In Kyrgyzstan, they plan to change the tax system for tailors, - GNS

According to Isabekov, the proposed changes will allow for the unification of conditions for all tailors. In particular, it is planned to establish insurance contributions at the level of 12% of 40% of the average salary, which amounts to approximately 2,200 soms. Additionally, a temporary exemption from income tax may be introduced.

“These measures will help support tailors in difficult times and stimulate the legalization of business,” noted the Deputy Chairman of the Tax Service.

He also pointed out that currently representatives of various categories in the sewing industry pay different tax rates and insurance contributions, which creates unequal conditions and complicates business operations. The new draft law aims to simplify these rules.

According to the Tax Service, official statistics record about 9,000 workers in this sector; however, the actual number of workers is significantly higher, indicating the prevalence of shadow employment. The proposed changes are expected to help bring workers and enterprises out of the shadows, providing them with social guarantees.

Furthermore, there are plans to enhance efforts to inform entrepreneurs about the proper documentation and compliance with the requirements of government agencies, including the tax service, fire safety, and sanitary standards.

“Our goal is to create equal conditions for all participants in the sewing industry, support small and medium-sized businesses, and ensure social guarantees for workers,” concluded Kubanychbek Isabekov.

Read also:

Over 310 billion soms in taxes and contributions collected in Kyrgyzstan since the beginning of the year

As of the beginning of 2025, 310.4 billion soms have been collected in taxes and contributions in...

Since the beginning of the year, tax revenues of the state budget have increased by 27 percent

According to the Ministry of Finance, tax revenues of the state budget from January to September of...

Changes are being made to the cashless payment system in Kyrgyzstan

Sadyr Japarov, the President of Kyrgyzstan, has approved a draft law that amends a number of...

A meeting with entrepreneurs on the latest changes in tax legislation was held at the State Tax Service

The meeting discussed in detail the changes in tax legislation, as well as the digitalization of...

Notaries Who Do Not Use Cash Register Machines May Lose Their Licenses

The President of the Kyrgyz Republic, Sadyr Japarov, has approved a law that amends a number of...

The GNS discussed the latest changes in tax legislation with businesses.

The meeting of representatives of the State Tax Service (GNS) with businesspeople was organized to...

The new procedure for collecting tax debts will come into effect from 2026.

Starting from January 1, 2026, important changes will come into effect in the Tax Code of...

Benefits for jewelers, tailors, and when selling cars: the president signed the decree

Sadyr Japarov, the President of Kyrgyzstan, signed a decree titled "On Measures to Support...

About 1.5 million citizens of Kyrgyzstan use the "Taxpayer's Cabinet"

The press service of the State Tax Service (STS) reported a significant increase in the number of...

Business and Almambet Shykmamatov Discussed Tax Changes and Digitalization

In a recent meeting with business representatives, the head of the Tax Service, Alambet...

The Prosecutor General's Office ordered the internet platform to pay $2.885 million in taxes

In the Kyrgyz Republic, the General Prosecutor's Office has identified tax violations...

The State Tax Service Exceeded the Plan for Tax and Insurance Contributions Collection for the First 10 Months

According to Rakhmanov, compared to the same period in 2024, tax revenues increased by 73.2...

About 1.5 million citizens use the Taxpayer's Cabinet

The Deputy Chairman of the State Tax Service (GNS), Mirlan Rakhmanov, shared information with...

The Cabinet will require businesses to accept payment only by card? Response from the State Tax Service

In late October 2025, a package of amendments to the Tax Code of the Kyrgyz Republic was approved,...

In Kyrgyzstan, tax registration for patent workers has been simplified

In Kyrgyzstan, changes have occurred in the tax registration process for individuals working under...

In Kyrgyzstan, more than 90 PPP projects worth 434 billion soms are being implemented, - Amangeldiev

At the IV International Conference on Public-Private Partnership in Kyrgyzstan, the First Deputy...

The Cabinet of Ministers of Kyrgyzstan approved the flag and symbols of the Tax Service authorities

A new regulation concerning the flag and symbols of the Tax Service has been adopted in Kyrgyzstan....

