Creation of Special Financial Zones and Support for Sports

A new special financial investment territory (SFIT) "Tamchi" has been established in the country. Residents of this zone are now exempt from all taxes. Additionally, organizations operating in the field of football will also receive tax preferences if they use their facilities exclusively for sports purposes.

Improving Taxpayer Rights Protection

The deadline for filing complaints against decisions of tax authorities is now 60 calendar days, providing businesses with more time to prepare justified appeals.

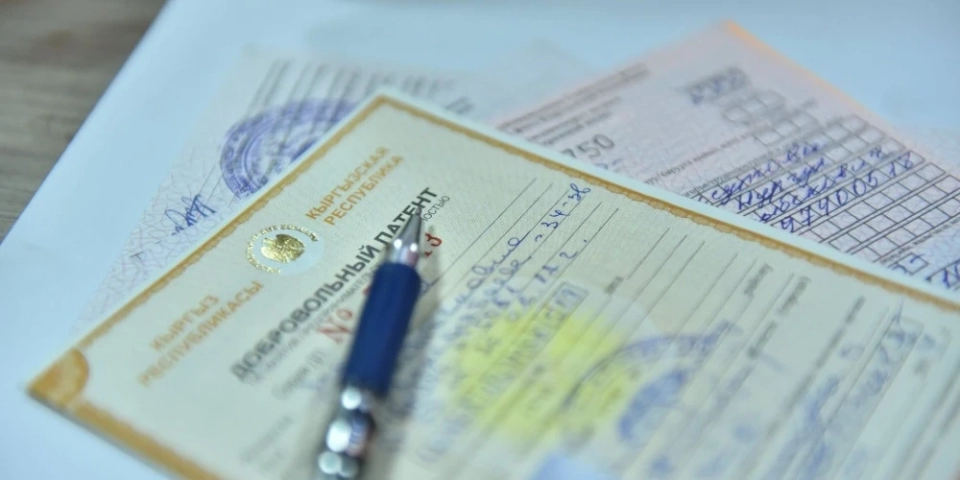

Tax Control in Markets and Shopping Centers

After a successful pilot project at the "Dordoy" market, all market and shopping center administrations have been granted tax control powers. They are now required to monitor the timeliness of tax payments and the acquisition of patents by entrepreneurs on their territory.

Implementation of a Unified Tax Account (UTA)

The tax service has introduced a "virtual wallet" system. With the UTA, taxpayers will be able to make a single payment, which will be automatically distributed among various items and insurance contributions.

Support for Various Industries: Automobiles, Jewelry, and Light Industry

A draft law has been presented in the Jogorku Kenesh proposing the following tax benefits:

Automotive Market: Complete exemption of individuals from taxes on the sale of cars until January 1, 2029. Car manufacturers in Kyrgyzstan will also not pay sales tax.

Jewelry Industry: Cancellation of VAT on the import of equipment and reagents. Jewelers are allowed to use their own hallmark, and a two-month moratorium on inspections for the legalization of product stocks has been introduced.

Light Industry: A minimum income tax of 1 percent of the average monthly salary has been established for tailors until January 1, 2030.

Alcohol: Licensing for the retail sale of alcoholic beverages is abolished.

Rental: A rate of insurance contributions of 6 percent has been established for landlords.

Implementation of Artificial Intelligence KEZET and Staff Reduction

Starting January 1, the implementation of a new electronic module KEZET will begin, which will effectively replace tax inspectors with artificial intelligence. The head of the State Tax Service, Almambet Shykmamatov, stated that the human factor will be completely eliminated.

The KEZET system will allow tracking the movement of goods from production or import to the point of sale, minimizing corruption risks and the number of inspections. A staff reduction of inspectors is planned for May, as control functions will be transferred to the new module. In the first phase, 500 employees will be laid off, and another 500 will follow in six months. Currently, there are 3,400 tax officials, and their number will be reduced by a thousand within a year.