New Benefits Will Be Provided for the Sewing and Textile Industry

According to this law, starting from January 1, 2026, enterprises in this sector will pay insurance contributions of 12% of 40% of the average monthly salary for each employee. This amounts to 2,115.5 soms. Additionally, the income tax will be 1% of the average monthly salary, which is 440.7 soms. In total, the overall amount of tax contributions per employee will be 2,556.2 soms.

It should be noted that in 2026, the average monthly salary in the country will be 44,070 soms.

These changes are aimed at supporting local producers, reducing the tax burden, optimizing tax administration, as well as creating conditions for the development of production capacities, increasing the competitiveness of goods in domestic and foreign markets, stimulating employment, and enhancing the export potential of the entire industry.

Read also:

The sewing industry is transitioning to preferential taxation until 2030

As part of new initiatives, special insurance contribution rates have been established for all...

Tax benefits enhance the competitiveness of the textile industry and trigger a cumulative effect, - board member of the "Legprom" association

The President has signed a new law that introduces tax benefits for various categories of...

In Kyrgyzstan, there are plans to abolish insurance contributions for state social insurance for the sewing and textile industry until 2030.

- Sadyr Japarov approved the Decree "On Measures to Support Certain Sectors of the...

The average salary in Kyrgyzstan will rise to 36,000 soms in 2026.

The government of Kyrgyzstan has approved new average salary parameters that will be applied in...

Tax incentives for businesses and citizens are being introduced in Kyrgyzstan

President Sadyr Japarov approved the draft law "On Amendments to Certain Legislative Acts of...

The Cabinet has determined the minimum wage for 2026 — 3,280 soms

The government of Kyrgyzstan has approved the minimum wage level for 2026, which will amount to...

The authorities proposed the minimum wage for the next year.

According to the information from the Cabinet of Ministers, it is planned to set the minimum wage...

In the sewing industry of Kyrgyzstan, only about 9,000 people are officially employed.

Despite the fact that hundreds of thousands of people are employed in the sewing industry of...

Labor Market in Kyrgyzstan

Wages and Labor Market. In January-May 2014, the average monthly nominal wage of one employee...

In Kyrgyzstan, excise tax rates on alcohol will increase starting in 2026

Starting from January 1, 2026, new excise tax rates on alcoholic products will come into effect in...

In Kyrgyzstan, the excise tax rate on alcohol has been increased (number)

Starting from January 1, 2026, an increase in excise tax rates on alcoholic beverages will come...

Football in Kyrgyzstan will receive tax benefits starting from 2026

New tax benefits for the football industry...

The average salary in Kyrgyzstan has risen to 42,700 soms

According to data from the National Statistical Committee, the average nominal salary of one...

