New Benefits for the Sewing and Textile Industry Have Emerged

According to the innovations, until January 1, 2030, a unified insurance contribution rate of 12% has been introduced for all participants in the sewing and textile industry, calculated from 40% of the average monthly wage. The minimum income tax rate for employees in this sector will be 1% of their average monthly salary.

Starting from January 1, 2026, enterprises will pay 12% of the insurance contribution for each employee based on 40% of the average monthly salary, which will amount to 2,115.5 soms, as well as 1% of the income tax from this salary — 440.7 soms. Thus, the total amount of mandatory payments for one employee will be 2,556.2 soms.

Read also:

The sewing industry is transitioning to preferential taxation until 2030

As part of new initiatives, special insurance contribution rates have been established for all...

Tax legislation has been amended again - the law has come into effect

The law previously adopted by Sadyr Japarov, "On Amendments to Certain Legislative Acts of the...

New Benefits Will Be Provided for the Sewing and Textile Industry

The State Tax Service (STS) announces the introduction of new benefits for the sewing and textile...

In the State Duma, a bill proposing tax incentives for certain sectors of the economy has been adopted in three readings.

- During the meeting of the Jogorku Kenesh, which took place on December 24, the parliamentarians...

Good news for Kyrgyz citizens. Changes have been made to the tax laws.

President Sadyr Japarov signed a new law concerning changes to the country's tax system,...

Tax incentives for businesses and citizens are being introduced in Kyrgyzstan

President Sadyr Japarov approved the draft law "On Amendments to Certain Legislative Acts of...

Tax benefits enhance the competitiveness of the textile industry and trigger a cumulative effect, - board member of the "Legprom" association

The President has signed a new law that introduces tax benefits for various categories of...

In Kyrgyzstan, there are plans to abolish insurance contributions for state social insurance for the sewing and textile industry until 2030.

- Sadyr Japarov approved the Decree "On Measures to Support Certain Sectors of the...

Tax and Insurance Benefits are Being Prepared for the Sewing Industry: Clarification from the State Tax Service

In Kyrgyzstan, the development of a draft law is planned, which will create uniform conditions for...

The State Duma supported amendments exempting certain categories of entrepreneurs from taxes

On December 24, the deputies of the Jogorku Kenesh approved amendments to the draft law concerning...

Tax and Insurance Benefits for Tailors and Small Businesses: What the New Presidential Decree Provides

In Kyrgyzstan, a draft law is being developed that will establish uniform rules for all sewing...

The bill providing tax incentives for certain sectors of the economy has been adopted by the Jogorku Kenesh.

During the last session of the Jogorku Kenesh, a draft law was approved concerning amendments to...

