Monopoly and the Need for Rare Earth Metals

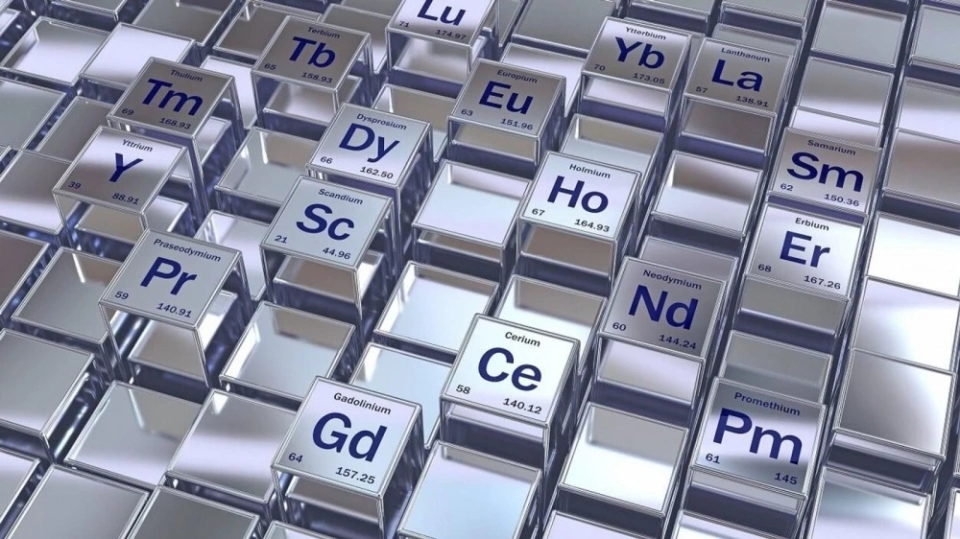

Rare earth metals, which comprise a group of 17 elements, are found in nature in limited quantities. Their popularity is due to their importance in the production of smartphones, electric vehicle batteries, as well as in defense and alternative energy. Therefore, access to these resources has become strategically important for many countries.As of today, China has reserves of rare earth metals amounting to 44 million tons, making it a monopoly in the market. Following China are Brazil (21 million tons), Canada (14 million tons), Russia (10 million tons), India (6.9 million tons), Australia (5.7 million tons), and the USA (3.6 million tons). However, according to estimates from the Russian Federal Agency for Subsoil Use (Rosnedra), Russia's reserves could reach up to 28.7 million tons.

In 2023, global production of rare earth metals, according to data from the Investing News Network (INN), increased by 84% over the past five years, totaling 350 thousand tons. The majority of production also belongs to China, which this year limited the export of several heavy rare earth metals necessary for the automotive industry.

According to Duishenbek Kamchybekov, head of the Association of Miners and Geologists, "The USA is interested in cooperating with countries that have reserves of rare earth metals. Currently, China is a monopoly in both reserves and supplies. Due to the imposition of tariffs and sanctions, as well as the threat from China to halt supplies to the USA and Europe, America is looking for new opportunities to make deals with other countries."

Central Asia in the Spotlight of Western Countries

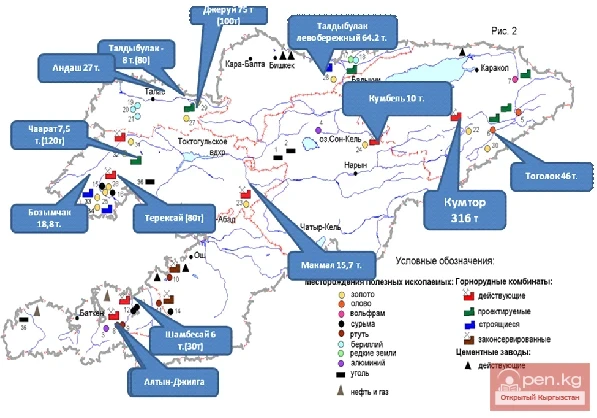

The interest of the USA and Europe in rare earth metals is not accidental. In 2012, the US Geological Survey began assessing the mineral potential of rare earth elements in Central Asia. The research was completed in 2016, and the data was updated in November 2025. The final list included 384 deposits — 160 in Kazakhstan, 75 in Kyrgyzstan, 60 in Tajikistan, 2 in Turkmenistan, and 87 in Uzbekistan.In November 2019, at the "C5+1" summit, leaders of Central Asian countries met at the invitation of US President Donald Trump. Following the summit, Trump announced the beginning of "new wonderful relations" between the USA and Central Asian states.

To reduce dependence on China, the USA is actively developing supply chains for lithium from Canada, Australia, and other countries, which explains their friendly attitude towards Central Asia — regions that can diversify the supply of necessary resources for the American economy, according to analyst and political scientist Kalnur Ormushev.

Kyrgyzstan's Opportunities

Kyrgyzstan can also contribute to the international market. The Republic intends to develop its mining industry, and in January 2024, President Sadyr Japarov signed a decree "On the Implementation of the National Project for the Extraction of Polymetals and Rare Earth Elements for the Dynamic Development of the Economy of the Kyrgyz Republic." The government has been tasked with creating a scientific and production organization based on "Kyrgyzgeology" and conducting research on promising deposits using modern technologies.Ruslan Kalilov, Deputy Director of the Kyrgyz Geological Service, reported on plans to attract investments in the critical minerals sector and develop a strategy for the growth of this sector.

The rare earth metals found in Kyrgyzstan include:

- cerium (Ce);

- lanthanum (La);

- neodymium (Nd);

- yttrium (Y);

- samarium (Sm);

- gadolinium (Gd).

Kyzyl-Ompol is currently being explored for rare earth metals, and "Kyrgyzgeology" is actively working on assessing the reserves of this deposit.

Northern Ak-Tash (antimony-fluorspar ores) is also undergoing geological exploration, with antimony reserves in this area amounting to 16.7 thousand tons, and fluorspar — 655 thousand tons.

Zardalek and Katranbashi are two sites with bauxite reserves that could be used for supplies to aluminum plants in Tajikistan.

"Critical minerals play a key role in modern technologies and the economy, including solar panels, wind turbines, and electric vehicles, but their reserves are limited, and there are supply issues," noted Ruslan Kalilov.

The Need for Exploration and Investments

"History shows that during the Soviet era, the Kutessai I deposit was developed in the Kemin district. At that time, the republic was the only supplier of elements such as yttrium, terbium, and samarium. However, after the collapse of the USSR, production and supplies faced difficulties, leading to the closure of the enterprise," recalls Duishenbek Kamchybekov.The deposit was developed by open-pit mining and reached a depth of 250 meters, but after that, its operation became economically unfeasible.Kamchybekov also noted that there were attempts to resume development, and foreign investors showed interest, but the results were insignificant. Currently, the reserves of the deposit amount to about 50 thousand tons, and the license for development belongs to "Kyrgyzgeology," which is now looking for a potential investor. There is interest in this project, but how events will unfold remains to be seen.

At present, we have no other well-explored deposits.Kamchybekov emphasized that investments and geological exploration are necessary to determine the real reserves in other regions of the country.