In Kyrgyzstan, a campaign for tax declaration submission has begun

The process of submitting declarations will be divided into two stages: legal entities, as well as state and municipal employees, must submit their declarations by April 1, while individuals and individual entrepreneurs have until May 1.

The declaration must be submitted by April 1:

– organizations registered in Kyrgyzstan, except for those funded from the budget and having no tax obligations for property tax for the reporting period;

– foreign companies operating in Kyrgyzstan and having a permanent representative office;

– state and municipal employees;

– members of the Council for the Selection of Judges, the Central Commission for Elections and Referendums, as well as the management of the National Bank.

By May 1, the declaration must be submitted by:

– individual entrepreneurs (except for those working in trade zones with special conditions, on the basis of a patent, as well as at the rates of the single tax of 0, 0.1, 0.5, and 1 percent, and peasant farms without legal entity status);

– citizens of Kyrgyzstan working in international organizations and in the diplomatic missions of foreign states on the territory of the republic;

– individuals who received taxable income from which income tax was not withheld during the reporting period.

Other categories of citizens wishing to receive social or property deductions may submit their declarations voluntarily.

The submission of the tax declaration is carried out electronically through the "taxpayer's cabinet" on the website Cabinet.salyk.kg.

It is important to note that the declaration must include information about income and expenses, economic activities, property objects, land plots, and the amount of taxes paid for the reporting period.

Additional information can be obtained from local tax authorities, by phone at 116, or on the website www.sti.gov.kg.

Read also:

Where the Most People Live: Population Distribution by Regions of the Kyrgyz Republic

According to population data (taking into account changes from the administrative-territorial...

Chairman of the Council of Judges of the Kyrgyz Republic on Pressure, Discipline, and Reforms

The judicial workload is increasing, society demands justice, and trust in the judicial system...

Presidential Christmas Tree. Happy Moments of Children in Photographs

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The taxpayer's cabinet is used by 1 million 521.6 thousand taxpayers – GNS KR

According to the State Tax Service, as of December 16, 2025, 1 million 521.6 thousand taxpayers...

Tashiev congratulated police officers on the upcoming professional holiday

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The main New Year tree of the country was lit up in Ala-Too Square in Bishkek.

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

Tashiev opened a new building for the special forces "Alpha" and launched the construction of a sports complex

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Vacation in Phuket: The Ultimate Guide for Kyrgyzstanis

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Tashiev opened a new building for the border post "Zhany-Zher"

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

Main Mistakes When Applying for Immigration Visas. Tips from a Lawyer in the USA

Photo by Joomart Zholdoshev Joomart Zholdoshev, an international lawyer and arbitrator with...

How the Reconstruction of Manas Airport is Progressing - Photo Report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

White Symphony of Winter – Photo Report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Ombudsman checked the conditions of detention in Women's Colony No. 2

In the village of Stepnoye, the Ombudsman of the Kyrgyz Republic, Jamila Jamambaeva, conducted an...

Intimidation and Denial of Medical Care. Inmates of SIZO-1 Talked About Problems in the Institution

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

Taxes, Cars, Transactions, and Benefits: The Cabinet Introduced Major Amendments to the Laws

The government of the country has submitted a draft law to the Jogorku Kenesh concerning amendments...

Tashiev handed over new equipment worth 100 million soms to the utility services of Balakchy

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

The GKNB donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, in the capital of Kyrgyzstan, the Chairman of the GKNB, Kamchybek Tashiev,...

The State Committee for National Security of the Kyrgyz Republic donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, the Chairman of the GKNB of the KR, Kamchybek Tashiev, visited a boarding...

In the Chui Region, 80 hectares of land have been returned to state ownership.

In the territory of the Chui region, in the Issyk-Ata district, 80 hectares of land have been...

Where You Can Travel Visa-Free with a Kyrgyz Passport in 2026 (Map)

According to the latest update of the Passport Index by Henley & Partners, the Kyrgyz passport...

In the Pervomaisky District of Bishkek, the results of the "Ülgülüür" competitions were summarized.

In the Pervomaisky district of Bishkek, the finals of the competitions "Үлгүлүү...

A new building of the district department of the GKNB has opened in the Ton District

On November 27, 2025, a new office building of the district department of the State National...

A new building of the District Department of the State Committee for National Security of the Kyrgyz Republic has opened in the Ton District

On November 27, 2025, a new building of the district department of the GKNB KR was opened in the...

