Tax Officials in Kyrgyzstan Train Tailors and Textile Workers on Using Electronic Tax Services

During the seminar, participants were explained the authorization procedures through the Unified Identification System (UIS), as well as the basic principles of taxation in the sewing and textile industries. Special attention was given to the calculation of income tax considering hired employees and the application of the unified tax.

Experts from the State Tax Service also discussed the necessary documents for exporting goods abroad, including electronic invoices. Such events are held regularly to improve awareness of tax regulations and ways to utilize electronic services.

Read also:

In Kyrgyzstan, budget revenues from income tax are increasing

According to information provided by the Ministry of Finance, from January to September of the...

Export to Russia: New Requirements Explained to Kyrgyzstan's Tailors

A practical seminar was held at the Kyrgyz Ministry of Economy and Commerce, organized in...

The issues of taxation were explained to the tailors of Kyrgyzstan.

A seminar was held in Kyrgyzstan, organized by the Ministry of Economy and Commerce in...

The Tax Service of Kyrgyzstan reported the average monthly salary for calculating income tax and insurance contributions for 2026.

The official website of the State Tax Service of Kyrgyzstan has published data on the average...

The GNS clarified who is required to use KKM, ETTN, and ESF

“These tools create a fair and effective tax system” The State Tax Service of the Kyrgyz Republic...

Who Should Use KKM, ETTN, and ESF. Clarification from the GNS

The State Tax Service has provided clarifications on the use of the electronic waybill (EWT),...

The average salary in Kyrgyzstan will rise to 36,000 soms in 2026.

The government of Kyrgyzstan has approved new average salary parameters that will be applied in...

The operational headquarters for supporting the light industry has begun work at the Ministry of Economic Development.

An operational headquarters has begun its activities at the Ministry of Economy and Commerce,...

In Kyrgyzstan, revenues from mining tax payments have doubled

According to the report from the Ministry of Finance, revenues from the mining tax in Kyrgyzstan...

The Tax Service of Kyrgyzstan explained who should use KKM, ETTN, and ESF

ETTN National taxpayers selling the specified goods must use ETTN during their turnover. This...

Cashless payment for labor will become mandatory for all employers. The President has signed the law.

- President Sadyr Japarov signed the Law "On Amendments to Certain Legislative Acts of the...

A Seminar on Taxes, Accounting, and Market Entry in the EAEU for Tailors Was Held at the Ministry of Economic Development

A practical seminar was held at the Ministry of Economy and Commerce, organized in collaboration...

The procedure for calculating property tax has been changed, the Tax Service reminds.

In the Kyrgyz Republic, changes have been made to the procedure for calculating property tax, as...

Sadyr Japarov Introduced Changes to the Tax Code and Other Acts in the Field of Taxation

According to information from the presidential administration, Sadyr Japarov has signed a new law...

The Ministry of Economy of Kyrgyzstan Initiates Gradual Increase in Excise Tax Rates on Alcohol

As part of this project, an increase in the excise tax on certain alcoholic products is planned....

Amendments Made to Certain Legislative Acts in the Field of Taxation

The President has signed a law...

Since the beginning of the year, over 77 million soms have been received in the budget from the mining tax

According to the data from the National Statistical Committee, from January to September 2025, the...

Kyrgyzstanis reminded of changes in the taxation of certain types of real estate

According to the law adopted on October 29, changes have been made to the Tax Code regarding...

More than 1.3 billion soms have been received in the KR budget from the payment of the "Google tax"

The Ministry of Finance of Kyrgyzstan reported the receipt of over 1.3 billion soms into the state...

The Tax Service of Kyrgyzstan reported on changes in the procedure for entering data into the EFS system.

At the same time, if the taxpayer uses the general tax regime and issues an invoice for goods...

The Tax Service of Kyrgyzstan Explained Changes to Property Tax

According to the latest changes, the procedure for calculating property tax and the tax rates have...

How Excise Taxes Will Increase from 2026: Beer, Wine, and Vodka Will Become More Expensive

The Ministry of Economy and Commerce of the Kyrgyz Republic has presented for public discussion a...

The GNS reminded candidates for deputies about the norms of tax legislation

The State Tax Service of the Kyrgyz Republic has reminded candidates for deputies of the Jogorku...

When the taxpayer must enter purchase data into the EFS system themselves

The State Tax Service reminds that taxpayers using electronic invoices must independently enter...

The Ministry of Internal Affairs of Kyrgyzstan is purchasing equipment for ballistic identification for 14.6 million soms

The Main Department of Financial and Economic Support of the Ministry of Internal Affairs has...

