The sewing industry is transitioning to preferential taxation until 2030

As part of new initiatives, special insurance contribution rates have been established for all participants in the sewing and textile industry until January 1, 2030. They amount to 12% and are calculated based on 40% of the average monthly salary. According to the press service of the State Tax Service, a minimum income tax rate of 1% of the average monthly salary is also provided for workers in this sector.

From January 1, 2026, for example, entrepreneurs will pay a 12% insurance contribution for one employee, which will amount to 2,115.5 soms, as well as a 1% income tax of 440.7 soms. Thus, the total amount of tax payments for one employee will be 2,556.2 soms.

It should be noted that in 2026, the average monthly salary will be 44,070 soms.

It is worth reminding that on December 31, 2025, President Sadyr Japarov signed a law that amends several legislative acts related to taxation and social insurance.

This law aims to support both individuals and legal entities and was adopted in accordance with the decree of December 5, 2025, regarding measures to support the economy.

Read also:

In Kyrgyzstan, there are plans to abolish insurance contributions for state social insurance for the sewing and textile industry until 2030.

- Sadyr Japarov approved the Decree "On Measures to Support Certain Sectors of the...

Good news for Kyrgyz citizens. Changes have been made to the tax laws.

President Sadyr Japarov signed a new law concerning changes to the country's tax system,...

Tax and Insurance Benefits are Being Prepared for the Sewing Industry: Clarification from the State Tax Service

In Kyrgyzstan, the development of a draft law is planned, which will create uniform conditions for...

Tax incentives for businesses and citizens are being introduced in Kyrgyzstan

President Sadyr Japarov approved the draft law "On Amendments to Certain Legislative Acts of...

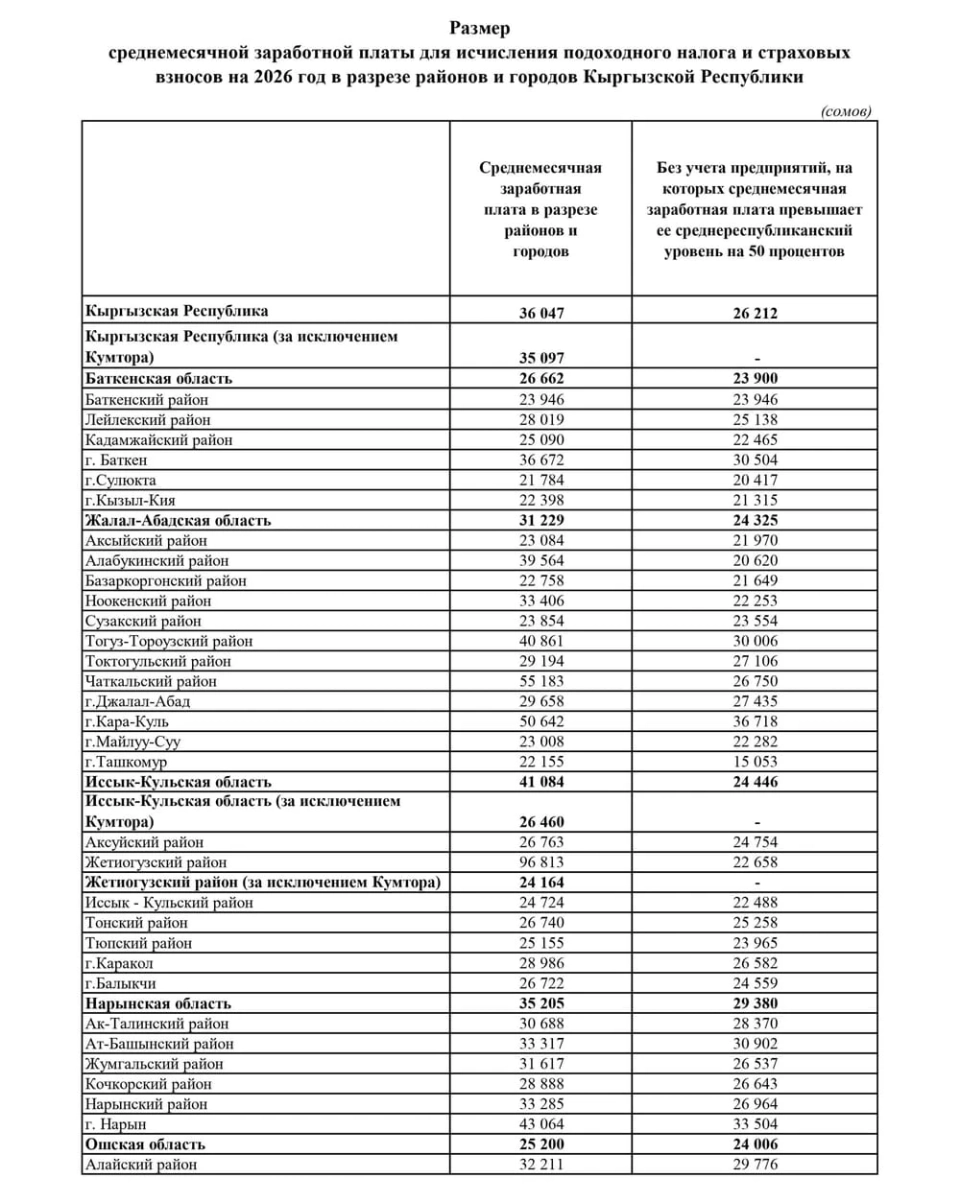

The Tax Service of Kyrgyzstan reported the average monthly salary for calculating income tax and insurance contributions for 2026.

The official website of the State Tax Service of Kyrgyzstan has published data on the average...

