Myrlan Rakhmanov: The level of the shadow economy in Kyrgyzstan has been reduced to 20 percent

“We have repeatedly made changes to the Tax Code to improve tax administration. In particular, we have revised the use of electronic waybills (EWT), which are now used only in three areas: retail sale of tobacco products, alcoholic beverages, and petroleum products,” he noted.

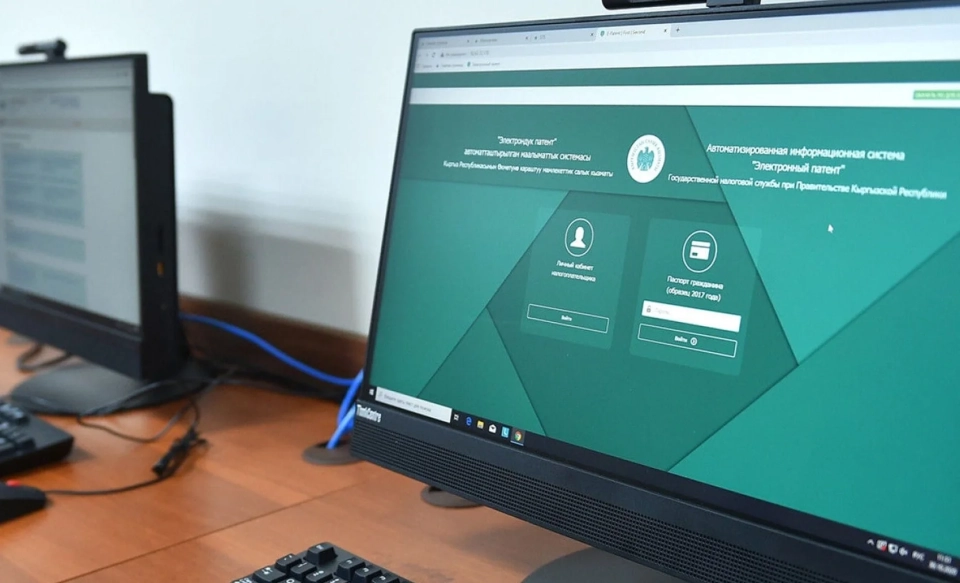

In addition, the patent taxation system for small and medium-sized enterprises has been modernized. This has given entrepreneurs the opportunity to choose the most suitable tax regime, significantly simplifying business operations in various markets and small retail outlets.

At the beginning of the year, an analytical group was established in the central office of the State Tax Service, which focuses on identifying large tax evasion schemes. Joint efforts with law enforcement agencies have helped strengthen the fight against the shadow economy and corruption.

“According to estimates by international observers, the level of the shadow economy in Kyrgyzstan in 2020-2021 was about 40 percent. To date, this figure has decreased to 20 percent, which means that over the past 3-4 years we have managed to halve the shadow economy, transferring a significant portion of businesses into the legal field,” Rakhmanov added.

He also emphasized that supporting and developing small and medium-sized businesses remains a key focus of state tax policy.

Read also:

About 1.5 million citizens of Kyrgyzstan use the "Taxpayer's Cabinet"

The press service of the State Tax Service (STS) reported a significant increase in the number of...

Over 310 billion soms in taxes and contributions collected in Kyrgyzstan since the beginning of the year

As of the beginning of 2025, 310.4 billion soms have been collected in taxes and contributions in...

GNS: Tax Conditions for Tailors in Kyrgyzstan Will Change

In particular, a temporary suspension of income tax is possible Deputy Chairman of the State Tax...

About 1.5 million citizens use the Taxpayer's Cabinet

The Deputy Chairman of the State Tax Service (GNS), Mirlan Rakhmanov, shared information with...

In Kyrgyzstan, they plan to change the tax system for tailors, - GNS

A new draft law is being developed in Kyrgyzstan that will create uniform conditions for all...

Notaries Who Do Not Use Cash Register Machines May Lose Their Licenses

The President of the Kyrgyz Republic, Sadyr Japarov, has approved a law that amends a number of...

About 1.5 million Kyrgyz citizens use the online Taxpayer's Cabinet

Mirlán Rakhmanov noted that the tax service is moving towards transforming into a service-oriented...

The State Tax Service Exceeded the Plan for Tax and Insurance Contributions Collection for the First 10 Months

According to Rakhmanov, compared to the same period in 2024, tax revenues increased by 73.2...

Since the beginning of the year, tax revenues of the state budget have increased by 27 percent

According to the Ministry of Finance, tax revenues of the state budget from January to September of...

Changes are being made to the cashless payment system in Kyrgyzstan

Sadyr Japarov, the President of Kyrgyzstan, has approved a draft law that amends a number of...

Tax and Insurance Benefits for Tailors and Small Businesses: What the New Presidential Decree Provides

In Kyrgyzstan, a draft law is being developed that will establish uniform rules for all sewing...

Tax and Insurance Benefits for Tailors and Small Businesses. The State Tax Service Explained What Will Change

The President has signed a decree regarding support for the sewing industry and small and...

