To activate the self-ban mechanism on lending, you can use the Tunduk application.

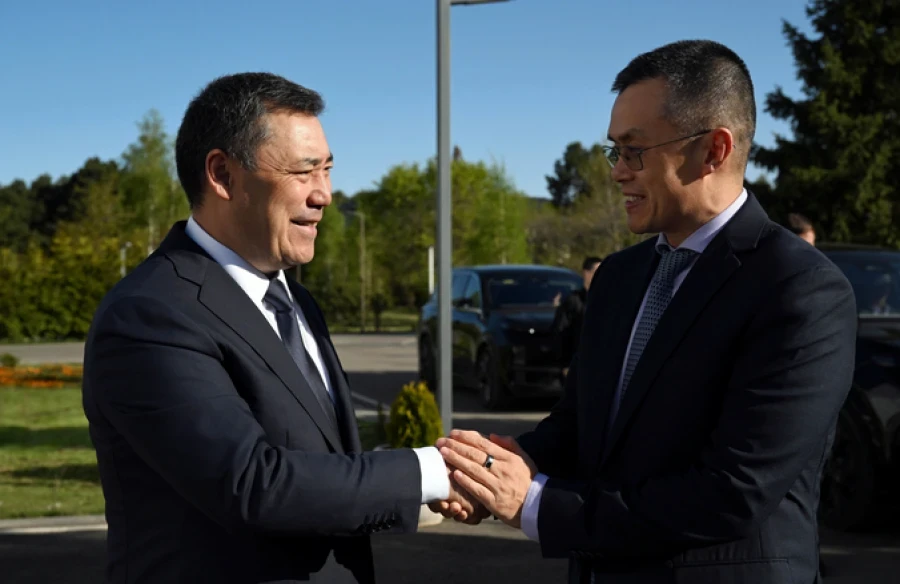

Starting from November 1, 2025, a self-ban mechanism for obtaining loans will come into effect in Kyrgyzstan. This was announced at a press conference in Bishkek by Azamat Jamangulov, the Minister of Digital Development and Innovative Technologies of the KR.

Citizens will have the opportunity to independently limit the issuance of loans and borrowings in their name from financial institutions.

According to the minister, this initiative is aimed at preventing fraudulent activities and protecting consumer interests. It will help avoid situations where loans are issued in someone else's name using stolen or forged documents, as well as ensure control over one's personal credit profile.

From November 1, citizens will be able to set or remove the ban on lending free of charge using the Tunduk mobile application. To do this, they need to log into the app, select the service "Self-Ban on Lending," choose a credit bureau, and impose the ban. The activation of the mechanism will occur instantly.

Removing the ban is also done in a similar manner. However, in this case, the ban will remain in effect for 12 hours after the application is submitted, and the protection will remain active.

Before issuing a loan, financial institutions are required to check for the presence of an active ban. If such a ban is in place, the lender must refuse to provide the loan. If a loan is issued while an active ban exists, such a contract will be considered legally invalid.

The Ministry of Digital Development noted that there are two credit bureaus operating in the country: KIB "Ishenim" and KIB "SES." To activate the protection, it is sufficient to impose a ban in at least one of them, as lenders check both bureaus.

Photo www