Business and Almambet Shykmamatov Discussed Tax Changes and Digitalization

The focus of the discussion was on innovations aimed at simplifying the operations of companies and reducing administrative burdens.

Shykmamatov noted that the changes in legislation are designed to create clearer conditions for business and support honest taxpayers. He emphasized: “All changes aim to facilitate business operations and promote entrepreneurship. The Tax Service is open to dialogue and ready to work with businesses to address emerging issues.”

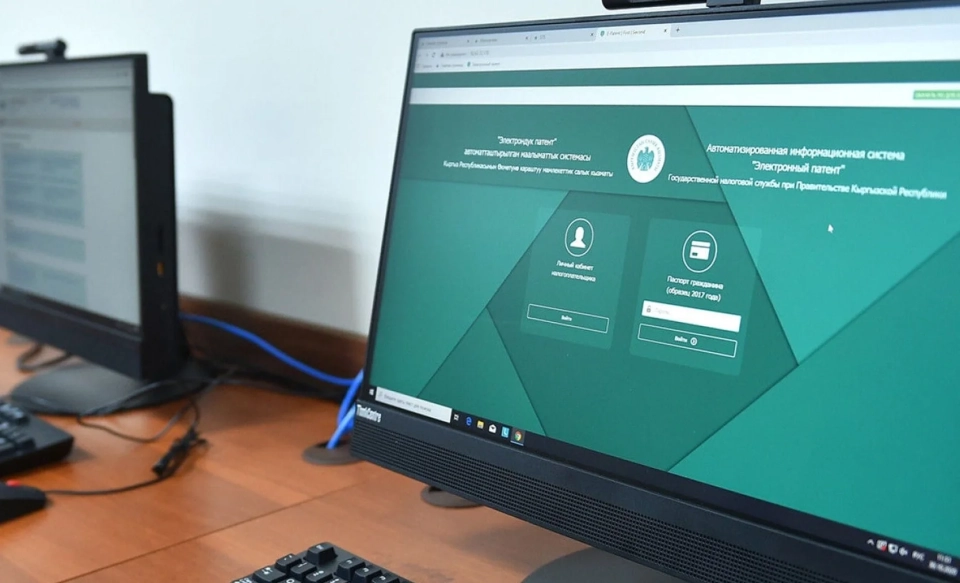

The deputy head of the service, Kubanychbek Isabekov, also shared information about key innovations related to the implementation of electronic transactions, digitization of procedures, and steps to enhance the transparency of calculations. In his opinion, these measures should significantly simplify processes for small and medium-sized businesses and accelerate the development of digital services.

During the meeting, entrepreneurs presented their proposals and initiatives aimed at improving tax policy.

Read also:

A meeting with entrepreneurs on the latest changes in tax legislation was held at the State Tax Service

The meeting discussed in detail the changes in tax legislation, as well as the digitalization of...

The GNS discussed the latest changes in tax legislation with businesses.

The meeting of representatives of the State Tax Service (GNS) with businesspeople was organized to...

Notaries Who Do Not Use Cash Register Machines May Lose Their Licenses

The President of the Kyrgyz Republic, Sadyr Japarov, has approved a law that amends a number of...

The opportunities for partnership between the government, business, and investors were discussed in the Kyrgyz Republic.

In Bishkek, an event titled "New Architecture of Investment Policy: Partnership of the State,...

At the meeting in Bishkek, the real protection of private business property rights was discussed

At the event titled "New Architecture of Investment Policy: Partnership of the State,...

Changes are being made to the cashless payment system in Kyrgyzstan

Sadyr Japarov, the President of Kyrgyzstan, has approved a draft law that amends a number of...

The Cabinet will require businesses to accept payment only by card? Response from the State Tax Service

In late October 2025, a package of amendments to the Tax Code of the Kyrgyz Republic was approved,...

The GNS clarified the new regulations on cashless payments in the Tax Code of Kyrgyzstan

The GNS clarifies that the law adopted on October 29, 2025, introduced a number of changes to the...

The head of the cabinet highly praised the work of the Tax and Customs Services of Kyrgyzstan

The Chairman of the Cabinet of Ministers of Kyrgyzstan, Adylbek Kasymaliev, spoke positively about...

Markets and shopping centers are required to monitor entrepreneurs and report to the State Tax Service.

In Kyrgyzstan, a new law has been adopted that significantly changes the rules of tax regulation....

The Federal Tax Service clarified the regulations on cashless payments: cash payments are not being canceled

The State Tax Service (STS) has denied rumors of a complete ban on cash transactions in retail,...

The opportunities for partnership between the government, business, and investors were discussed in Bishkek

A memorandum of cooperation has been signed between the National Agency for Investments, the...

About 1.5 million citizens of Kyrgyzstan use the "Taxpayer's Cabinet"

The press service of the State Tax Service (STS) reported a significant increase in the number of...

The Prosecutor General's Office launches a digital framework for business protection: a registry of cases, monitoring of inspections, and an application

The head of the Department for Combating Corruption and Monitoring Compliance with Legislation in...

