The deputy head of the agency noted that the new rules will help create equal conditions for all categories of seamstresses.

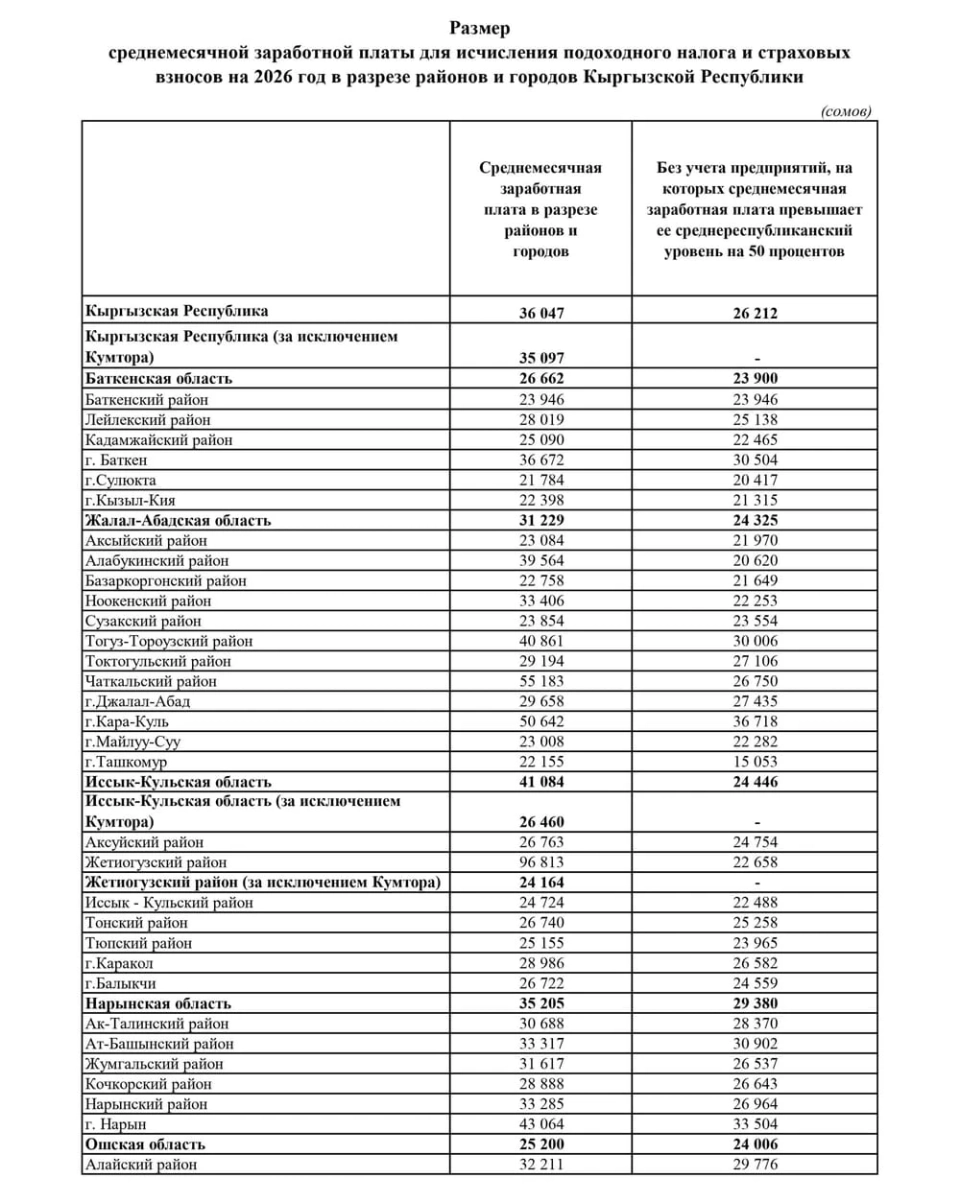

Insurance contributions will amount to 12% of 40% of the average monthly salary, which is approximately 2,200 soms on average. Additionally, a temporary exemption from income tax may be introduced.According to Isabekov, this innovation will support seamstresses in difficult times and will contribute to the legalization of business.

It should be noted that earlier President Sadyr Japarov signed a decree dedicated to "Measures to Support Certain Sectors of the Economy," which is aimed at supporting the sewing industry and small and medium enterprises (SMEs).

Within the framework of this decree, the following measures are provided:

- reduction of income tax rates for the sewing industry;

- reduction of insurance contribution rates for sewing industry enterprises;

- reduction of insurance contribution rates for small and medium enterprises;

- establishment of a single tax of 0.1% for activities conducted outside the Kyrgyz Republic;

- introduction of a transaction tax of 0.1% for operations conducted through banks of foreign states.

The Cabinet of Ministers has been instructed to consider the possibility of reducing income tax rates and insurance contribution rates for participants in the sewing industry in order to enhance the efficiency of the pension system and strengthen the socio-economic stability of the sector.