According to information provided by the National Bank, record results have been achieved this year. The volume of international reserves increased by 48.4%, which corresponds to a growth of $2 billion 462.5 million, reaching $7 billion 550.6 million. This is a historical maximum for the country and, as noted by bank representatives, significantly strengthened trust in the economy of Kyrgyzstan.

Additionally, a new market rate—the Bishkek Interbank Rate (BIR)—was introduced in September, which will serve as the basis for pricing a wide range of financial instruments.

Based on the regulator's data, the banking system demonstrates stability:

- bank assets increased by 29.7% and amounted to 1 trillion 58.1 billion soms;

- the loan portfolio grew to 447 billion soms, which is 31% more;

- the volume of deposits increased by 25% and reached 741 billion soms;

- financing based on Islamic principles increased by 70%, amounting to 15 billion soms.

It is noted that digitalization is actively developing: in the first nine months of 2025, 325 million payments were made using QR codes for a total of over 551 billion soms, which is 16 times more compared to the previous year. At the same time, fees for payments through mobile applications have been canceled.

The National Bank is also introducing new client protection mechanisms, including a "cooling-off period" for online loans and the option for self-restriction on obtaining loans, as well as strengthening the fight against financial fraud.

According to representatives of the National Bank, all these initiatives are aimed at strengthening trust, maintaining price stability, and ensuring the security of the country's financial system.

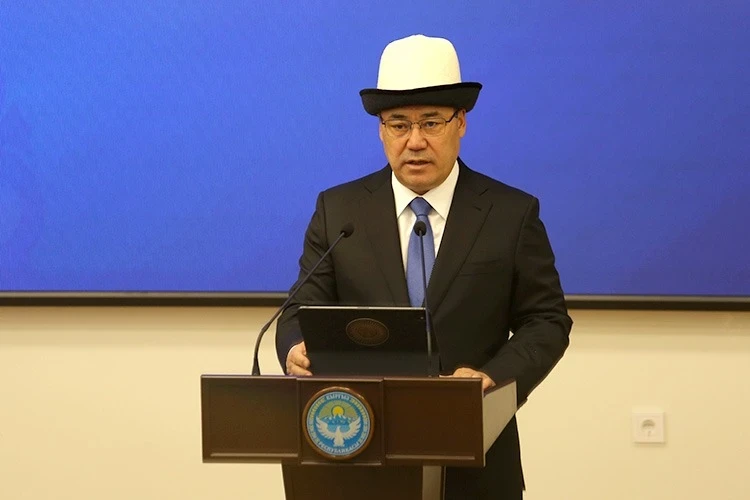

Sadyr Japarov congratulated the leadership and staff of the National Bank on achieving record results.