Migrants in Russia will confirm their income and pay taxes in advance

These amendments are aimed at strengthening control over migrants' incomes, introducing new tax obligations, and providing for a reduction in their stay in Russia in case of violations.

According to the new rules, foreigners temporarily staying in Russia will be required to provide the Ministry of Internal Affairs with information about their legal income. Acceptable forms of confirmation include income statements, copies of tax returns, or documents proving tax payments. In the absence of income confirmation, the duration of temporary stay may be reduced, and this will also apply to the family members of migrants.

The minimum income level will also be specified: to obtain or extend a work patent, the income must not be below the subsistence minimum of the region. Exceptions will be made for cases of initial patent acquisition and work for private individuals, provided that such work is conducted exclusively for personal needs.

Additionally, a new obligation is being introduced — advance payment of personal income tax (PIT). For labor migrants working for private individuals, the amount of the advance payment will increase by 50% for each dependent minor child.

“The base rate for employees of organizations and individual entrepreneurs will be 1,200 rubles per month; for those working for private individuals — 1,700 rubles,” noted Vladimir Gruzdev, chairman of the Russian Lawyers Association.

Read also:

Vacation in Phuket: The Ultimate Guide for Kyrgyzstanis

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Taxes, Cars, Transactions, and Benefits: The Cabinet Introduced Major Amendments to the Laws

The government of the country has submitted a draft law to the Jogorku Kenesh concerning amendments...

"Ay-Pery" has transformed into an international business center — photo report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Presidential Christmas Tree. Happy Moments of Children in Photographs

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Supreme Court Judge of the Kyrgyz Republic on Innovations in Labor Law and How They Will Affect People

The update of the Labor Code of the Kyrgyz Republic has become an important step in changing the...

Tashiev congratulated police officers on the upcoming professional holiday

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The main New Year tree of the country was lit up in Ala-Too Square in Bishkek.

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

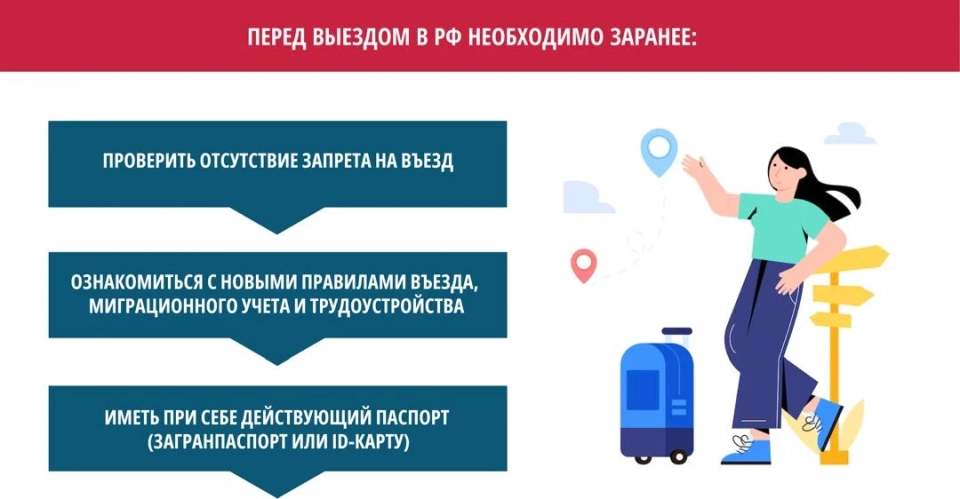

Guide for Migrants from Kyrgyzstan: How to Settle in Russia Legally and Safely

Russia continues to be one of the most attractive countries for labor migrants from Kyrgyzstan....

Tashiev opened a new building for the special forces "Alpha" and launched the construction of a sports complex

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Tashiev opened a new building for the border post "Zhany-Zher"

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

How the Reconstruction of Manas Airport is Progressing - Photo Report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Bangkok + Pattaya: how to choose a hotel, area, and what to see

Bangkok and Pattaya are the perfect route for those who want to combine the dynamics of a big city...

The Ombudsman checked the conditions of detention in Women's Colony No. 2

In the village of Stepnoye, the Ombudsman of the Kyrgyz Republic, Jamila Jamambaeva, conducted an...

Main Mistakes When Applying for Immigration Visas. Tips from a Lawyer in the USA

Photo by Joomart Zholdoshev Joomart Zholdoshev, an international lawyer and arbitrator with...

