In Kyrgyzstan, tax registration for patent workers has been simplified

Now, the registration procedure for taxpayers using a patent has become more accessible.

Individuals obtaining a patent through the STS electronic systems are automatically registered with the tax authorities from the moment the document is issued. This means that the need for a personal visit for registration is eliminated.

A similar mechanism has also been implemented for individual entrepreneurs. Registration occurs automatically upon acquiring a patent, and a separate application is not required.

It is important to note that activities conducted under a patent are now exempt from exit tax audits for the entire duration of its validity, except for counter audits.

Read also:

Taxpayers on a Patent Are No Longer Required to Visit Tax Authorities

Changes have occurred in the tax registration process for taxpayers using patents in Kyrgyzstan....

GNS: Simplified Registration for Taxpayers Operating on a Patent Basis

Thus, individual entrepreneurs or individuals operating on the basis of a patent will now be...

The Prosecutor General's Office ordered the internet platform to pay $2.885 million in taxes

In the Kyrgyz Republic, the General Prosecutor's Office has identified tax violations...

The Prosecutor General's Office reported the receipt of $2.8 million in taxes at once from the internet platform "T."

It has become known that the international platform "T." was operating in Kyrgyzstan...

About 1.5 million citizens of Kyrgyzstan use the "Taxpayer's Cabinet"

The press service of the State Tax Service (STS) reported a significant increase in the number of...

Over 310 billion soms in taxes and contributions collected in Kyrgyzstan since the beginning of the year

As of the beginning of 2025, 310.4 billion soms have been collected in taxes and contributions in...

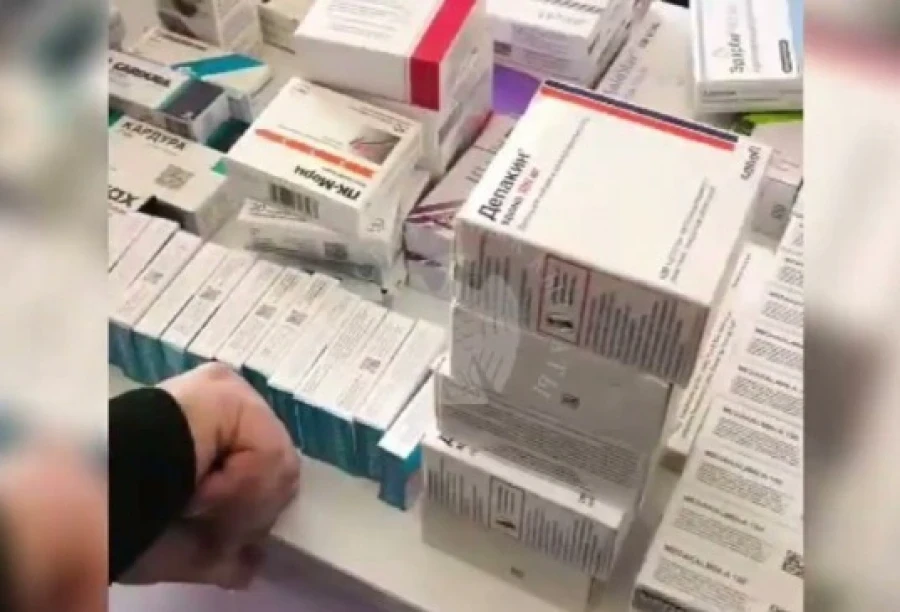

Pharmacy in Osh Sold Medications Without Registration and License

In the city of Osh, a batch of medications was discovered that had not undergone state registration...

The new procedure for collecting tax debts will come into effect from 2026.

Starting from January 1, 2026, important changes will come into effect in the Tax Code of...

In Kyrgyzstan, penalties and fines will be calculated automatically

A new law has been adopted in Kyrgyzstan, amending the provisions of the Tax Code. Now, the accrual...

When the taxpayer must enter purchase data into the EFS system themselves

The State Tax Service reminds that taxpayers using electronic invoices must independently enter...

Notaries Who Do Not Use Cash Register Machines May Lose Their Licenses

The President of the Kyrgyz Republic, Sadyr Japarov, has approved a law that amends a number of...

The Cabinet of Ministers of Kyrgyzstan approved the flag and symbols of the Tax Service authorities

A new regulation concerning the flag and symbols of the Tax Service has been adopted in Kyrgyzstan....

Candidates for deputies reminded of the provisions of the Tax Code related to elections

According to the information from the press service of the State Tax Service, candidates for...

The Ministry of Internal Affairs proposes mandatory genomic and fingerprint registration

The Ministry of Internal Affairs of the Kyrgyz Republic has initiated a discussion on a draft law...

The head of the cabinet highly praised the work of the Tax and Customs Services of Kyrgyzstan

The Chairman of the Cabinet of Ministers of Kyrgyzstan, Adylbek Kasymaliev, spoke positively about...

Changes are being made to the cashless payment system in Kyrgyzstan

Sadyr Japarov, the President of Kyrgyzstan, has approved a draft law that amends a number of...

Who Should Use KKM, ETTN, and ESF. Clarification from the GNS

The State Tax Service has provided clarifications on the use of the electronic waybill (EWT),...

The GNS clarified who is required to use KKM, ETTN, and ESF

“These tools create a fair and effective tax system” The State Tax Service of the Kyrgyz Republic...