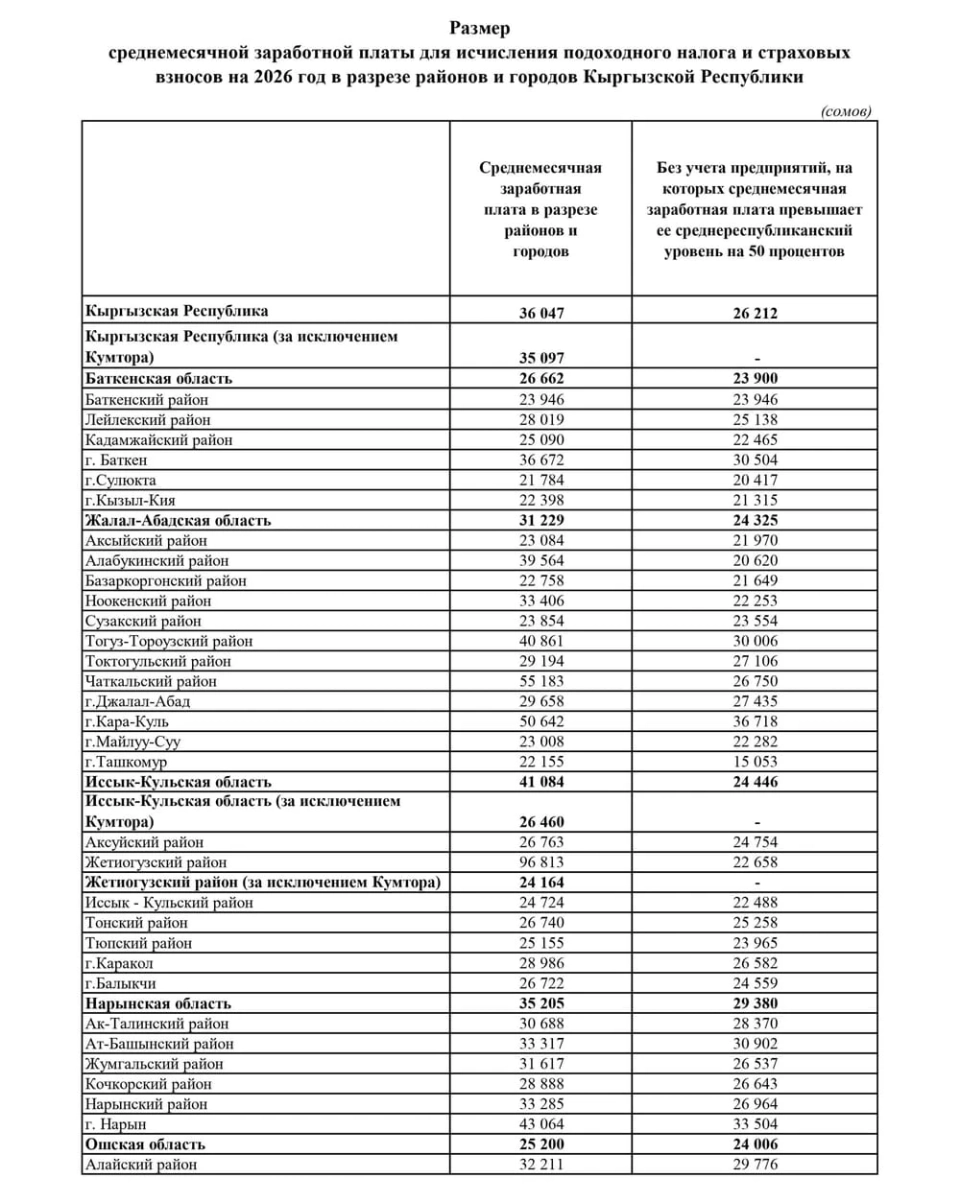

The Tax Service of Kyrgyzstan reported the average monthly salary for calculating income tax and insurance contributions for 2026.

The official website of the State Tax Service of Kyrgyzstan has published data on the average...

The average salary in Kyrgyzstan will rise to 36,000 soms in 2026.

The government of Kyrgyzstan has approved new average salary parameters that will be applied in...

Tax and Insurance Reliefs for Businesses Introduced in Kyrgyzstan

The President of the Kyrgyz Republic, Sadyr Japarov, has initiated a draft law concerning...

In Kyrgyzstan, unified working conditions will be established for all sewing enterprises

In Kyrgyzstan, a new draft law is currently being developed that will create unified conditions...

In Kyrgyzstan, transportation may become cheaper

On December 24, the changes in legislation regarding taxation, social insurance, and non-tax...

Cashless payment for labor will become mandatory for all employers. The President has signed the law.

- President Sadyr Japarov signed the Law "On Amendments to Certain Legislative Acts of the...

In Kyrgyzstan, a tourist tax is proposed to be introduced

The Unified Portal of Public Discussions presents the draft law "On Amendments to Certain...

Taxes, Cars, Transactions, and Benefits: The Cabinet Introduced Major Amendments to the Laws

The government of the country has submitted a draft law to the Jogorku Kenesh concerning amendments...

Tax and Insurance Benefits for Tailors and Small Businesses. The State Tax Service Explained What Will Change

The President has signed a decree regarding support for the sewing industry and small and...

The President signed a law on tax and administrative benefits for businesses and citizens

The document introduces the cancellation and reduction of a number of tax obligations, as well as...

The deputy proposed to resume the legalization of cars with foreign license plates.

- At the plenary session of the Jogorku Kenesh held on December 24, 2025, Deputy Marlen Mamataliyev...

Sadyr Japarov Introduced Changes to the Tax Code and Other Acts in the Field of Taxation

According to information from the presidential administration, Sadyr Japarov has signed a new law...

The Housing Complex Supported Amendments to Tax Laws

On December 24, the deputies of the Jogorku Kenesh adopted amendments to the legislation on...

Amendments Made to Certain Legislative Acts in the Field of Taxation

The President has signed a law...

Sadyr Japarov signed a decree on measures to support the jewelry, textile industry, and small business

President Sadyr Japarov signed a decree aimed at the development of the jewelry and textile...

In Kyrgyzstan, excise tax rates on alcohol will increase starting in 2026

Starting from January 1, 2026, new excise tax rates on alcoholic products will come into effect in...

In Kyrgyzstan, average salary indicators for tax calculation have been approved

New average salary indicators have been established in Kyrgyzstan, which will be used for tax...

Football in Kyrgyzstan will receive tax benefits starting from 2026

New tax benefits for the football industry...

The GNS reminded candidates for deputies about the norms of tax legislation

The State Tax Service of the Kyrgyz Republic has reminded candidates for deputies of the Jogorku...

The State Tax Service will receive more powers regarding non-tax revenues.

- On October 29, 2025, President Sadyr Japarov approved the KR Law No. 243 "On Amendments to...

Expanded list of NGOs required to submit consolidated information to the Tax Service

The State Tax Service of the Kyrgyz Republic has announced a significant expansion of the list of...

The amount of the average monthly salary for calculating income tax has been announced. List

On the website sti.gov.kg in the "Knowledge Base" section and the "Useful...

The issues of taxation were explained to the tailors of Kyrgyzstan.

A seminar was held in Kyrgyzstan, organized by the Ministry of Economy and Commerce in...

Tax Officials in Kyrgyzstan Train Tailors and Textile Workers on Using Electronic Tax Services

During the seminar, participants were explained the authorization procedures through the Unified...

In Kyrgyzstan, the excise tax on alcohol is being increased

The Ministry of Economy and Commerce of the Kyrgyz Republic is proposing a draft resolution to...

The GNS explained who will have their insurance contribution debts written off

The State Tax Service of the Kyrgyz Republic informs that according to the Law of the KR, adopted...

Attempts were made to illegally import gold items into Kyrgyzstan worth almost 14 million soms

The State Tax Service of the Kyrgyz Republic has prevented an attempt to smuggle gold items. Based...

In Kyrgyzstan, the list of types of NGOs required to submit consolidated information to the GNS has been expanded

The State Tax Service of the Kyrgyz Republic reminds of the necessity to provide consolidated...

The deputy spoke out against the abolition of licensing for the retail sale of alcoholic beverages.

- During the meeting, Gulya Kozhokulova expressed dissatisfaction with the cancellation of...

A large-scale support program for the jewelry and sewing industries is being launched in Kyrgyzstan

President of the Kyrgyz Republic Sadyr Japarov has signed a decree regarding the support of...

Exhibition of Paintings by Talaybek Usubaliev

May 22 - June 4 at "12 Restaurant"...