In early November, more than 19 thousand citizens of Kyrgyzstan used the mobile application "Tunduk" to impose a self-ban on lending, according to data from the National Bank.

Definition of "self-ban on lending"

This is a free and voluntary measure that allows citizens to preemptively limit the possibility of obtaining loans and credits in their name from financial institutions.

Goals of implementing this mechanism:

Among the main objectives are preventing fraud and protecting consumers: eliminating cases where loans are issued in someone else's name using stolen or false data, as well as reducing the risks of falling into debt traps and resolving disputed issues.

Additionally, it provides the opportunity to control one's credit profile by setting a "digital lock" on one's name at any time.

Financial prudence: citizens have the opportunity to think through their financial decisions.

Process of imposing and lifting the ban

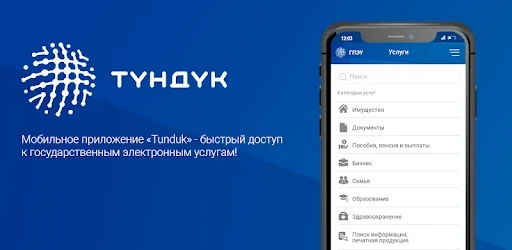

Citizens can easily impose or lift the ban through the State Portal of Electronic Services (Tunduk application) at any time without any costs.

Scope of application

There are two main credit bureaus operating in Kyrgyzstan — KIB "Ishenim" and KIB "SES".

It is sufficient to impose a ban in one of them to ensure protection, as creditors check information in both bureaus.

Waiting period

The lifting of the ban does not happen instantly, but rather 12 hours after the request is submitted. During this time, the citizen has the opportunity to cancel the lifting, and the protection will remain in effect, allowing for the avoidance of hasty decisions and increasing the level of security.

Responsibilities of financial institutions

Before issuing a loan, financial organizations are required to check for the existence of an active ban. If it exists, the creditor must refuse to conclude the contract, stating the reason.

Legal consequences

If a loan is issued with an active ban, such a contract is considered invalid (null and void).

The citizen is not obligated under such a contract, and the creditor has no right to demand the return of funds. The responsibility for violating this provision lies with the creditor.

Step-by-step instructions (through the Tunduk application)

To impose a self-ban: Log into Tunduk → select the option "Self-ban on lending" → click "Submit application" → choose a credit bureau → confirm the action. Protection is activated immediately.

To lift the ban: Log into the same option → select KIB → click "Lift self-ban". Lifting will occur automatically after 12 hours.

To cancel the lifting: Within 12 hours after submitting the application, you can log into the service and click "Cancel application" — protection will be retained.