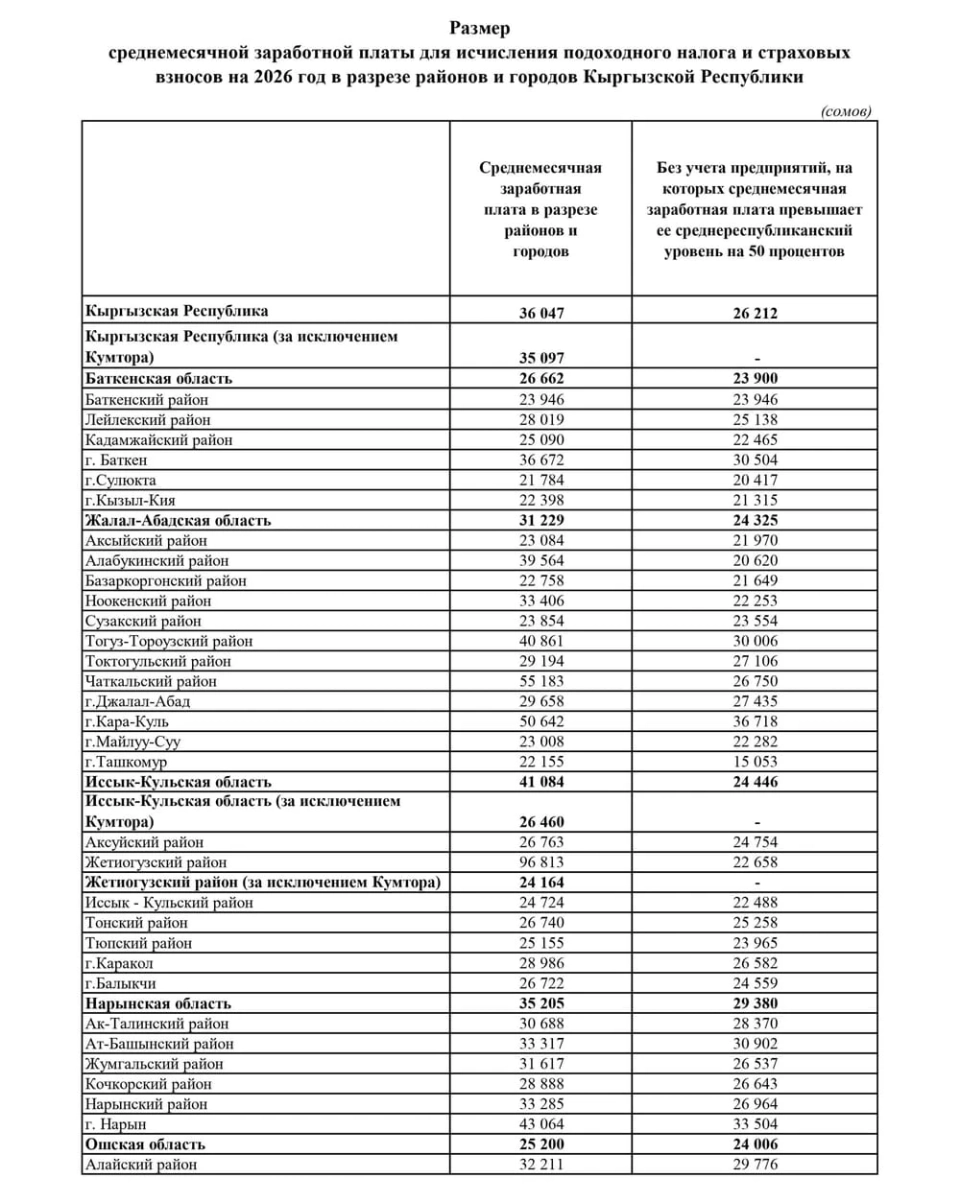

In Kyrgyzstan, average salary indicators for tax calculation have been approved

New average salary indicators have been established in Kyrgyzstan, which will be used for tax...

In Kyrgyzstan, excise tax rates on alcoholic beverages have been increased

The State Tax Service of Kyrgyzstan confirms that the excise tax on vodka will be 200 soms per...

Tax and Insurance Benefits are Being Prepared for the Sewing Industry: Clarification from the State Tax Service

In Kyrgyzstan, the development of a draft law is planned, which will create uniform conditions for...

In Kyrgyzstan, the reform of labor remuneration was discussed

From November 3 to 7, 2025, a mission from the IMF worked in Kyrgyzstan, focusing on issues related...

Special Zone and Unified Wallet of the EAS. What Will Change in the Tax Sphere in 2026

Starting from 2026, significant changes are expected in the tax sphere, affecting various...

Strike halted against the backdrop of an agreement to raise salaries for doctors and healthcare workers in Mongolia

The document was signed by the Minister of Health Chinburen Zhigjidsuren, the Chairman of the...

In Kyrgyzstan, they plan to change the tax system for tailors, - GNS

A new draft law is being developed in Kyrgyzstan that will create uniform conditions for all...

The Tax Service of Kyrgyzstan reported the average monthly salary for calculating income tax and insurance contributions for 2026.

The official website of the State Tax Service of Kyrgyzstan has published data on the average...

The Wallet of Kyrgyzstan Residents in 2026: Who Will See Increases in Income and Expenses

Photo from the internet In 2026, changes in the financial situation of citizens of Kyrgyzstan will...

Nearly 21 billion soms in tax and insurance contribution debts collected in the Kyrgyz Republic

In the 11 months of 2025, Kyrgyzstan collected 20 billion 996.1 million soms in tax and insurance...

Tax and Insurance Benefits for Tailors and Small Businesses: What the New Presidential Decree Provides

In Kyrgyzstan, a draft law is being developed that will establish uniform rules for all sewing...

In Kyrgyzstan, unified working conditions will be established for all sewing enterprises

In Kyrgyzstan, a new draft law is currently being developed that will create unified conditions...

The GNS explained who will have their insurance contribution debts written off

The State Tax Service of the Kyrgyz Republic informs that according to the Law of the KR, adopted...

The National Statistics Committee calculated the average salary of Kyrgyz citizens for 2025

According to the report from the National Statistical Committee, the average salary of citizens of...

Over 127 million soms in insurance payouts received by Kyrgyz citizens

As of today, the total amount of insurance payments made to citizens is 127 million 653 thousand...

Tax and Insurance Reliefs for Businesses Introduced in Kyrgyzstan

The President of the Kyrgyz Republic, Sadyr Japarov, has initiated a draft law concerning...

In 2025, 63 new enterprises and 2,700 jobs were created, - Ministry of Agriculture

As of the end of 2025, within the framework of further development of the country's...

In Kyrgyzstan, the excise tax on alcohol is being increased

The Ministry of Economy and Commerce of the Kyrgyz Republic is proposing a draft resolution to...

In Kazakhstan, starting from the new year, fines for traffic violations for drivers and pedestrians are being increased.

Starting from January 2026, the monthly calculation indicator (MCI) in Kazakhstan will increase to...

The GNS reminded candidates for deputies about the norms of tax legislation

The State Tax Service of the Kyrgyz Republic has reminded candidates for deputies of the Jogorku...

Tax and Insurance Benefits for Tailors and Small Businesses. The State Tax Service Explained What Will Change

The President has signed a decree regarding support for the sewing industry and small and...

"The benefits proposed in the bill for the jewelry industry do not exist in any post-Soviet country," - Almatbek Shykmamatov

- Almambet Shykmamatov, Chairman of the State Tax Service of the Kyrgyz Republic, stated that the...

For Violating Import Rules into the EAEU Territory, It Is Proposed to Increase Fines

The Ministry of Economy and Commerce of Kyrgyzstan has initiated a proposal to increase fines for...

At the Ministry of Economic Development, support for the textile industry and access to products in the Russian Federation were discussed.

A meeting dedicated to supporting the textile industry and issues related to the access of its...

In Kyrgyzstan, penalties and fines will be calculated automatically

A new law has been adopted in Kyrgyzstan, amending the provisions of the Tax Code. Now, the accrual...

Prices for National Bank gold bullion bars are decreasing

In Kyrgyzstan, a decrease in the buyback price of standard gold bars has been recorded, indicating...

After the salary increase, some teachers and doctors will start earning 90,000 soms.

At the People's Kurultai on December 25, President Sadyr Japarov presented information about...

The Cabinet allocated 133 million soms for increasing the salaries of scientists in Kyrgyzstan.

The Cabinet of Ministers of Kyrgyzstan has decided to allocate additional financial resources for...

The State Tax Service Implements Automated Property Tax Assessment

As part of the updates to the tax legislation, the State Tax Service of the Kyrgyz Republic is...