Expert: Reducing Permitting Documents Will Make Business Life Easier

- In Kyrgyzstan, the process of reforming the licensing and permitting system continues. This was...

The head of the cabinet highly praised the work of the Tax and Customs Services of Kyrgyzstan

The Chairman of the Cabinet of Ministers of Kyrgyzstan, Adylbek Kasymaliev, spoke positively about...

Markets and shopping centers are required to monitor entrepreneurs and report to the State Tax Service.

In Kyrgyzstan, a new law has been adopted that significantly changes the rules of tax regulation....

The Second Stage of Tax Service Reforms: How the KEZET System Will Replace Inspectors

Photo from the internet. Almambet Shykmamatov, Chairman of the Tax Service A year ago, the...

Sadyr Japarov signed a decree on measures to support the jewelry, textile industry, and small business

President Sadyr Japarov signed a decree aimed at the development of the jewelry and textile...

Powers in the field of external labor migration will be transferred to the Ministry of Internal Affairs

The Deputy Chairman of the Security Council of Russia, Dmitry Medvedev, announced the transfer of...

"Will business flee from Kazakhstan to Kyrgyzstan?"

Starting January 1, 2026, a new Tax Code will come into effect in the neighboring country In...

In 9 months, about 57 thousand cases for the collection of alimony have been initiated

In the first nine months of 2025, 56,930 enforcement proceedings for the collection of alimony were...

300,000 companies may close in Kazakhstan due to tax reform. Consequences for the KR

A large-scale tax reform in Kazakhstan is already causing significant concern among representatives...

History of the Tax Service of the Kyrgyz Republic

The strength of the state lies in its budget. This postulate is indisputable. The main task of tax...

Debts of Insurance Contribution Payers Will Be Written Off

In accordance with the message from the Tax Service of the Kyrgyz Republic, according to the Law...

