In 2025, the National Bank laid the legal foundation for the transition to a digital som.

Photo from the archive. Head of the National Bank of Kyrgyzstan Melis Turgunbaev

One of the significant achievements he mentioned was the introduction of a self-restriction mechanism for obtaining loans through the electronic services portal "Tunduk," which has already been used by about 114,000 citizens.

Turgunbaev also emphasized the importance of enshrining the principles of responsible lending in legislation, according to which borrowers must receive complete information in advance about rates, fees, terms, and payment schedules. He noted that it is prohibited to impose additional paid services not specified in the loan agreement.

Previously, the National Bank limited the possibility of applying penalties for late payments and prohibited banks from unilaterally worsening the terms of contracts.

The head of the National Bank spoke about the factors that contributed to the acceleration of digitalization, including the cancellation of fees for transfers between accounts in different banks. This led to a 54.5-fold increase in operations through the ELQR system and an almost 85-fold increase in the volume of payments. In the first half of 2025, 274.9 billion soms were processed through QR codes, which is 20 times higher than the results of the same period last year. Fees for opening and maintaining loan accounts, as well as for early repayment and other basic operations, have been canceled.

From this year, banks are required to publish tariffs and service conditions in advance, at least 10 working days before any changes, to ensure transparency for clients.

There has also been a legislative provision established regarding the digital som as the third form of national currency, alongside cash and non-cash money. According to Turgunbaev, the National Bank has the exclusive right to issue the digital som.

Read also:

The Head of the National Bank of Kyrgyzstan Discussed the Achievements of the Country's Financial System

An important step was the improvement of customer service standards. The introduction of a...

In Kyrgyzstan, the number of payments made via QR codes in the first half of the year was 20 times higher than the previous year.

At the Congress of Financiers of Kazakhstan, the head of the National Bank of Kyrgyzstan, Melis...

The National Bank is developing a mechanism for storing gold for citizens, - Deputy Head of the Regulator

The National Bank of Kyrgyzstan announced the development of a new mechanism for providing citizens...

More than 57,000 Kyrgyz citizens have imposed a self-ban on obtaining loans

The National Bank reports that in November 2023, 57,005 citizens of Kyrgyzstan set a self-ban on...

The National Bank of Kyrgyzstan Signed an Agreement for the Implementation of the Digital Som

The National Bank of Kyrgyzstan has presented a demo version of the digital som, developed on a...

QR payments instead of cash: NBKR explained what is behind the growth of cashless payments

Kyrgyzstan is experiencing a real boom in cashless transactions, which the Chairman of the...

Global Finance included the head of the National Bank of the Kyrgyz Republic in the Central Banker Report Cards ranking.

Every year, Global Finance magazine publishes a ranking called Central Banker Report Cards. This...

In Kyrgyzstan, over 19,000 people have imposed a self-ban on obtaining loans

From November 1 to 7, over 19,000 people in Kyrgyzstan used the new self-restriction mechanism for...

The National Bank has banned charging fees for domestic transfers in the national currency

The National Bank of Kyrgyzstan has introduced a temporary ban on charging fees for domestic money...

What is Behind the Explosive Growth of ELQR Payments in Kyrgyzstan? The Head of the National Bank Discusses the Situation with Cashless Transactions

With the transition to cashless payments in Kyrgyzstan, a significant effect is being observed....

The Central Bank named the main reasons for introducing the self-ban mechanism on loan issuance.

The Deputy Chairman of the National Bank, Bektur Aliyev, announced at a press conference in Bishkek...

The Bank of Russia will consider large transfers to oneself as a sign of fraud.

The Central Bank of Russia plans to amend its list of fraud indicators by adding large transfers to...

Reserves of the National Bank of Kyrgyzstan in gold and currency increased by almost 2.7 times

The reserves of the National Bank of the Kyrgyz Republic from the revaluation of foreign currency...

Self-Ban on Lending. How Many Kyrgyzstanis Have Already Taken Advantage of This Opportunity?

Starting from November 1, residents of Kyrgyzstan have been given the opportunity to impose a...

The American agency Bloomberg published an article about the economy of Kyrgyzstan.

Melis Turgunbaev, head of the National Bank of Kyrgyzstan, gave an extensive interview to the...

Financial Record: The Central Bank Accumulates $7.5 Billion in Reserves

The official opening of the new building of the National Bank of the Kyrgyz Republic took place in...

Exchange rates in commercial banks. Euro and ruble are falling in price

As of November 17, the exchange rate of the National Bank of Kyrgyzstan is as follows: The dollar...

More and more Kyrgyz citizens are imposing a self-ban on borrowing.

Starting from November 1 of this year, citizens of Kyrgyzstan have the opportunity to activate a...

NBKR updated 19 regulatory acts on credit risks and Islamic financing

- The National Bank of Kyrgyzstan, according to the resolution dated October 23, 2025, has updated...

Melis Turgunbaev: Migrants are Returning, but There is a Shortage of Labor in the Kyrgyz Republic

During the plenary session of the congress taking place in Almaty, Turgunbaev noted that there is...

From Cash to Smartphone: Why Kyrgyzstan is Rapidly Moving Towards Cashless and QR Payments

When was the last time you paid in cash at a store or on public transport? It was probably a long...

