A meeting with entrepreneurs on the latest changes in tax legislation was held at the State Tax Service

The meeting discussed in detail the changes in tax legislation, as well as the digitalization of tax administration processes and the improvement of conditions for entrepreneurship.

Almambet Shykmamatov noted that all changes being made to the tax system are aimed at simplification, transparency, and creating more favorable conditions for doing business, as well as reducing the administrative burden for honest taxpayers.

“The goal of all the changes adopted is to facilitate business operations and support entrepreneurs. The State Tax Service is open to cooperation and ready to work with businesses to address emerging issues,” he added.

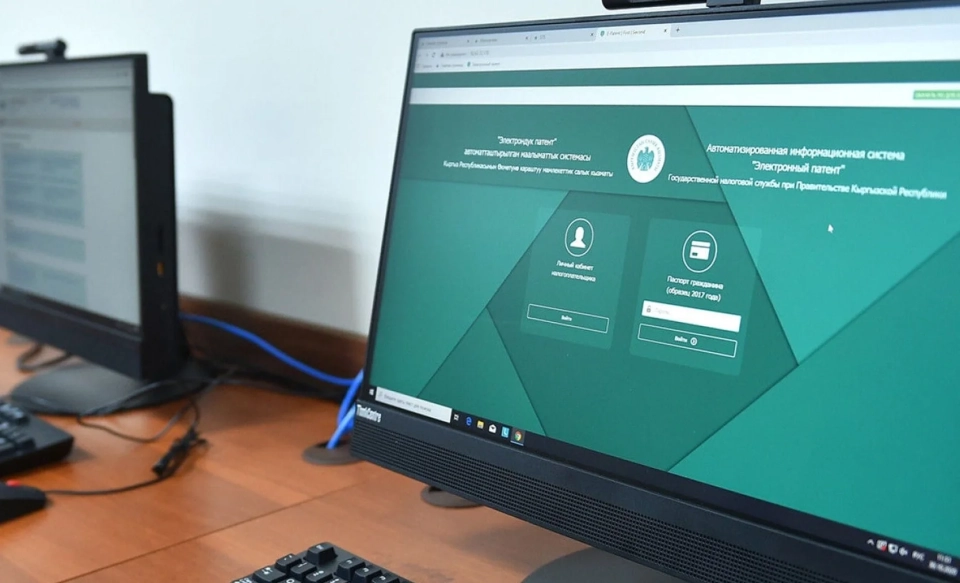

Deputy Chairman of the State Tax Service Kubanychbek Ysabekov presented information on key changes in tax laws, the implementation of electronic transactions, and the digitization of tax procedures.

He emphasized that the measures being taken are aimed at increasing the transparency of calculations and optimizing tax processes, especially for small and medium-sized businesses, with the goal of further developing the digital infrastructure in the field of taxation.

The format of the meeting allowed entrepreneurs to ask questions, propose ideas, and share initiatives for improving tax policy.

The event was attended by representatives of various associations, including suppliers, markets, services, tax consultants, the agro-industrial complex, tailors, jewelers, as well as banks, telecommunications operators, and industrial enterprises.

The State Tax Service plans to hold similar meetings regularly, which will help strengthen trust and establish effective partnerships between government agencies and the business community.

Read also:

About 1.5 million citizens of Kyrgyzstan use the "Taxpayer's Cabinet"

The press service of the State Tax Service (STS) reported a significant increase in the number of...

The GNS clarified the new regulations on cashless payments in the Tax Code of Kyrgyzstan

The GNS clarifies that the law adopted on October 29, 2025, introduced a number of changes to the...

The Cabinet will require businesses to accept payment only by card? Response from the State Tax Service

In late October 2025, a package of amendments to the Tax Code of the Kyrgyz Republic was approved,...

The Federal Tax Service clarified the regulations on cashless payments: cash payments are not being canceled

The State Tax Service (STS) has denied rumors of a complete ban on cash transactions in retail,...

The opportunities for partnership between the government, business, and investors were discussed in the Kyrgyz Republic.

In Bishkek, an event titled "New Architecture of Investment Policy: Partnership of the State,...

About 1.5 million citizens use the Taxpayer's Cabinet

The Deputy Chairman of the State Tax Service (GNS), Mirlan Rakhmanov, shared information with...

At the meeting in Bishkek, the real protection of private business property rights was discussed

At the event titled "New Architecture of Investment Policy: Partnership of the State,...

The Prosecutor General's Office launches a digital framework for business protection: a registry of cases, monitoring of inspections, and an application

The head of the Department for Combating Corruption and Monitoring Compliance with Legislation in...

The opportunities for partnership between the government, business, and investors were discussed in Bishkek

A memorandum of cooperation has been signed between the National Agency for Investments, the...

The Prosecutor General's Office ordered the internet platform to pay $2.885 million in taxes

In the Kyrgyz Republic, the General Prosecutor's Office has identified tax violations...

Notaries Who Do Not Use Cash Register Machines May Lose Their Licenses

The President of the Kyrgyz Republic, Sadyr Japarov, has approved a law that amends a number of...