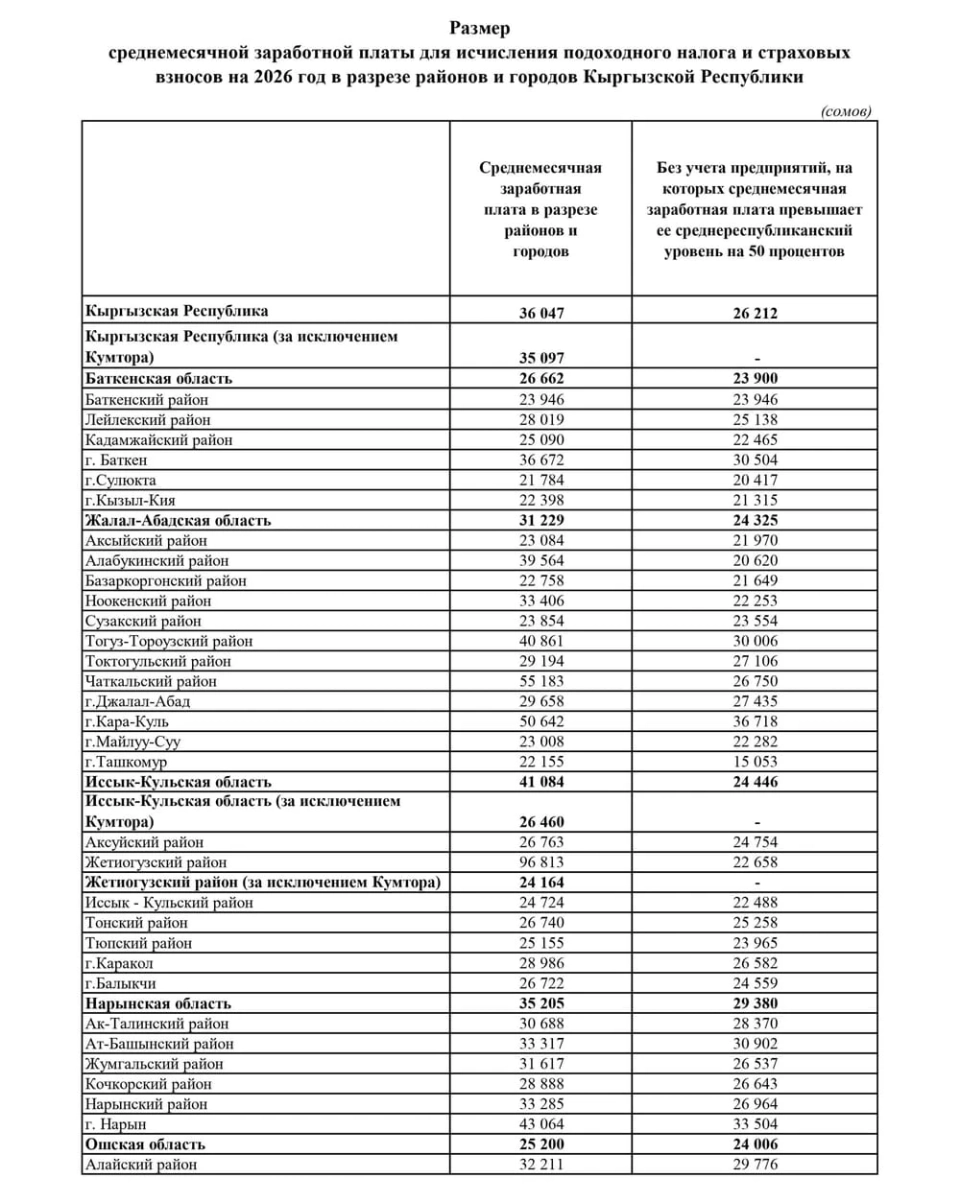

The average salary in Kyrgyzstan will rise to 36,000 soms in 2026.

The government of Kyrgyzstan has approved new average salary parameters that will be applied in...

A Seminar on Taxes, Accounting, and Market Entry in the EAEU for Tailors Was Held at the Ministry of Economic Development

A practical seminar was held at the Ministry of Economy and Commerce, organized in collaboration...

The portfolio of PPP projects in Kyrgyzstan exceeded 434 billion soms

The IV International Conference dedicated to public-private partnership was held in Bishkek. The...

Kyrgyzstanis reminded of changes in the taxation of certain types of real estate

According to the law adopted on October 29, changes have been made to the Tax Code regarding...

Candidates for deputies reminded of the provisions of the Tax Code related to elections

According to the information from the press service of the State Tax Service, candidates for...

The Tax Service of Kyrgyzstan reported the average monthly salary for calculating income tax and insurance contributions for 2026.

The official website of the State Tax Service of Kyrgyzstan has published data on the average...

A large-scale support program for the jewelry and sewing industries is being launched in Kyrgyzstan

President of the Kyrgyz Republic Sadyr Japarov has signed a decree regarding the support of...

Taxpayers on a Patent Are No Longer Required to Visit Tax Authorities

Changes have occurred in the tax registration process for taxpayers using patents in Kyrgyzstan....

Doctors in Kyrgyzstan will receive a 50 percent salary increase starting from April 2026

The Minister of Health, Erkin Checheybaev, stated in an interview with the news agency...

Banks should more actively finance production rather than consumption, - economist

Today, in Kyrgyzstan, areas such as digital transformation and regional development are rapidly...

In Kyrgyzstan, average salary indicators for tax calculation have been approved

New average salary indicators have been established in Kyrgyzstan, which will be used for tax...

The GNS clarified the new regulations on cashless payments in the Tax Code of Kyrgyzstan

The GNS clarifies that the law adopted on October 29, 2025, introduced a number of changes to the...

The State Tax Service Exceeded the Plan for Tax and Insurance Contribution Collection in the First 10 Months of 2025

In an interview on "Birinchi Radio," the Deputy Chairman of the State Tax Service,...

GNS Employees Exchanged Experience with the Swiss Company SICPA

From October 21 to 23 of this year, a delegation from the State Tax Service of Kyrgyzstan, led by...