1938...

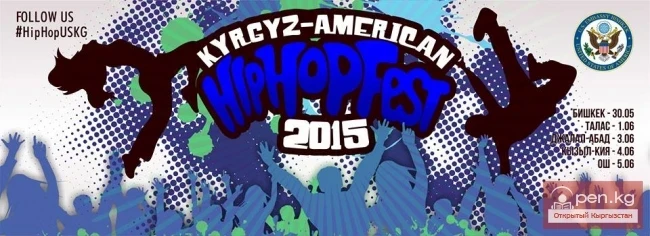

Kyrgyz-American Hip-Hop Fest 2015

From May 28 to June 5, 2015, a youth festival "Kyrgyz-American Hip-Hop Fest 2015" will...

Kyrgyzstan will be represented at the "International Heritage" festival in New Jersey.

On May 31, the "International Heritage" festival will take place in New Jersey (USA)....

Maripov Arapbay

Maripov Arapbay (1939), Doctor of Physical and Mathematical Sciences (1994), Professor (1994)...

Narrow Yurt or Spacious? (A Parable)

A very sad young man approached the wise elder. - Help me, elder. I have a yurt, but my family is...

Niedzvetzki’s Apple-tree \ Red-leaved Apple

Niedzvetzki’s Apple-tree Status: VU. Very rare, endemic, endangered species with a small...

Hero of the Kyrgyz Republic Aliaskulov Aliyasbek Tolbashievich

Aliaskulov Aliyasbek Tolbashievich Born on May 5, 1971, in the village of Ken-Aral, Talas region....

Hero of the Kyrgyz Republic Akbaraly Kabaev

Akbaraly Kabaev, foreman of builders at JSC "Narynhydroenergoстрой" Born in Jalal-Abad...

AFC U-17 Cup Qualifiers: Kyrgyzstan Snatches Victory from Laos with Last-Second Goal

As part of the qualifying tournament for the Asian Cup (U-17), the youth national team of...

Petunnikov's Almond

Petunnikov’s Almond Status: VU. One of 40 species growing from the Mediterranean to Central Asia....

Hero of the Kyrgyz Republic Kumushalieva Sabira

People's Artist of the Kyrgyz Republic Sabira Kumushalieva Born in 1917 in the village of...

On May 17, a parade of Turkic peoples will take place in New York.

On May 17, a parade of Turkic peoples will take place in New York. This parade has been one of the...

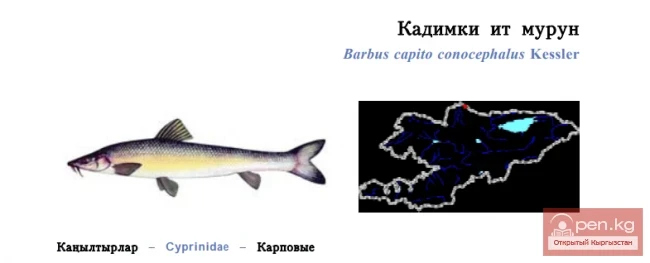

Turkestan Barbel / Kadimki It Murun / Turkestan Barbel

Turkestan Barbel Status: 2 [VU: D]. A subspecies that is endangered in Kyrgyzstan. One of...

The presentation of the Regulations on the national award "KYRGYZ TOURISM AWARDS" took place.

On April 16, 2014, a press conference was held at the "Kabar" news agency regarding the...

Dance Flash Mob in Support of Social Justice in Kyrgyzstan

Popular dance teams Tumar, Let's Dance, and dancer Jan Voinov participated in a flashmob...