About 1.5 million citizens use the Taxpayer's Cabinet

The Deputy Chairman of the State Tax Service (GNS), Mirlan Rakhmanov, shared information with...

The Prosecutor General's Office ordered the internet platform to pay $2.885 million in taxes

In the Kyrgyz Republic, the General Prosecutor's Office has identified tax violations...

The State Tax Service Exceeded the Plan for Tax and Insurance Contributions Collection for the First 10 Months

According to Rakhmanov, compared to the same period in 2024, tax revenues increased by 73.2...

The Minister of Natural Resources visited the Jalal-Abad Regional Office of the Department

During his visit to the Jalal-Abad region, the Minister of Natural Resources, Ecology, and...

GNS and KTU "Manas" agreed on the training of jewelers in Kyrgyzstan

The Kyrgyz State Tax Service (GNS) and the Kyrgyz-Turkish University "Manas" have...

Banks should more actively finance production rather than consumption, - economist

Today, in Kyrgyzstan, areas such as digital transformation and regional development are rapidly...

The new investment law aims to protect the rights of entrepreneurs and investors, - Prosecutor General's Office

In Bishkek, on October 30, 2025, an event titled "New Architecture of Investment Policy:...

This is a record: "Altyn Alliance" has transferred over 10 billion soms in taxes to the Kyrgyzstan budget for the first time in just 9 months

Since the beginning of the development of the "Djeruy" deposit in 2015, "Alliance...

Minister of Justice of the Kyrgyz Republic A. Shykmamatov participated in the meeting of the Council of Ministers of Justice of the SCO countries

The Minister of Justice of the Kyrgyz Republic A. Shykmamatov participated in the second meeting...

The State Tax Service will receive more powers regarding non-tax revenues.

- On October 29, 2025, President Sadyr Japarov approved the KR Law No. 243 "On Amendments to...

By 2030, the goal is set to triple the contribution of small businesses, - AP

By 2030, Kyrgyzstan aims to triple the volume of gross added value created by small and...

In Kyrgyzstan, penalties and fines will be calculated automatically

A new law has been adopted in Kyrgyzstan, amending the provisions of the Tax Code. Now, the accrual...

The Tax Service of the Kyrgyz Republic clarified who should apply KKM, ETTN, and ESF

The Tax Service of the Kyrgyz Republic has provided information on the rules for the use of cash...

More than 125 million soms allocated for the development of small and medium-sized enterprises

The country continues to implement an initiative aimed at supporting small and medium-sized...

Over 140 million soms allocated to support small and medium-sized businesses

In Kyrgyzstan, the project "Preferential Lending for Small and Medium Enterprises" is...

Kazakhstanis are waiting for summer at Issyk-Kul

The meeting with representatives of the tourism business of Kazakhstan in Almaty was successful....

Over 310 billion soms in taxes and contributions collected in Kyrgyzstan since the beginning of the year

As of the beginning of 2025, 310.4 billion soms have been collected in taxes and contributions in...

New Head of the Main Directorate for Road Traffic Safety of the Ministry of Internal Affairs Appointed

There have been personnel changes in the Ministry of Internal Affairs: Colonel of Police Azenbek...

3.4 Thousand Liters of Illegal Motor Oil Discovered in Bishkek

During a raid organized by the State Tax Service, a significant batch of motor oil without excise...

Pharmacy in Osh Sold Medications Without Registration and License

In the city of Osh, a batch of medications was discovered that had not undergone state registration...

For the first time, "Altyn Alliance" transferred over 10 billion soms to the budget in 9 months

In the first nine months of this year, "Alliance Altyn" contributed over 10.5 billion...

Amendments Made to Certain Legislative Acts in the Field of Taxation

The President has signed a law...

In Kyrgyzstan, control over foreign operations for large businesses is being tightened

In Kyrgyzstan, there is a tightening of control over large taxpayers and tax agents, especially...

The Cabinet of Ministers of Kyrgyzstan approved the flag and symbols of the Tax Service authorities

A new regulation concerning the flag and symbols of the Tax Service has been adopted in Kyrgyzstan....

GNS Employees Exchanged Experience with Swiss Company SICPA

The State Tax Service of Kyrgyzstan is exploring the implementation of SICPA technologies Led by...

Kyrgyzstan and the USA Discussed Strengthening Political Dialogue and Economic Cooperation

A meeting took place in Washington, where the Ambassador of Kyrgyzstan to the USA, Aibek...

Presentation of the project "USAID Business Development Initiative"

On October 14, the Vice Prime Minister of the Kyrgyz Republic, Valery Dil, participated in the...

Since the beginning of the year, tax revenues of the state budget have increased by 27 percent

According to the Ministry of Finance, tax revenues of the state budget from January to September of...

The Ministry of Transport handed over new official vehicles to the state company "Kyrgyzavtozhol-Tunduk"

On October 24, the Minister of Transport and Communications of Kyrgyzstan, Abdykar Syrgabaev,...

Population of Kyrgyzstan as of January 1, 2013

Population of Kyrgyzstan Thanks to the fundamental changes that occurred in Kyrgyzstan after the...