According to him, the completion of the first stage of reforms is characterized by several important changes: the abolition of the ETTN for most goods, the exclusion of mandatory use of cash registers, acceleration of digitalization, and overall simplification of tax administration. This has made procedures more convenient and transparent, reduced bureaucratic burdens, and simplified the process of reporting and paying taxes. An internal reorganization of the service itself was also carried out in parallel with the reforms,” he said.

Shykmamatov added that the second stage of reforms will begin immediately after the New Year holidays. A key element of this stage will be the implementation of a new electronic accounting module, KEZET, which will effectively replace the tax inspector with artificial intelligence. This will eliminate the human factor and provide the ability to track each product—from its production or import to the moment it reaches the cash register.

Created based on Estonian technologies, KEZET is a highly effective solution for the digitalization of government services. It will help eliminate subjective factors in the work of inspectors, automatically identify discrepancies in reports, reduce the number of inspections, and minimize corruption risks. The test launch of KEZET is scheduled for January 2026, after which adaptation and training of employees will take place over the next six months. Starting in May, there will be a reduction in the number of inspectors—at the first stage, it is planned to lay off 500 people, and after six months, another 500. Currently, there are 3,400 employees in the State Tax Service, and in a year, there will be a thousand fewer,” he commented.

Alambet Shykmamatov highlighted that such a reduction will not lead to a weakening of control. On the contrary, this is a step towards a more efficient and corruption-free system. The digital module will operate accurately, transparently, and without the possibility of manipulation.“We strive for the tax service to stop functioning under a punitive model and to become a full-fledged service for businesses and citizens. The main task is not to punish but to help entrepreneurs fulfill their obligations simply and transparently, without unnecessary costs. The tax service should provide convenient digital tools, clear rules, timely consultations, and support so that taxpayers feel like partners rather than objects of pressure. This approach fosters increased trust, encourages voluntary tax payments, and creates a healthy economic environment,” he emphasized.

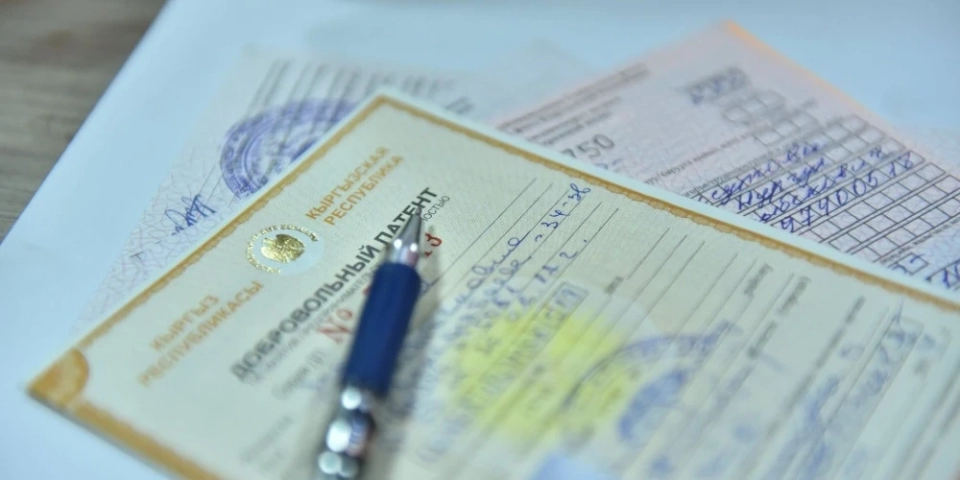

All reforms are being carried out with a focus on business development, especially small and medium-sized enterprises. Kyrgyzstan offers some of the most favorable and convenient conditions for doing business in the CIS, including aspects of starting a business, registration, and tax procedures,” Shykmamatov concluded.