The Tax Service of Kyrgyzstan explained who should use KKM, ETTN, and ESF

ETTN National taxpayers selling the specified goods must use ETTN during their turnover. This...

Markets and shopping centers are required to monitor entrepreneurs and report to the State Tax Service.

In Kyrgyzstan, a new law has been adopted that significantly changes the rules of tax regulation....

The state license plates for cars have changed slightly; they have started being issued in Kyrgyzstan.

In Kyrgyzstan, the issuance of new state license plates for vehicles has begun, as announced on...

"Kyrgyz citizens abroad do not need to register with the consulate to participate in the voting, - CEC"

The Central Commission for Elections and Referendums (CEC) informs the citizens of Kyrgyzstan, both...

The Prosecutor General's Office has ordered the internet platform to pay $2.9 million in taxes

Most likely, this refers to the marketplace Temu...

Kyrgyzstanis reminded of changes in the taxation of certain types of real estate

According to the law adopted on October 29, changes have been made to the Tax Code regarding...

The Tax Service of the Kyrgyz Republic clarified who should apply KKM, ETTN, and ESF

The Tax Service of the Kyrgyz Republic has provided information on the rules for the use of cash...

In Kyrgyzstan, artificial intelligence will be implemented in tax administration

The government of Kyrgyzstan has instructed the Tax Service to implement an analytics system based...

3.4 Thousand Liters of Illegal Motor Oil Discovered in Bishkek

During a raid organized by the State Tax Service, a significant batch of motor oil without excise...

In 9 months, 181 appeals were received regarding tax service employees

From the reviewed appeals: for 67 cases, the information was fully confirmed; for 5 cases —...

The Tax Service of Kyrgyzstan reported on changes in the procedure for entering data into the EFS system.

At the same time, if the taxpayer uses the general tax regime and issues an invoice for goods...

In Kyrgyzstan, they want to introduce mandatory DNA registration for convicts and foreigners

The draft Law "On State Genomic and Dactyloscopic Registration in the Kyrgyz Republic,"...

The State Tax Service will receive more powers regarding non-tax revenues.

- On October 29, 2025, President Sadyr Japarov approved the KR Law No. 243 "On Amendments to...

Business and Almambet Shykmamatov Discussed Tax Changes and Digitalization

In a recent meeting with business representatives, the head of the Tax Service, Alambet...

From May, citizens of the Kyrgyz Republic will be able to stay in Kazakhstan for 30 days without registration.

From May, citizens of the Kyrgyz Republic will be able to stay for 30 days without registration in...

Car registration has started to bring significantly more money to the budget

From January to September 2025, Kyrgyzstan received 3 billion 999.2 million soms (approximately...

The Financial Supervisory Authority requires all auditing organizations to submit physical copies of previously issued licenses for their withdrawal and accounting.

- According to information provided by the press service of the State Financial Supervision, all...

Almost $3 million in taxes came from the activities of a popular internet platform in Kyrgyzstan

In Kyrgyzstan, approximately 3 million dollars in taxes were received from the activities of one...

The tax service of Kyrgyzstan has a new flag and emblem

The Cabinet of Ministers of Kyrgyzstan has approved a new Regulation on the flag and emblem of the...

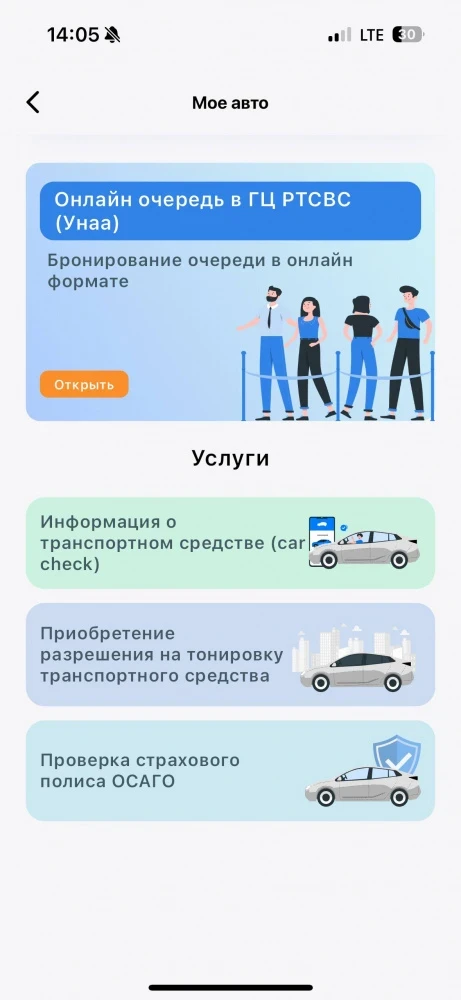

The Tunduk app now features electronic queues for "Unaa" and "Cadastre"

The press service of the State Institution "Kyzmat" announced updates to the electronic...

Tax authorities discovered an illegal shipment of medicines in Osh.

Medicines were found in the pharmacy that were sold without a license In the city of Osh,...

About 1.5 million citizens use the Taxpayer's Cabinet

The Deputy Chairman of the State Tax Service (GNS), Mirlan Rakhmanov, shared information with...

Candidate for Deputy Denied Registration Due to Religious Activities

The decision to deny Mirlan Nurbayev's registration as a candidate for deputy was made by the...

Taxi drivers reminded: without submitting documents by December 1, there will be no license

The Patrol Police Service (PPS) has urged taxi drivers to prepare a complete set of documents for...