The National Bank of Kyrgyzstan Tightens Rules on Payments and Combating Money Laundering

As part of the proposed project, amendments are planned in 15 resolutions of the Board of the National Bank of the Kyrgyz Republic, including rules related to money transfers, remote banking services, as well as the regulation of payment organizations and payment system operators, electronic money, financial marketplaces, and virtual assets.

According to the new proposals, the terminology in the existing acts of the National Bank will be standardized in accordance with the recently adopted law "On Counteracting the Financing of Criminal Activities and the Legalization (Laundering) of Criminal Income" (CCFCA/LCI). For example, the term "financing of terrorist activities" will be replaced with the broader "financing of criminal activities," and the use of the abbreviation CCFCA/LCI will also be clarified.

Requirements for the identification and verification of clients, as well as for beneficial owners of accounts, will also be specified, which includes accounting for and storing information about money transfers, transactions with electronic wallets, bank cards, and QR payments.

Banking institutions and payment organizations, including their agents, are required to retain information on transactions and client verification for at least five years. This is necessary to ensure the possibility of restoring the transaction chain and providing information upon request from supervisory and law enforcement agencies.

The National Bank will also gain the authority to refuse the registration of an operator of an international money transfer system if such an operator is registered in an offshore zone or in a country that is included in the list of high-risk countries compiled by financial intelligence. The changes also pertain to the application of sanctions lists and financial measures against clients and counterparties from such countries.

Requirements for internal controls in payment organizations and payment system operators will also be tightened. They must now include risk assessment, ongoing monitoring of transactions, rules for working with public officials, staff training, and the extension of these procedures to agents and sub-agents.

Read also:

The National Bank of the Kyrgyz Republic Tightens Control Over Prices and Monopolies in the Banking Sector

The National Bank of the Kyrgyz Republic has initiated discussions on a new draft resolution...

Banks in Kyrgyzstan will be required to justify the pricing of their services

The National Bank of Kyrgyzstan has proposed amendments to a number of legislative acts related to...

The State Financial Supervision Authority spoke about the development of the virtual asset market in Kyrgyzstan

Regulatory Framework for Virtual Assets Since the beginning of 2022, the country has implemented...

In Kyrgyzstan, changes to the accounting of imported goods within the EAEU are being discussed.

The Cabinet of Ministers of the Kyrgyz Republic has initiated a public discussion on a project...

NBKR updated lending rules: self-restriction on loans through the government portal will take effect on November 1

- The National Bank of Kyrgyzstan, according to resolution No. 2025-P-12/55-3-(NPA) dated October...

The National Bank is considering simplifying the sales procedure, - Deputy Head of the NBKR Kozubekov

- During a press conference held on October 29, 2025, in Bishkek, the Deputy Chairman of the...

The state has regained 80 hectares of land associated with the organized crime group of Kamchi Kolbaev.

During the investigation of a criminal case concerning the financing of activities of organized...

The NBKR Tightens Accounting for QR Payments: System Participants Will Report Monthly According to Established Codes

- On October 29, 2025, the Board of the National Bank of Kyrgyzstan issued resolution No....

New Measures Against Organized Crime Are Being Prepared in Kyrgyzstan

The President's Administration has presented for discussion a draft law "On Amendments...

Loans at 60-120% on "predatory terms." The State Committee for National Security is conducting an investigation into the legalization of criminal proceeds.

The Main Investigative Department of the State National Security Committee (GKNB) is conducting an...

The National Bank approved new requirements for anti-fraud systems in payment organizations to protect against fraud

- In an effort to strengthen the fight against fraudulent activities in the payment system, the...

NBKR updated 19 regulatory acts on credit risks and Islamic financing

- The National Bank of Kyrgyzstan, according to the resolution dated October 23, 2025, has updated...

NBKR proposes to change the regulations for microfinance organizations towards tightening.

- The National Bank of Kyrgyzstan is initiating a public discussion on a draft resolution that...

In the Kyrgyz Republic, rights to electronic money and other digital assets will be included in inheritance.

The Ministry of Justice has developed a draft law concerning amendments to the legislation on the...

In Kyrgyzstan, the rules for allowing foreign vehicles to operate have been changed

The Cabinet of Ministers of the Kyrgyz Republic has approved changes to the existing resolution...

The National Bank intends to strengthen control over credit unions in Kyrgyzstan.

The National Bank of Kyrgyzstan has announced its intention to increase control over the...

The Ministry of Internal Affairs detained an associate of the leader of the organized crime group "Dzhengo," who had illegally registered a land plot worth 43.7 million soms.

Employees of the Ministry of Internal Affairs detained an individual close to the leader of the...

Amendments Made to the Action Plan for the Implementation of the State Program to Increase the Share of Cashless Payments

- Adjustments have been made to the Action Plan aimed at implementing the State Program for...

From Mining to Tokens: How the Cabinet is Strengthening Requirements for All Participants in the Virtual Assets Market?

The Cabinet of Ministers of the Kyrgyz Republic is taking steps to tighten control over...

In Kyrgyzstan, escrow accounts for virtual assets are being introduced

The National Bank of Kyrgyzstan has announced the introduction of the concept of "escrow...

