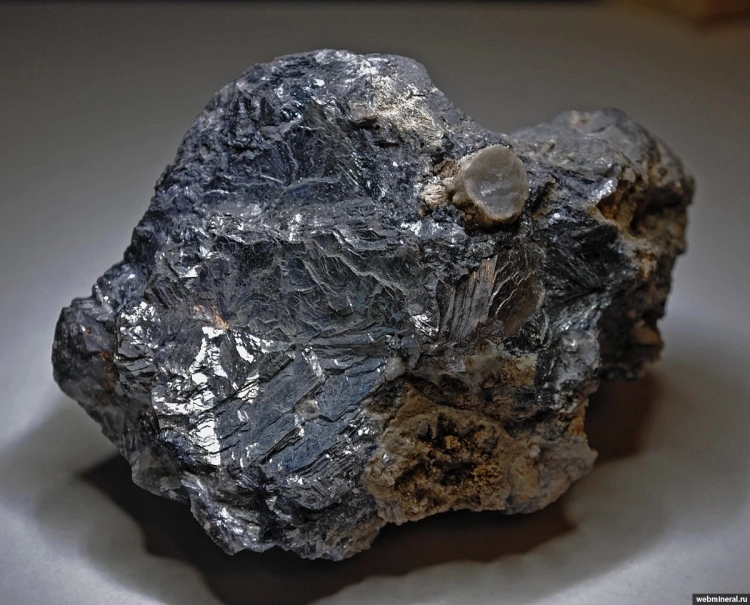

Key minerals and metals such as lithium, rare earth elements, cobalt, and tungsten are essential for personal technology operations. They are also necessary for industries such as electric vehicle manufacturing and AI data centers, as noted by the BBC.

When you read this article, you may not think about how the device is structured while it functions properly. However, the components that support it are becoming the subject of serious competition between the world's largest economies — the US and China, with African countries at the center of this confrontation.

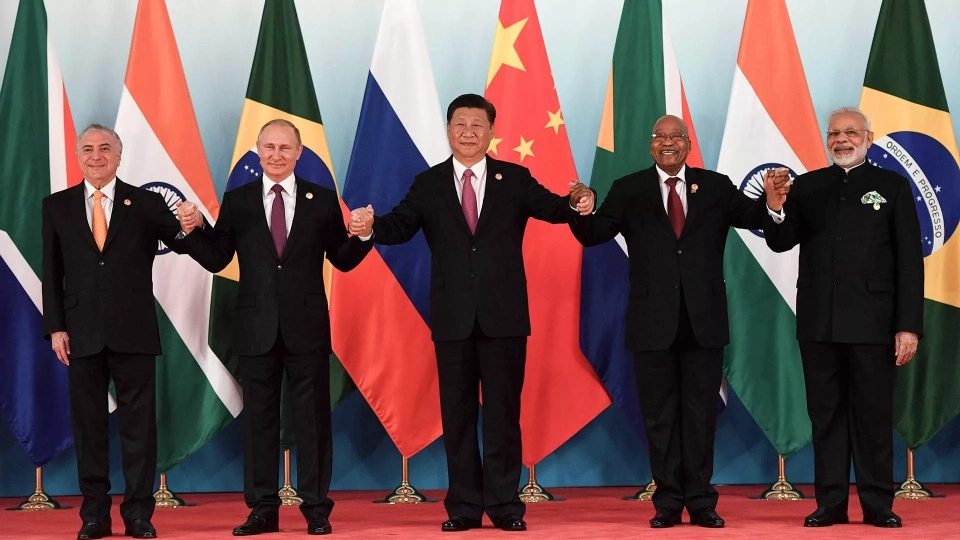

China has long held a leading position in the global market for critical minerals, possessing significant domestic reserves and active overseas investments, particularly in Africa. Beijing also controls the processing of global reserves, which poses a threat to the US in the form of potential export restrictions. Therefore, Washington is striving to expand access to these minerals, with a particular focus on African resources.

Recent data shows that the US has actually surpassed China, becoming the largest direct foreign investor in Africa. In 2023, the US invested $7.8 billion (£6 billion), while China invested only $4 billion, according to information from the China-Africa Research Initiative at Johns Hopkins University.

This marks the first return of the US to leadership since 2012.

US investments are managed by the Development Finance Corporation (DFC), established in 2019 during Trump's presidency. It actively emphasizes its mission to counter China's influence in strategically important regions, as stated on its website.

How will these investments reflect on African countries and companies that benefit from them? Last year, the Rwandan company Trinity Metals received $3.9 million from the DFC to develop its mines, where tin, tantalum, and tungsten are extracted.

“The US government has provided us with significant support in establishing a direct link between our supply chain and the United States,” says Trinity's chairman, Sean McCormick.

The company is now shipping tungsten from Rwanda for processing in Pennsylvania and has contracted to supply Rwandan tin to a similar plant in the US.

McCormick emphasizes that the decision to supply to the US was not imposed by funding from Washington. “This was our decision as market participants,” he notes.

5% of Trinity's shares are owned by the Rwandan government, and among the shareholders is the Irish investment company TechMet, which is involved in the extraction of critical resources.

McCormick also claims that while some African mining companies may employ untrained workers in hazardous conditions, Trinity adheres to strict standards. “We have proven that it is possible to produce these materials professionally, without conflicts and child labor, while complying with laws and respecting society and the environment,” he adds.

Economist Sepo Haimambo from FNB Namibia emphasizes that African countries must defend their interests in negotiations with American companies and not rely on their goodwill. “It is unrealistic to expect that Americans will offer terms favorable to Africa,” she says. “Africa must be ready to negotiate and clearly know what it wants.”

Haimambo believes that the governments of African countries should avoid simple "money for minerals" deals. “Alternative formats should be considered, such as production-sharing agreements or joint ventures,” she says. This could lead to the creation of sovereign wealth funds that would finance important areas such as education and healthcare.

She also emphasizes the importance of processing minerals and metals on the continent to increase financial benefits.

One of the American companies building a mineral processing plant in Africa is ReElement Africa, a subsidiary of American Resources. The plant will be located in the Gauteng province of South Africa.

“We are pleased to collaborate with African countries to create processing capacities near mining projects, which will allow for greater benefits and economic development,” notes Ben Kincaid, CEO of ReElement Africa.

However, Professor Lee Branstetter from Carnegie Mellon University believes that the US could improve its position. He points out that the tariffs imposed by Trump reduced African countries' interest in cooperating with the US, while many express dissatisfaction with Chinese projects.

“If the current administration had not imposed tariffs on many countries without apparent reasons, the US could have occupied a more advantageous position amid Africans' dissatisfaction with Chinese investments,” says Branstetter.

According to Haimambo, in the future, the US and China may face increasing competition in Africa from other countries such as Brazil, India, and Japan.