Tax benefits enhance the competitiveness of the textile industry and trigger a cumulative effect, - board member of the "Legprom" association

Zarlyk Imankulov, a board member of the "Legprom" Association, emphasized the importance of the adopted law in a comment to state media, noting that it will provide significant support to the garment industry.

He explained that social and income payments were mainly financed by the entrepreneurs themselves, which created a heavy burden on businesses and negatively affected the cost of production. This, in turn, led to a decrease in competitiveness.

Imankulov also noted that creating favorable conditions to enhance the competitiveness of the garment industry compared to traditional global leaders such as China, Turkey, and Bangladesh will have a positive effect on the economy as a whole. According to unofficial data, over 200,000 people are employed in this sector, accounting for about 8% of the total working-age population of the country.

Moreover, he added that the deterioration of the situation in the light industry negatively impacts other sectors, such as trade and construction. Workers in the garment industry are generally homebuyers and play a key role in shaping domestic demand.

Read also:

Tax and Insurance Benefits for Tailors and Small Businesses. The State Tax Service Explained What Will Change

The President has signed a decree regarding support for the sewing industry and small and...

Tax and Insurance Benefits are Being Prepared for the Sewing Industry: Clarification from the State Tax Service

In Kyrgyzstan, the development of a draft law is planned, which will create uniform conditions for...

In Kyrgyzstan, there are plans to abolish insurance contributions for state social insurance for the sewing and textile industry until 2030.

- Sadyr Japarov approved the Decree "On Measures to Support Certain Sectors of the...

Tax and Insurance Benefits for Tailors and Small Businesses: What the New Presidential Decree Provides

In Kyrgyzstan, a draft law is being developed that will establish uniform rules for all sewing...

In Kyrgyzstan, they plan to change the tax system for tailors, - GNS

A new draft law is being developed in Kyrgyzstan that will create uniform conditions for all...

Tax incentives for businesses and citizens are being introduced in Kyrgyzstan

President Sadyr Japarov approved the draft law "On Amendments to Certain Legislative Acts of...

In Kyrgyzstan, unified working conditions will be established for all sewing enterprises

In Kyrgyzstan, a new draft law is currently being developed that will create unified conditions...

In the sewing industry of Kyrgyzstan, only about 9,000 people are officially employed.

Despite the fact that hundreds of thousands of people are employed in the sewing industry of...

Sadyr Japarov signed a decree on measures to support the jewelry, textile industry, and small business

President Sadyr Japarov signed a decree aimed at the development of the jewelry and textile...

Good news for Kyrgyz citizens. Changes have been made to the tax laws.

President Sadyr Japarov signed a new law concerning changes to the country's tax system,...

Benefits for jewelers, tailors, and when selling cars: the president signed the decree

Sadyr Japarov, the President of Kyrgyzstan, signed a decree titled "On Measures to Support...

The operational headquarters for supporting the light industry has begun work at the Ministry of Economic Development.

An operational headquarters has begun its activities at the Ministry of Economy and Commerce,...

Football in Kyrgyzstan will receive tax benefits starting from 2026

New tax benefits for the football industry...

The State Duma supported amendments exempting certain categories of entrepreneurs from taxes

On December 24, the deputies of the Jogorku Kenesh approved amendments to the draft law concerning...

At the Ministry of Economic Development, support for the textile industry and access to products in the Russian Federation were discussed.

A meeting dedicated to supporting the textile industry and issues related to the access of its...

A large-scale support program for the jewelry and sewing industries is being launched in Kyrgyzstan

President of the Kyrgyz Republic Sadyr Japarov has signed a decree regarding the support of...

The President signed a law on tax and administrative benefits for businesses and citizens

The document introduces the cancellation and reduction of a number of tax obligations, as well as...

Cashless payment for labor will become mandatory for all employers. The President has signed the law.

- President Sadyr Japarov signed the Law "On Amendments to Certain Legislative Acts of the...

Tax and Insurance Reliefs for Businesses Introduced in Kyrgyzstan

The President of the Kyrgyz Republic, Sadyr Japarov, has initiated a draft law concerning...