NBKR Introduced Minimum Anti-Fraud Requirements for Payment Organizations — Text of the Regulation

The National Bank of Kyrgyzstan, at its meeting on October 31, decided to approve the Regulation...

More than 57,000 Kyrgyz citizens have imposed a self-ban on obtaining loans

The National Bank reports that in November 2023, 57,005 citizens of Kyrgyzstan set a self-ban on...

NBKR proposes to expand the powers of the "Financial Company of Credit Unions"

- The National Bank of the Kyrgyz Republic is proposing for discussion a draft of amendments to...

The National Bank fined a payment organization and exchange offices

The National Bank of Kyrgyzstan has announced the introduction of penalties against a number of...

The approximate leader of the organized crime group Djengo had lands worth 43.7 million soms taken away.

The land plot was obtained illegally...

The law establishing the rules for determining the limit on the percentage or markup of loans has been signed

According to information provided by the press service of the President's Administration,...

The President signed the law: The National Bank does not carry out licensing, supervision, and regulation of the activities of the State Development Bank.

- The President of the Kyrgyz Republic, Sadyr Japarov, has approved the law "On Amendments to...

In Kyrgyzstan, control over banks and loans has been intensified: fines up to 65,000 soms

Sadyr Japarov, the President of Kyrgyzstan, recently signed a law that amends the Civil Code and...

In Kyrgyzstan, electricity usage rules will be updated to take into account solar energy.

The Cabinet of Ministers of Kyrgyzstan has presented a draft of amendments to the resolution dated...

Changes are being made to the cashless payment system in Kyrgyzstan

Sadyr Japarov, the President of Kyrgyzstan, has approved a draft law that amends a number of...

The Cabinet will require businesses to accept payment only by card.

The government of Kyrgyzstan has announced a new mandatory transition to cashless payments, which...

More than 26 hectares of land associated with the organized crime group Kamchi Kolbaev have been returned to the state.

In the Chui region, specifically in the Issyk-Ata district, 26.43 hectares of land were returned to...

Arrested associate of the leader of the organized crime group Djengo. Illegally re-registered land in Osh.

The press service of the Ministry of Internal Affairs reports the detention of a close associate...

The Bank of Russia will consider large transfers to oneself as a sign of fraud.

The Central Bank of Russia plans to amend its list of fraud indicators by adding large transfers to...

In Kyrgyzstan, control over miners and the crypto sector is being strengthened

In Kyrgyzstan, the State Financial Supervision Agency has presented a new set of legislative...

The National Bank of the Kyrgyz Republic commented on the sanctions against "Eurasian Savings Bank" and "Tolubaya"

On October 23, the countries of the European Union officially approved a new package of sanctions,...

The Ministry of Internal Affairs proposes mandatory genomic and fingerprint registration

The Ministry of Internal Affairs of the Kyrgyz Republic has initiated a discussion on a draft law...

A Separate Customs Regime for E-commerce Goods Introduced in Kyrgyzstan

A law has been adopted in Kyrgyzstan that amends several regulations related to customs...

In Kyrgyzstan, over 19,000 people have imposed a self-ban on obtaining loans

From November 1 to 7, over 19,000 people in Kyrgyzstan used the new self-restriction mechanism for...

The NBKR has made changes to the regulation of credit risk and operations with virtual assets

- The Resolution of the Board of the National Bank of the Kyrgyz Republic No. 2025-П-12/60-4-(NPA),...

Sadyr Japarov signed the updated edition of the constitutional law "On the National Bank"

- President Sadyr Japarov approved a new edition of the constitutional law "On the National...

In Uzbekistan, the abolition of the "salary slavery" system is being prepared

Freedom to Choose a Bank for Salary Transfers Currently, in Uzbekistan, the employer chooses the...

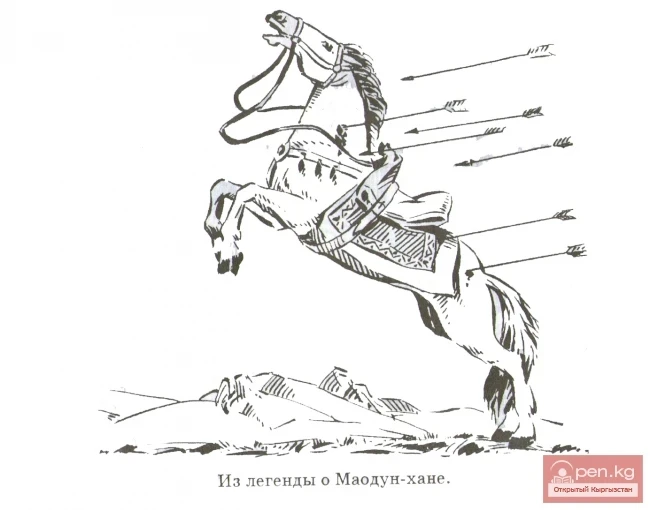

Ancient Kyrgyz under the Rule of the Huns

The word “Kyrgyz” is first mentioned alongside the name of the king of the Huns, Maodun-khan...