What Will Happen to Cash in Trade - GNS Commentary

Changes in the Tax and Labor Codes The State Tax Service reported that cash continues to be used...

In Kyrgyzstan, artificial intelligence will be implemented in tax administration

The government of Kyrgyzstan has instructed the Tax Service to implement an analytics system based...

Markets and shopping centers are required to monitor entrepreneurs and report to the State Tax Service.

In Kyrgyzstan, a new law has been adopted that significantly changes the rules of tax regulation....

Cashless payment for labor will become mandatory for all employers. The President has signed the law.

- President Sadyr Japarov signed the Law "On Amendments to Certain Legislative Acts of the...

Since the beginning of the year, tax revenues of the state budget have increased by 27 percent

According to the Ministry of Finance, tax revenues of the state budget from January to September of...

In Kyrgyzstan, penalties and fines will be calculated automatically

A new law has been adopted in Kyrgyzstan, amending the provisions of the Tax Code. Now, the accrual...

The GNS explains why the service charge in cafes is listed differently on receipts.

The State Tax Service of the Kyrgyz Republic explained why service charges in restaurants and cafes...

The State Tax Service Exceeded the Plan for Tax and Insurance Contributions Collection for the First 10 Months

According to Rakhmanov, compared to the same period in 2024, tax revenues increased by 73.2...

The GNS clarified who is required to use KKM, ETTN, and ESF

“These tools create a fair and effective tax system” The State Tax Service of the Kyrgyz Republic...

The Ministry of Natural Resources plans to achieve control over the payment of environmental fees.

Meder Mashiyev, head of the Ministry of Natural Resources, noted that many enterprises are delaying...

Amendments Made to Certain Legislative Acts in the Field of Taxation

The President has signed a law...

The State Tax Service will receive more powers regarding non-tax revenues.

- On October 29, 2025, President Sadyr Japarov approved the KR Law No. 243 "On Amendments to...

In Bishkek, measures to improve the investment and business environment in the country will be discussed

On October 30, the National Investment Agency will organize an open discussion, following the...

Expanded list of NGOs required to submit consolidated information to the tax authorities

Consolidated information must be submitted to the State Tax Service no later than April 1 of each...

The State Tax Service of Kyrgyzstan will conduct remote business inspections - without visits and notifications

The Tax Service of Kyrgyzstan has announced the introduction of a new approach to tax control,...

Amangeldiev and Barsegyan Discussed Cooperation Issues in Industry and the Agro-Industrial Complex

- At the meeting held between the First Deputy Chairman of the Cabinet of Ministers Danyar...

The new investment law aims to protect the rights of entrepreneurs and investors, - Prosecutor General's Office

In Bishkek, on October 30, 2025, an event titled "New Architecture of Investment Policy:...

The State Tax Service Exceeded the Plan for Tax and Insurance Contribution Collection in the First 10 Months of 2025

In an interview on "Birinchi Radio," the Deputy Chairman of the State Tax Service,...

The Tax Service of Kyrgyzstan explained who should use KKM, ETTN, and ESF

ETTN National taxpayers selling the specified goods must use ETTN during their turnover. This...

More than 125 million soms allocated for the development of small and medium-sized enterprises

The country continues to implement an initiative aimed at supporting small and medium-sized...

The Tax Service of the Kyrgyz Republic clarified who should apply KKM, ETTN, and ESF

The Tax Service of the Kyrgyz Republic has provided information on the rules for the use of cash...

In Kyrgyzstan, the tightening of rules for the operation of checkpoints and goods accounting is being discussed.

The draft resolution of the Cabinet of Ministers concerning changes to the rules for the operation...

Changes are being made to the cashless payment system in Kyrgyzstan

Sadyr Japarov, the President of Kyrgyzstan, has approved a draft law that amends a number of...

History of the Tax Service of the Kyrgyz Republic

The strength of the state lies in its budget. This postulate is indisputable. The main task of tax...

Over 140 million soms allocated to support small and medium-sized businesses

In Kyrgyzstan, the project "Preferential Lending for Small and Medium Enterprises" is...

GNS Employees Exchanged Experience with Swiss Company SICPA

The State Tax Service of Kyrgyzstan is exploring the implementation of SICPA technologies Led by...

Why is the service charge in cafes indicated differently in KKM receipts? Explanation from the State Tax Service

The State Tax Service of Kyrgyzstan explains how information about the service charge should be...

The Prosecutor General's Office has ordered the internet platform to pay $2.9 million in taxes

Most likely, this refers to the marketplace Temu...

In Kyrgyzstan, all private driving schools will be transferred to state management

Tumanbaev emphasized that the main goal of this reform is to increase transparency and reduce...

The head of the cabinet highly praised the work of the Tax and Customs Services of Kyrgyzstan

The Chairman of the Cabinet of Ministers of Kyrgyzstan, Adylbek Kasymaliev, spoke positively about...

Amendments Made to the Action Plan for the Implementation of the State Program to Increase the Share of Cashless Payments

- Adjustments have been made to the Action Plan aimed at implementing the State Program for...