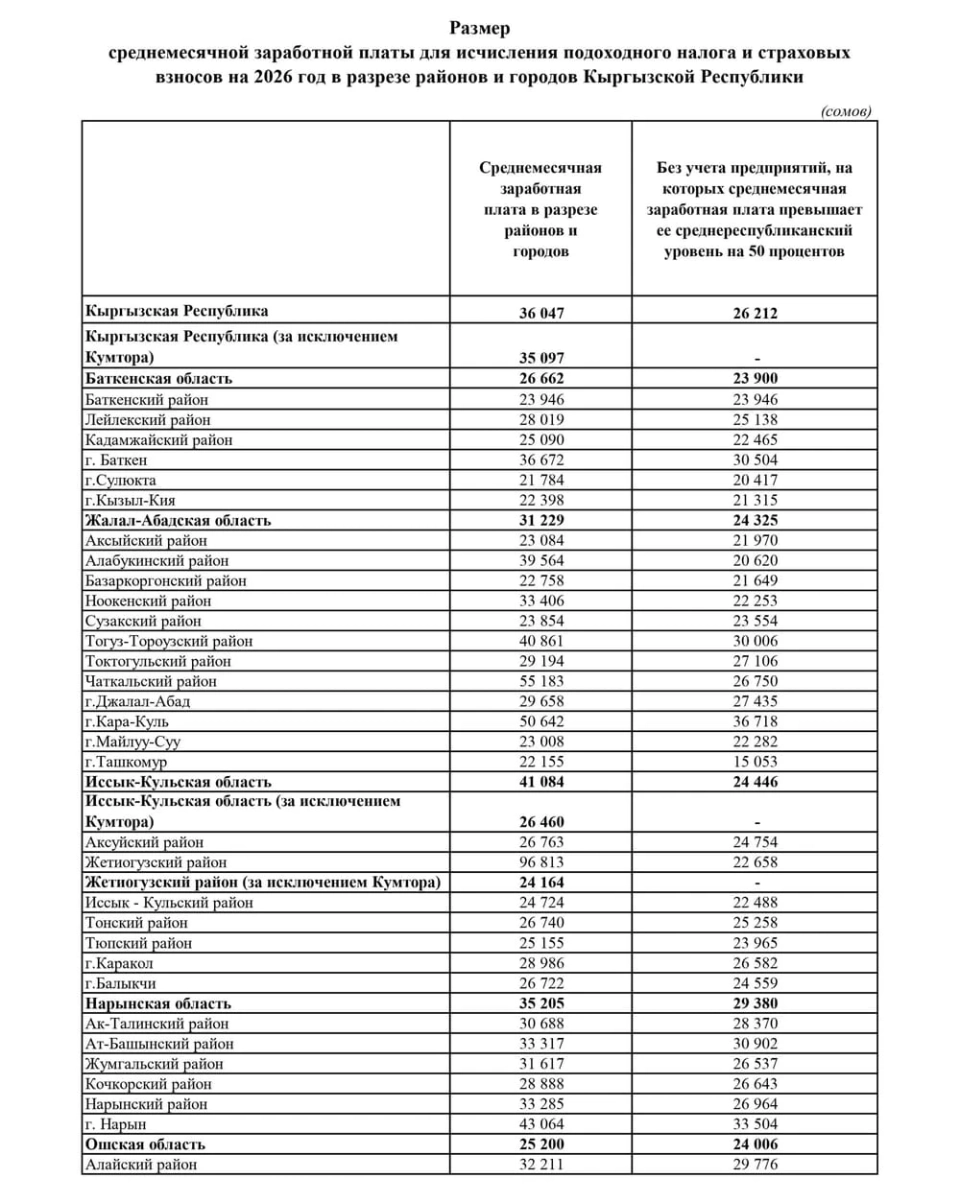

The average salary in Kyrgyzstan will rise to 36,000 soms in 2026.

The government of Kyrgyzstan has approved new average salary parameters that will be applied in...

The issues of taxation were explained to the tailors of Kyrgyzstan.

A seminar was held in Kyrgyzstan, organized by the Ministry of Economy and Commerce in...

Kyrgyzstan is Reviving the Textile Industry

OSH - The textile industry of Kyrgyzstan continues to make progress, providing jobs and economic...

Taxes, Cars, Transactions, and Benefits: The Cabinet Introduced Major Amendments to the Laws

The government of the country has submitted a draft law to the Jogorku Kenesh concerning amendments...

In the State Duma, a bill proposing tax incentives for certain sectors of the economy has been adopted in three readings.

- During the meeting of the Jogorku Kenesh, which took place on December 24, the parliamentarians...

Russia Tightens Control. The Ministry of Economic Development Explained Why Kyrgyzstani Textile Products Faced Barriers When Importing to Russia

- A meeting was held at the Ministry of Economy, under the leadership of Daniyar Amangeldiev, with...

An Operational Headquarters for Supporting the Textile Industry Has Been Established in the Ministry of Economy of the Kyrgyz Republic

The operational headquarters of the "Kyrgyz Export" Center has been established at the...

The bill providing tax incentives for certain sectors of the economy has been adopted by the Jogorku Kenesh.

During the last session of the Jogorku Kenesh, a draft law was approved concerning amendments to...

GNS: Tax Conditions for Tailors in Kyrgyzstan Will Change

In particular, a temporary suspension of income tax is possible Deputy Chairman of the State Tax...

Tax Officials in Kyrgyzstan Train Tailors and Textile Workers on Using Electronic Tax Services

During the seminar, participants were explained the authorization procedures through the Unified...

Sadyr Japarov signed a decree on measures to support certain sectors of the economy

Sadyr Japarov, the President of Kyrgyzstan, signed a decree regarding the support of certain...

Amendments Made to Certain Legislative Acts in the Field of Taxation

The President has signed a law...

The Housing Complex Supported Amendments to Tax Laws

On December 24, the deputies of the Jogorku Kenesh adopted amendments to the legislation on...

Production of varnishes and paints increased the output of chemical products by 17.7% in January-September

- From January to September 2025, there is an observed increase in the production volume of...

In Kyrgyzstan, benefits and support are being introduced for the development of the jewelry industry

The main task is to increase export volumes...

Sadyr Japarov Introduced Changes to the Tax Code and Other Acts in the Field of Taxation

According to information from the presidential administration, Sadyr Japarov has signed a new law...

At the Ministry of Economic Development, measures to support the textile industry and issues of product access to the Russian market were discussed.

The Ministry of Economy and Commerce of the Kyrgyz Republic held a meeting chaired by the First...

In Russia, the VAT rate has been raised to 22% - the law has been signed

The law signed by Russian President Vladimir Putin increases the value-added tax (VAT) rate from...

Amendments Made to the Law on State Benefits

The President of the Kyrgyz Republic, Sadyr Japarov, has signed a new law "On Amendments to...

In Kyrgyzstan, budget revenues from income tax are increasing

According to information provided by the Ministry of Finance, from January to September of the...

Kyrgyz Light Industry in Crisis. Why Are Goods Stuck at the Border with Russia?

In Kyrgyzstan, the sewing industry is facing a new crisis, caused not by a lack of orders or a...

In Kyrgyzstan, average salary indicators for tax calculation have been approved

New average salary indicators have been established in Kyrgyzstan, which will be used for tax...