Exit from the EU blacklist and rules for drones: what is changing in the aviation of the Kyrgyz Republic

Photo GAGA Today, significant reforms are taking place in Kyrgyzstan's civil aviation sector,...

Celebration of the New Year Took Place at Ala-Too Square in Bishkek - Photo Report

The grand event dedicated to the celebration of the New Year 2026 took place at Ala-Too Square, as...

White Symphony of Winter – Photo Report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Tashiev handed over new equipment worth 100 million soms to the utility services of Balakchy

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

The GKNB donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, in the capital of Kyrgyzstan, the Chairman of the GKNB, Kamchybek Tashiev,...

The State Committee for National Security of the Kyrgyz Republic donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, the Chairman of the GKNB of the KR, Kamchybek Tashiev, visited a boarding...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Intimidation and Denial of Medical Care. Inmates of SIZO-1 Talked About Problems in the Institution

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

A new building of the district department of the GKNB has opened in the Ton District

On November 27, 2025, a new office building of the district department of the State National...

In the Chui Region, 80 hectares of land have been returned to state ownership.

In the territory of the Chui region, in the Issyk-Ata district, 80 hectares of land have been...

Kazakhstan Becomes the New Winter Capital of Eurasia

Winter skiing holidays in Kazakhstan are becoming a real trend this season in the region....

Government agencies reminded of the obligation to hire people with disabilities. Quotas

The Ministry of Labor, Social Protection, and Migration has made an important reminder for state...

Driver reform, words of Zhapikeev, visas, prices, GIC. What was January 2026 like?

For Kyrgyzstan citizens, January 2026 became particularly long: the New Year holidays stretched...

The Border Service Reminded About the Rules for the Stay of Citizens of Kazakhstan in Kyrgyzstan

The Border Service of the State Committee for National Security of the Kyrgyz Republic has...

A new building of the District Department of the State Committee for National Security of the Kyrgyz Republic has opened in the Ton District

On November 27, 2025, a new building of the district department of the GKNB KR was opened in the...

A Health Improvement Complex of the State National Security Committee "Kyzyl-Beles" Opened in Chui Region

Today, a ceremonial opening of the health complex of the GKNB "Kyzyl-Beles" took place...

What salary bonuses are provided by the new budget of Bishkek and for whom (list)

The draft budget of Bishkek for 2026 and the forecast data for 2027-2028 have been published by the...

"Don't be afraid, but don't underestimate." A professor on the dangers of pneumonia

Every year on November 12, we celebrate World Pneumonia Day. Professor Talant Sooronbaev, head of...

Ishenaly Arabaev. A Moldovan Who Gave His Life for Enlightenment

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

In the Pervomaisky District of Bishkek, the results of the "Ülgülüür" competitions were summarized.

In the Pervomaisky district of Bishkek, the finals of the competitions "Үлгүлүү...

The Murder of Aysulu, the Return of the Death Penalty, and the Elimination of the Suspect. October Results

October turned out to be eventful for Kyrgyzstan: the country witnessed high-profile crimes,...

From Quotas to Employment: How They Propose to Change the Rules for Hiring People with Disabilities

At the round table titled "Implementation of Labor Rights for People with Disabilities"...

Salaries, retirement eligibility, and new fines. What else will change in the KR in 2026?

Starting from 2026, a number of new laws will come into effect in Kyrgyzstan that will impact the...

Minimum Service Period - 20 Years: Why Kyrgyzstan is Tightening Retirement Rules

Since October 1 of this year, changes have occurred in the pension system of Kyrgyzstan: pensions...

Tashiev transferred medical equipment worth 35 million soms to the National Center for the Protection of Motherhood and Childhood

Deputy Prime Minister and Head of the State Committee for National Security, Kamchybek Tashiev,...

In St. Petersburg, the patent for labor migrants will become more expensive

In 2026, the cost of a patent for labor migrants in St. Petersburg will rise to 8,000 rubles, TASS...

In the city of Kara-Kul, multi-storey mortgage houses will be built

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

Without Rose-Colored Glasses: Arina from Kyrgyzstan Talks About the Realities of Studying Abroad in Korea

Photo by Arina Kydralieva Exchange studies do not always go carefree and rosy. For many students,...

Dennis Wolf - a native of Kyrgyzstan

Strangely enough, the athlete Dennis Wolf, competing under the German flag, can be considered a...