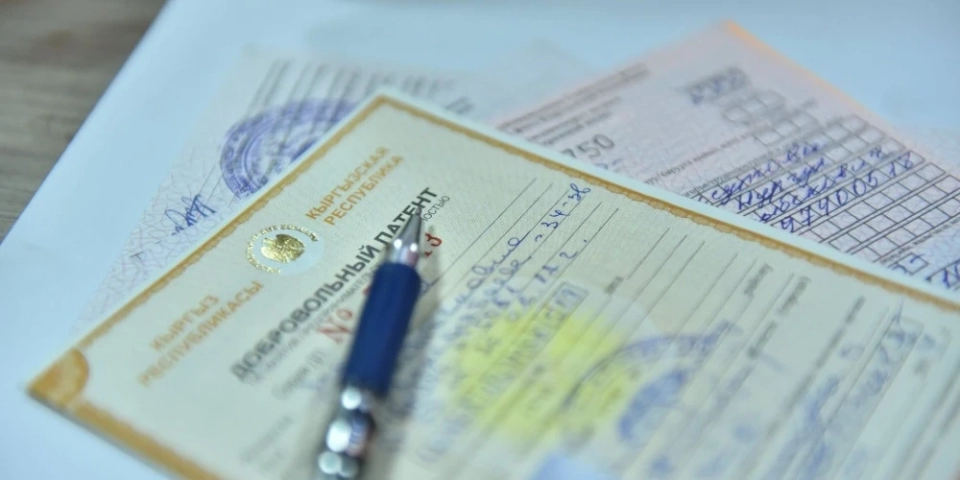

From March 15 to August 15, 2025, in accordance with the Decree of the President of the Kyrgyz Republic Sadyr Japarov on conducting pilot projects for tax administration in markets, a new project was implemented in the territory of the 'Dordoy' complex. As part of this initiative, the market administration became a tax agent responsible for the accounting and control of tax obligations of entrepreneurs.

The main goal of the project is to simplify taxation for entrepreneurs, making it more transparent and convenient. To achieve this goal, the 'Bazar' information system was developed — a modern platform that facilitates interaction between entrepreneurs and tax authorities, as well as banks, improving tax administration and creating more comfortable conditions for doing business.

Previously, tax inspectors conducted rounds of the markets, informing entrepreneurs about debts, which led to chaos: some acquired patents, others did not, some paid taxes, while others forgot. Now all processes are automated, and each trading container can be tracked in real time.

The market administration now interacts with entrepreneurs through a digital platform.

The functions of the 'Bazar' system include:

· conducting online banking operations,

· accounting for all trading points and their tenants,

· submission and processing of documents and applications,

· monitoring tax and insurance contributions payments,

· online monitoring of debts,

· data reconciliation on rent, taxes, and social contributions.

Thanks to the implementation of the system, all entrepreneurs and trading entities have been digitized and integrated into the 'Dislocation' system, allowing real-time tracking of data on their tax payments, as well as the start and completion of activities of the entities.

Now, if an entrepreneur has a debt, the container is highlighted in red, while paid periods are displayed in green.

Main results of the pilot project:

· 13,697 taxpayers and 13,890 entities registered at the 'Dordoy' market,

· Tax and insurance contributions administration has significantly improved,

· Tax revenues have increased more than threefold.

If before the implementation of the digital system, about 30 million soms were collected from the market per month, after digitization this figure rose to 100 million soms.

In the first 10 months of 2025, tax collections exceeded 727 million soms, and by the end of the year, it is expected that the amount will exceed 1 billion soms.

After the successful completion of the pilot, the 'Bazar' system was implemented in the 'Kara-Suu' and 'Madina' markets, and the next step will be to expand the system to all markets in Kyrgyzstan.

This project clearly demonstrated how digitization simplifies the work of entrepreneurs, freeing them from unnecessary inspections and making tax payments transparent — everyone pays according to their turnover.

In conclusion, it should be noted that as a result of the pilot project, amendments were made to the Tax Code, delegating market and shopping center administrations the authority to monitor tax payments by entities operating in their territory. The procedure for such control will be approved by a resolution of the Cabinet of Ministers.