The State Tax Service of the Kyrgyz Republic has presented the results of the implementation of the new information system "Bazar" at the "Dordoy" trading complex.

According to information from the tax authority, from March 15 to August 15, 2025, as part of a pilot project initiated by the decree of President Sadyr Japarov "On the implementation of pilot projects for tax administration in markets and mini-markets of the Dordoy trading complex," this project was realized.

As part of this initiative, the market administration took on the functions of a tax agent, which made it possible to control the tax obligations and insurance contributions of entrepreneurs.

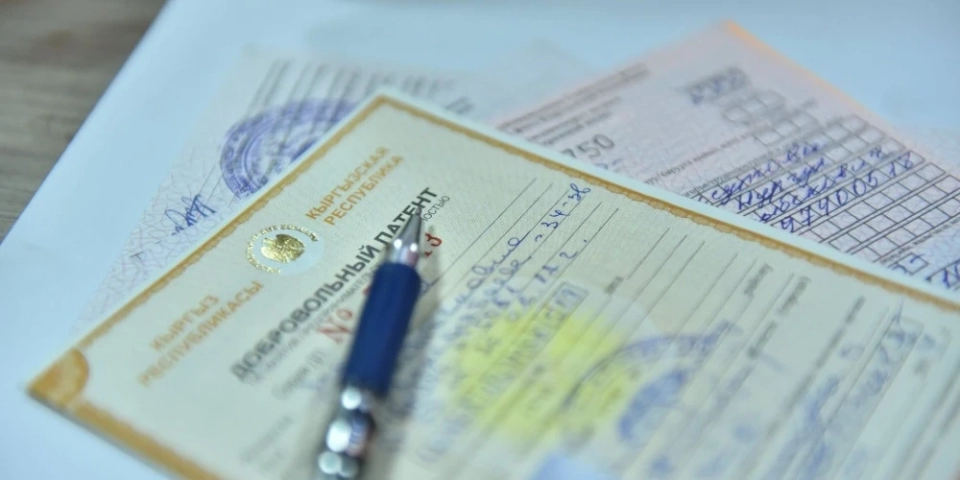

The main goal of the project was to simplify and increase the transparency of taxation for businesspeople.

To this end, the information system "Bazar" was developed, representing a modern digital platform that facilitates interaction with tax authorities and financial institutions, improves tax administration, and creates more comfortable conditions for doing business.

Previously, tax inspectors personally visited the trading rows, informing entrepreneurs about debts, which created confusion: some businesspeople acquired patents, while others did not; some paid taxes in one month and forgot about it in the next.

Now all processes have been transferred to the digital realm, allowing for real-time tracking of the status of each trading container.

Additionally, the market administration now interacts with entrepreneurs through the digital platform.

The functionality of the "Bazar" system includes:

- conducting online banking operations,

- accounting for all trading points, their property, and tenants,

- submission and processing of applications and documents,

- monitoring tax payments and insurance contributions,

- online monitoring of debts,

- reconciliation of data on rent, taxes, social contributions, and other indicators.

This allows for tracking tax payments of all participants, as well as the opening and closing of entities in real-time.

If there is a debt, the container is highlighted in red, while paid periods are highlighted in green.

The results of the pilot project are as follows:

- 13,697 taxpayers and 13,890 entities have been registered at the "Dordoy" market,

- tax and insurance administration has significantly improved,

- tax revenues have increased more than threefold.

In the first 10 months of 2025, collected taxes exceeded 727 million soms, and by the end of the year, more than 1 billion soms is expected.

After the successful completion of the pilot project, the "Bazar" system was implemented at the "Kara-Suu" and "Madina" markets. Further expansion of the system to all markets in Kyrgyzstan is planned.

This project demonstrated how digitization significantly simplifies the work of entrepreneurs, freeing them from unnecessary inspections and making the tax payment process transparent—everyone pays taxes honestly, in accordance with their turnover.

It should be noted that based on the results of the pilot project, changes were made to the Tax Code, which provide for the delegation of powers to market and shopping center administrations to monitor tax payments by entities operating in their territory.

The procedure for exercising such control will be approved by a resolution of the Cabinet of Ministers.