In the sewing industry of Kyrgyzstan, only about 9,000 people are officially employed.

Despite the fact that hundreds of thousands of people are employed in the sewing industry of...

In the jewelry sector, numerous problems have accumulated, including a high share of shadow turnover, - GNS

- Recently, President Sadyr Japarov approved the Decree "On Measures to Support Certain...

A meeting with entrepreneurs on the latest changes in tax legislation was held at the State Tax Service

The meeting discussed in detail the changes in tax legislation, as well as the digitalization of...

In Kyrgyzstan, unified working conditions will be established for all sewing enterprises

In Kyrgyzstan, a new draft law is currently being developed that will create unified conditions...

The State Tax Service Exceeded the Plan for Tax and Insurance Contribution Collection in the First 10 Months of 2025

In an interview on "Birinchi Radio," the Deputy Chairman of the State Tax Service,...

Sadyr Japarov Introduced Changes to the Tax Code and Other Acts in the Field of Taxation

According to information from the presidential administration, Sadyr Japarov has signed a new law...

The Second Stage of Tax Service Reforms: How the KEZET System Will Replace Inspectors

Photo from the internet. Almambet Shykmamatov, Chairman of the Tax Service A year ago, the...

The Ministry of Economic Development proposes to increase fines for illegal transportation of goods

The Ministry of Economy of Kyrgyzstan has presented amendments to the Tax Code aimed at...

The head of the cabinet highly praised the work of the Tax and Customs Services of Kyrgyzstan

The Chairman of the Cabinet of Ministers of Kyrgyzstan, Adylbek Kasymaliev, spoke positively about...

The IMF suggests that Kyrgyzstan improve its investment climate.

At a press conference in Bishkek on May 16, the head of the International Monetary Fund mission,...

Expert: Reducing Permitting Documents Will Make Business Life Easier

- In Kyrgyzstan, the process of reforming the licensing and permitting system continues. This was...

The Prosecutor General's Office ordered the internet platform to pay $2.885 million in taxes

In the Kyrgyz Republic, the General Prosecutor's Office has identified tax violations...

The Cabinet will require businesses to accept payment only by card? Response from the State Tax Service

In late October 2025, a package of amendments to the Tax Code of the Kyrgyz Republic was approved,...

"Will business flee from Kazakhstan to Kyrgyzstan?"

Starting January 1, 2026, a new Tax Code will come into effect in the neighboring country In...

Tax and Insurance Benefits are Being Prepared for the Sewing Industry: Clarification from the State Tax Service

In Kyrgyzstan, the development of a draft law is planned, which will create uniform conditions for...

Sale of cars until 2029 will not be considered a business: key amendments to the Tax Code

- Sadyr Japarov signed a decree titled "On Measures to Support Certain Sectors of the...

History of the Tax Service of the Kyrgyz Republic

The strength of the state lies in its budget. This postulate is indisputable. The main task of tax...

300,000 companies may close in Kazakhstan due to tax reform. Consequences for the KR

A large-scale tax reform in Kazakhstan is already causing significant concern among representatives...

The new procedure for collecting tax debts will come into effect from 2026.

Starting from January 1, 2026, important changes will come into effect in the Tax Code of...

In Kyrgyzstan, tax registration for patent workers has been simplified

In Kyrgyzstan, changes have occurred in the tax registration process for individuals working under...

Over 275 billion soms in taxes collected in Kyrgyzstan in 11 months

According to the press service of the State Tax Service of the Kyrgyz Republic, the tax and payment...

The GNS clarified the new regulations on cashless payments in the Tax Code of Kyrgyzstan

The GNS clarifies that the law adopted on October 29, 2025, introduced a number of changes to the...

Export to Russia: New Requirements Explained to Kyrgyzstan's Tailors

A practical seminar was held at the Kyrgyz Ministry of Economy and Commerce, organized in...

In Kyrgyzstan, tax administration for large companies will be strengthened

In the Kyrgyz Republic, plans are in place to strengthen tax administration for large companies, as...

GNS Employees Exchanged Experience with the Swiss Company SICPA

From October 21 to 23 of this year, a delegation from the State Tax Service of Kyrgyzstan, led by...

Kyrgyzstanis reminded of changes in the taxation of certain types of real estate

According to the law adopted on October 29, changes have been made to the Tax Code regarding...

GNS Employees Exchanged Experience with Swiss Company SICPA

The State Tax Service of Kyrgyzstan is exploring the implementation of SICPA technologies Led by...

The GNS discussed the latest changes in tax legislation with businesses.

The meeting of representatives of the State Tax Service (GNS) with businesspeople was organized to...

The issues of taxation were explained to the tailors of Kyrgyzstan.

A seminar was held in Kyrgyzstan, organized by the Ministry of Economy and Commerce in...

In Kyrgyzstan, over 2 million tons of fuel have been marked.

[img]""[/img] This information was provided by the press service of the...

Taxpayers on a Patent Are No Longer Required to Visit Tax Authorities

Changes have occurred in the tax registration process for taxpayers using patents in Kyrgyzstan....