A Health Improvement Complex of the State National Security Committee "Kyzyl-Beles" Opened in Chui Region

Today, a ceremonial opening of the health complex of the GKNB "Kyzyl-Beles" took place...

In the city of Kara-Kul, multi-storey mortgage houses will be built

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

In Bishkek, the 225th anniversary of Alymbek Datka and the 110th anniversary of Academician Musa Adyshaev were celebrated

On December 9, a solemn event was held at the T. Satylganov Kyrgyz National Philharmonic in...

A new three-story building of the children's creativity center "Ariet" has opened in Manas

Today in Manas, a significant event took place — the opening of a new three-story building of the...

The resettlement of residents from border villages in the Leilek district has been completed.

On November 29, the process of resettling residents from the border villages of the Leilek...

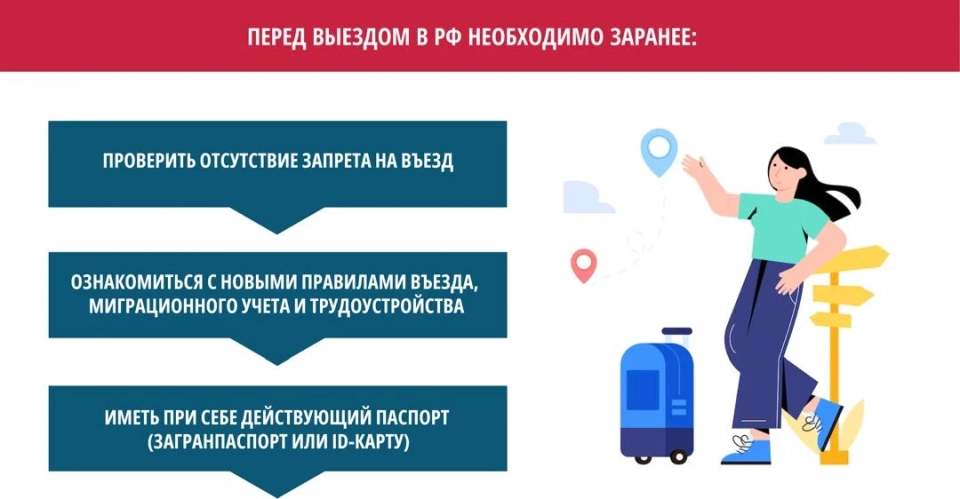

Guide for Migrants from Kyrgyzstan: How to Settle in Russia Legally and Safely

Russia continues to be one of the most attractive countries for labor migrants from Kyrgyzstan....

Bangkok + Pattaya: how to choose a hotel, area, and what to see

Bangkok and Pattaya are the perfect route for those who want to combine the dynamics of a big city...

Who Received Presidential Scholarships This Year (List and Photos of the Best Students in the Country)

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Osh Improvement Combine Received a New Building

In Osh, a ceremonial opening of a new building for the municipal enterprise "Improvement and...

Tashiev transferred medical equipment worth 35 million soms to the National Center for the Protection of Motherhood and Childhood

Deputy Prime Minister and Head of the State Committee for National Security, Kamchybek Tashiev,...

In Sulukta, servicemen were handed the keys to apartments

In Sulyukta, a ceremonial opening of new service apartments for military personnel took place,...

In Batken, children were shown a New Year's fairy tale and received gifts from the regional administration.

In Batken, a New Year's celebration for children was held, organized by the presidential...

The New Year's Tree of the Head of the Region Took Place in Osh

On December 23, a New Year event was held in Osh organized by the regional administration for...

In Bishkek, the results of the construction industry for the record year 2025 were summarized.

On December 22, a summary of the construction industry's performance for the record year 2025...

Tashiev hands over apartment keys to border guards in Osh region

In the Osh region, a ceremony was held during which keys to new service apartments were handed...

"Don't be afraid, but don't underestimate." A professor on the dangers of pneumonia

Every year on November 12, we celebrate World Pneumonia Day. Professor Talant Sooronbaev, head of...

Ishenaly Arabaev. A Moldovan Who Gave His Life for Enlightenment

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Tashiev familiarized himself with the progress of construction works on two large residential complexes in Balakchy

During his working trip to the Issyk-Kul region, Kamchybek Tashiev, who holds the position of...

Driver reform, words of Zhapikeev, visas, prices, GIC. What was January 2026 like?

For Kyrgyzstan citizens, January 2026 became particularly long: the New Year holidays stretched...