Tax benefits enhance the competitiveness of the textile industry and trigger a cumulative effect, - board member of the "Legprom" association

The President has signed a new law that introduces tax benefits for various categories of...

In Kyrgyzstan, unified working conditions will be established for all sewing enterprises

In Kyrgyzstan, a new draft law is currently being developed that will create unified conditions...

The average salary in Kyrgyzstan will rise to 36,000 soms in 2026.

The government of Kyrgyzstan has approved new average salary parameters that will be applied in...

Notaries Who Do Not Use Cash Register Machines May Lose Their Licenses

The President of the Kyrgyz Republic, Sadyr Japarov, has approved a law that amends a number of...

Tax and Insurance Reliefs for Businesses Introduced in Kyrgyzstan

The President of the Kyrgyz Republic, Sadyr Japarov, has initiated a draft law concerning...

The President signed a law on tax and administrative benefits for businesses and citizens

The document introduces the cancellation and reduction of a number of tax obligations, as well as...

Tax and Insurance Benefits for Tailors and Small Businesses: What the New Presidential Decree Provides

In Kyrgyzstan, a draft law is being developed that will establish uniform rules for all sewing...

In Kyrgyzstan, they plan to change the tax system for tailors, - GNS

A new draft law is being developed in Kyrgyzstan that will create uniform conditions for all...

The State Duma supported amendments exempting certain categories of entrepreneurs from taxes

On December 24, the deputies of the Jogorku Kenesh approved amendments to the draft law concerning...

In Kyrgyzstan, budget revenues from income tax are increasing

According to information provided by the Ministry of Finance, from January to September of the...

In Kyrgyzstan, the excise tax rate on alcohol has been increased (number)

Starting from January 1, 2026, an increase in excise tax rates on alcoholic beverages will come...

The Housing Complex Supported Amendments to Tax Laws

On December 24, the deputies of the Jogorku Kenesh adopted amendments to the legislation on...

GNS: Tax Conditions for Tailors in Kyrgyzstan Will Change

In particular, a temporary suspension of income tax is possible Deputy Chairman of the State Tax...

Tax and Insurance Benefits for Tailors and Small Businesses. The State Tax Service Explained What Will Change

The President has signed a decree regarding support for the sewing industry and small and...

Changes are being made to the cashless payment system in Kyrgyzstan

Sadyr Japarov, the President of Kyrgyzstan, has approved a draft law that amends a number of...

Over 275 billion soms in taxes collected in Kyrgyzstan in 11 months

According to the press service of the State Tax Service of the Kyrgyz Republic, the tax and payment...

The law establishing the rules for determining the limit on the percentage or markup of loans has been signed

According to information provided by the press service of the President's Administration,...

Benefits for jewelers, tailors, and when selling cars: the president signed the decree

Sadyr Japarov, the President of Kyrgyzstan, signed a decree titled "On Measures to Support...

In Kyrgyzstan, average salary indicators for tax calculation have been approved

New average salary indicators have been established in Kyrgyzstan, which will be used for tax...

Taxes, Cars, Transactions, and Benefits: The Cabinet Introduced Major Amendments to the Laws

The government of the country has submitted a draft law to the Jogorku Kenesh concerning amendments...

Football in Kyrgyzstan will receive tax benefits starting from 2026

New tax benefits for the football industry...

In the State Duma, a bill proposing tax incentives for certain sectors of the economy has been adopted in three readings.

- During the meeting of the Jogorku Kenesh, which took place on December 24, the parliamentarians...

Sadyr Japarov signed a decree on measures to support the jewelry, textile industry, and small business

President Sadyr Japarov signed a decree aimed at the development of the jewelry and textile...

In Kyrgyzstan, excise tax rates on alcohol will increase starting in 2026

Starting from January 1, 2026, new excise tax rates on alcoholic products will come into effect in...

Cashless payment for labor will become mandatory for all employers. The President has signed the law.

- President Sadyr Japarov signed the Law "On Amendments to Certain Legislative Acts of the...

Over 310 billion soms in taxes and contributions collected in Kyrgyzstan since the beginning of the year

As of the beginning of 2025, 310.4 billion soms have been collected in taxes and contributions in...

The bill providing tax incentives for certain sectors of the economy has been adopted by the Jogorku Kenesh.

During the last session of the Jogorku Kenesh, a draft law was approved concerning amendments to...

The amount of the average monthly salary for calculating income tax has been announced. List

On the website sti.gov.kg in the "Knowledge Base" section and the "Useful...

In Kyrgyzstan, the excise tax on alcohol is being increased

The Ministry of Economy and Commerce of the Kyrgyz Republic is proposing a draft resolution to...

The Cabinet has determined the minimum wage for 2026 — 3,280 soms

The government of Kyrgyzstan has approved the minimum wage level for 2026, which will amount to...

The authorities proposed the minimum wage for the next year.

According to the information from the Cabinet of Ministers, it is planned to set the minimum wage...

Sadyr Japarov Introduced Changes to the Tax Code and Other Acts in the Field of Taxation

According to information from the presidential administration, Sadyr Japarov has signed a new law...

In Russia, the VAT rate has been raised to 22% - the law has been signed

The law signed by Russian President Vladimir Putin increases the value-added tax (VAT) rate from...

The average salary in Kyrgyzstan has risen to 42,700 soms

According to data from the National Statistical Committee, the average nominal salary of one...

Debts of Insurance Contribution Payers Will Be Written Off

In accordance with the message from the Tax Service of the Kyrgyz Republic, according to the Law...

In Kyrgyzstan, transportation may become cheaper

On December 24, the changes in legislation regarding taxation, social insurance, and non-tax...

The President signed a law on the digitalization of judicial proceedings starting from 2026.

President Sadyr Japarov has approved a law concerning amendments to several legislative acts,...