The National Bank Warned About Widespread Financial Fraud Schemes

- In a live broadcast, Anara Sabyrbek kyzy, the chief specialist of the financial literacy group at...

The dollar is rising, the ruble is falling. Currency exchange rates in commercial banks on November 3.

The National Bank of Kyrgyzstan published the exchange rates for November 3: The US dollar remains...

Exchange rates in commercial banks on November 18: euro and ruble have fallen in price

As of November 18, the exchange rates set by the National Bank of Kyrgyzstan are presented below:...

The National Bank of Kyrgyzstan conducted its sixth currency intervention in 2025.

In 2025, the National Bank of Kyrgyzstan conducted its largest currency intervention, marking the...

Sadyr Japarov suggested to the head of the National Bank how to earn more from gold.

On October 28, President Sadyr Japarov attended the opening of the new building of the National...

Kyrgyzstan's Gold and Foreign Exchange Reserves Set Records

As of the end of November 2025, Kyrgyzstan's gold and foreign currency reserves amounted to $8...

How many Kyrgyz citizens have registered a self-ban on lending through "Tunduk"

According to data from the National Bank, from November 1 to December 5, 2025, 65,356 citizens of...

The National Bank fined a commercial bank more than 21 million soms

On December 5, the National Bank of the Kyrgyz Republic decided to impose a fine of 21 million 600...

Scammers Distribute Fake Documents from the National Bank via Messengers

The National Bank of the Kyrgyz Republic warns that fake documents are being circulated via...

Kyrgyzstan's Gold and Foreign Exchange Reserves Reached Nearly $8 Billion

According to the National Bank, as of the end of October 2025, Kyrgyzstan's gross...

Already 19 thousand Kyrgyz citizens have imposed a self-ban on loans

In early November, more than 19 thousand citizens of Kyrgyzstan used the mobile application...

The National Bank of Kyrgyzstan Tightens Rules on Payments and Combating Money Laundering

The National Bank of Kyrgyzstan has initiated a public discussion on a draft of amendments to...

Bloomberg: Kyrgyzstan is Becoming the New "Tiger Economy" of Central Asia

According to forecasts from the Central Bank, the gross domestic product of Kyrgyzstan is expected...

The National Bank commented on the EU sanctions imposed on 2 banks of Kyrgyzstan

The National Bank of Kyrgyzstan reacted to the sanctions imposed by the European Union concerning...

Fraudsters impersonating the National Bank promise citizens preferential loans

Citizens of Kyrgyzstan are receiving messages from unknown individuals via the Telegram messenger,...

How will Kyrgyzstan's GDP grow in 2026? National Bank Forecast

According to data from the National Bank, the economy showed positive results in the third quarter...

In November, banknotes of 20 and 50 soms will begin to be printed in Kyrgyzstan

In Kyrgyzstan, the printing of new banknotes in denominations of 20 and 50 soms will begin on...

The National Bank sold $179.5 million on the market. This is the largest intervention of the year.

On December 22, the National Bank of Kyrgyzstan conducted an intervention in the foreign exchange...

Head of the National Bank of Kyrgyzstan: Climate has become a risk factor just like inflation or unstable exchange rates

According to Turgunbaev, the impact of climate on the economy is becoming increasingly evident....

The price of gold bullion bars from the National Bank has decreased

Currently, there is a decrease in prices for standard gold bars, which can be repurchased from the...

Exchange rates in commercial banks of Kyrgyzstan as of November 20

The National Bank of Kyrgyzstan has presented the foreign exchange rates for November 20: The...

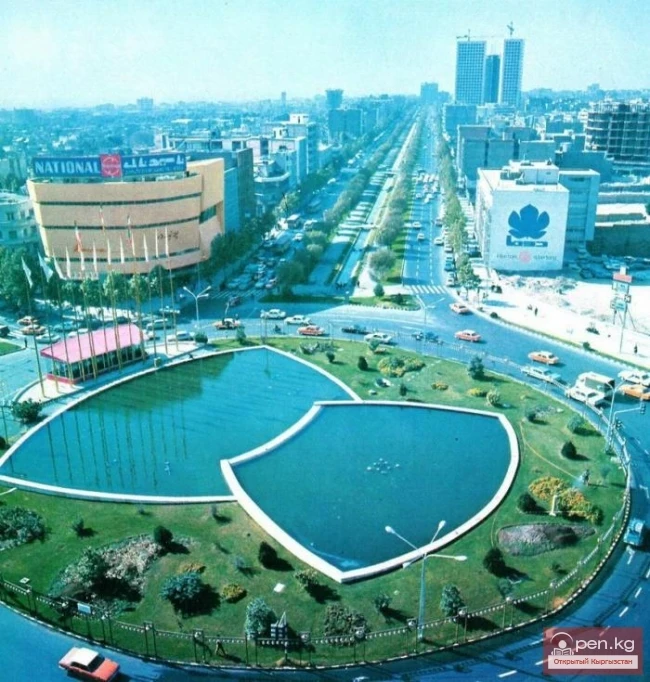

The Greatness and Fall of Persepolis

The Capital of the Ancient World: Persepolis There are countries on earth that cannot be measured...