History of the Tax Service of the Kyrgyz Republic

The strength of the state lies in its budget. This postulate is indisputable. The main task of tax...

In Kyrgyzstan, budget contributions from one tax have significantly increased

According to data provided by the Ministry of Finance, from January to September of this year, the...

Markets and shopping centers are required to monitor entrepreneurs and report to the State Tax Service.

In Kyrgyzstan, a new law has been adopted that significantly changes the rules of tax regulation....

Airport staff at "Manas" trained to work with passengers with disabilities

Recent training sessions for the staff of "Manas" airport were organized with the aim of...

Amendments to Property Taxes Introduced in the Tax Code of the Kyrgyz Republic

The State Tax Service informs that changes have been made to the Tax Code of the Kyrgyz Republic...

Kyrgyzstan and Japan Hold a Seminar on Youth Football

As part of this seminar, which takes place on October 23 and 24, experts from Japan are sharing...

The amount of the average monthly salary for calculating income tax has been announced. List

On the website sti.gov.kg in the "Knowledge Base" section and the "Useful...

A meeting with entrepreneurs on the latest changes in tax legislation was held at the State Tax Service

The meeting discussed in detail the changes in tax legislation, as well as the digitalization of...

Production of varnishes and paints increased the output of chemical products by 17.7% in January-September

- From January to September 2025, there is an observed increase in the production volume of...

The Ministry of Health is reviewing the system for appointing, selecting, and evaluating hospital directors.

As part of the seminar dedicated to human resource management, Minister Erkin Checheybaev announced...

"VAT on agricultural products will be reduced in retail chains, - Ministry of Agriculture"

The Cabinet of Ministers approved an initiative to reduce the value-added tax (VAT) on agricultural...

The Tax Service of the Kyrgyz Republic clarified who should apply KKM, ETTN, and ESF

The Tax Service of the Kyrgyz Republic has provided information on the rules for the use of cash...

At Issyk-Kul, fish farmers are trained in the diagnosis and prevention of fish diseases

During the seminar, participants were able to undergo both theoretical and practical training,...

The total revenue of residents of the Creative Industries Park for 2025 amounted to 516 million soms.

At a press conference at the "Kabar" agency, the director of the Creative Industries...

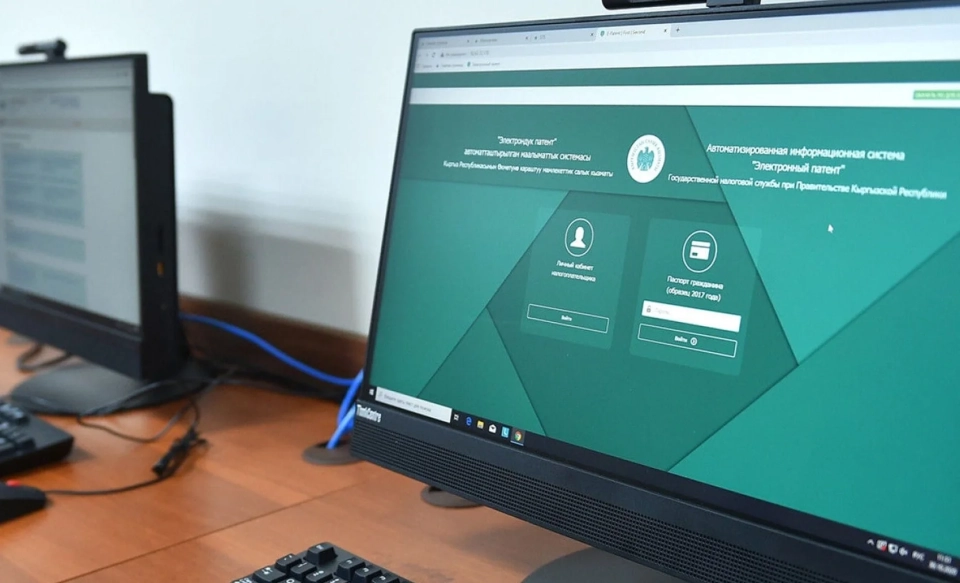

About 1.5 million citizens use the Taxpayer's Cabinet

The Deputy Chairman of the State Tax Service (GNS), Mirlan Rakhmanov, shared information with...

A Unified Digital Ecosystem for Public and Private Services Will Be Created in the Kyrgyz Republic

The Ministry of Digital Development and Innovative Technologies has presented for public...