A year ago, the President of Kyrgyzstan set a priority — to simplify tax procedures for entrepreneurs while finding a balance between the interests of business and the state. Almambet Shykmamatov, who heads the Tax Service, shared information about achievements and upcoming reforms.

First stage of reforms: simplification of processes

The head of the Tax Service reported that the first stage of reforms has been completed, and the results are impressive:

“We have made tax procedures more convenient and transparent, reduced bureaucracy, simplified reporting and tax payments. We also conducted an internal reorganization of the service,” he noted.

This stage can be characterized by statistical data. The annual tax revenue plan for 2025 was set at 268 billion soms, and the Tax Service was able to exceed it by more than 30 billion in 11 months.

Introduction of KEZET and optimization of staff

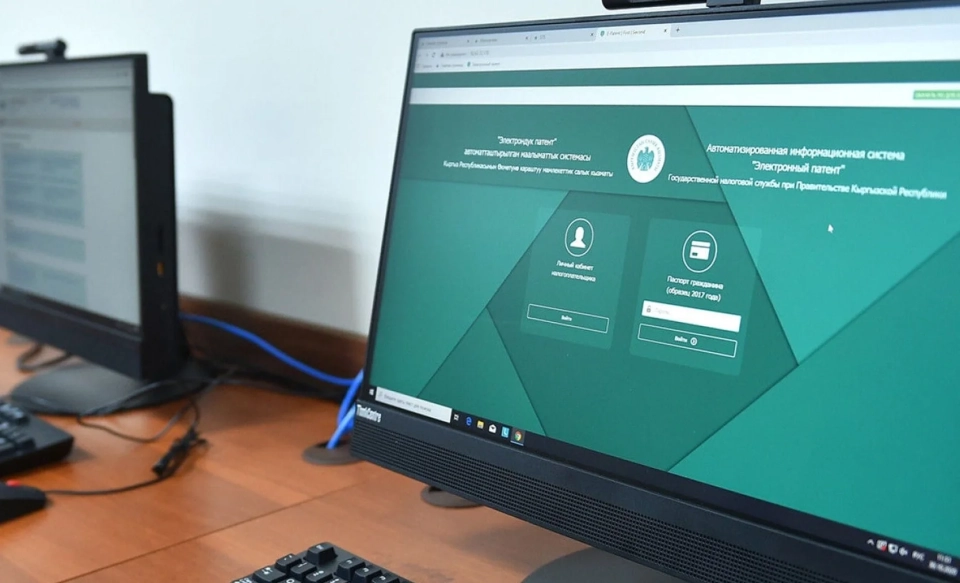

Right after the New Year holidays, the second stage of reforms will begin, which will be based on the implementation of the new electronic accounting module KEZET. This system will replace tax inspectors, completely eliminating the human factor, as Shykmamatov emphasized.

“With KEZET, we will be able to track every product — from production to the cash register receipt. This system is based on Estonian solutions recognized as among the best in the field of digitalization. It will help eliminate subjectivity in the work of inspectors, automatically identify discrepancies in reports, reduce the number of inspections, and minimize corruption risks,” he added.

Testing of KEZET is scheduled for January 2026. Adaptation and training will take place over six months.

Starting in May, the number of inspectors will begin to decrease, as control functions will transition to the new system. In the first stage, it is planned to reduce 500 employees, with another 500 to follow six months later. Currently, the Tax Service employs 3,400 tax officials, and in a year there will be a thousand fewer.

Tax Service as a service

“It is important to note that the reduction in the number of inspectors will not lead to a weakening of control. This is a step towards creating a more efficient and corruption-free system. The digital module will operate accurately, transparently, and without interference,” noted the Chairman of the Tax Service.

We strive for the Tax Service to stop being a "punitive model" and to become a full-fledged service for business and citizens.

Almambet Shykmamatov

According to him, the main goal of the state is not to punish but to support entrepreneurs in fulfilling their obligations simply and transparently.

For this, the service must offer convenient digital tools, clear rules, and timely consultations, the official added.

“All our reforms are aimed at supporting business development, especially small and medium-sized enterprises. Kyrgyzstan today has some of the most favorable conditions for entrepreneurship in the CIS,” he concluded.