The EFSR reported on how the Ministry of Finance of the Kyrgyz Republic allocated funds from the placement of Eurobonds.

According to analysts' information, the funds raised from the issuance of eurobonds were used for the recapitalization of JSC "Eldik Bank." In turn, this bank invested these funds in 15-year government short-term obligations with an interest rate of 3% per annum amounting to 60 billion soms (about $700 million) in the primary market.

As a result, domestic debt increased by 4.6% and accounted for 16.7% of GDP. The total amount of the country's debt reached 44.6% of GDP, as noted in the fund's report.

Photo on the main page: AFP / VANDERLEI ALMEIDA.

Read also:

The EDB has once again improved the forecast for Kyrgyzstan's economic growth in 2025.

According to the EFSR forecasts, by the end of 2025, the gross domestic product of Kyrgyzstan will...

It has been announced how much electricity was produced in Kyrgyzstan this year

According to data from the National Statistical Committee, from January to September of this year,...

Women's Entrepreneurship. The Guarantee Fund issued 440 guarantees

OJSC "Guarantee Fund" provided 440 guarantees totaling 369 million soms, which enabled...

The state debt of Kyrgyzstan has increased.

The size of Kyrgyzstan's national debt currently amounts to $4 billion 366.55 million or...

Under the project "Development of Seed Production and Nurseries," subsidized loans totaling 2.85 million soms have been financed, - Ministry of Finance

The Ministry of Finance has announced the launch of a project aimed at developing seed production...

In the Kyrgyz Republic, the yield of certain crops in 2025 decreased due to a lack of irrigation water, - Ministry of Economy

- In the first nine months of 2025, the gross agricultural output of the country reached 348.4...

In Osh, a child died after a dog attack

In the Kara-Kulja district of the Osh region, a dog attacked a child, resulting in the child's...

A tender has been announced in Manas for the construction of the presidential lyceum "Aqylman"

A tender has been launched in Manas for the construction of the presidential lyceum...

Kyrgyzstan Increased Imports of Water, Sugary Drinks, and Soft Drinks by Nearly One and a Half Times

According to data from the National Statistics Committee, from January to August of this year,...

The Ministry of Labor reminds that there will be no additional days off in November.

The Ministry of Labor, Social Security and Migration reminds that according to Article 66 of the...

In Kyrgyzstan, more than 90 PPP projects worth 434 billion soms are being implemented, - Amangeldiev

At the IV International Conference on Public-Private Partnership in Kyrgyzstan, the First Deputy...

Non-communicable diseases cost the economy of the Kyrgyz Republic nearly 30 billion soms

Non-communicable diseases (NCDs) inflict an economic loss of 29.8 billion soms on the economy of...

Kyrgyzstan Increases Production of Construction Materials, Pharmaceuticals, and Food Products in 9 Months

- According to data from the Ministry of Economy and Commerce, the gross output produced by...

"Large Potholes". Pedestrians complain about the condition of the road at the bus stop

Residents of the village of Maevka have turned to the Call Center Kaktus.media for help,...

Increase in electricity tariffs by 23.8% in May boosted inflation in Kyrgyzstan, - EFSR

- The analysis of the reasons for the inflation increase in Kyrgyzstan for June 2025 was presented...

Tashiev handed over special equipment to the Ak-Talinsky district

Today, October 23, 2025, a ceremony was held for the delivery of special equipment for the...

In Bishkek, prices for residential houses have increased by 35 percent over the year

According to the State Agency for Land Resources, the average cost of individual residential houses...

Tax officials intercepted the smuggling of cosmetics worth over 5 million soms

At the checkpoint "Ak-Zhol," tax officials, together with border guards, identified an...

CCTV Cameras Installed in the Restrooms of One School. Comment from the Bishkek City Hall

The Department of Education of the Bishkek City Hall commented on the situation related to video...

The Audit Chamber identified violations in the Ministry of Foreign Affairs amounting to 72.7 million soms

According to the press service, the Audit Chamber of the Kyrgyz Republic has completed an audit of...

In Russian regions, an increase in fuel prices at small gas stations has been recorded. The Ministry of Energy of the Russian Federation announced it is monitoring the situation.

In certain regions of Russia, there is an increase in fuel prices at small gas stations that are...

The rise in fuel prices has intensified inflationary processes in Kyrgyzstan, - Ministry of Economy

- According to information from the Ministry of Economy and Commerce, the consumer price index,...

At the market in Novopavlovka, a resident of Bishkek was deceived out of 8.3 million soms

A suspect in large-scale fraud has been detained in Bishkek, and the police are looking for other...

There is a structural shortage of quality warehouse real estate in the Eurasian region, - EDB

- The analysis of warehouse real estate in the Eurasian region was presented by EDB analysts on...

Reserves of the National Bank of Kyrgyzstan in gold and currency increased by almost 2.7 times

The reserves of the National Bank of the Kyrgyz Republic from the revaluation of foreign currency...

Construction of a large poultry farm for 185 million soms is nearing completion in Bazar-Korgon

The products will be aimed at meeting the needs of the markets in the Jalal-Abad and Osh regions....

Exhibition "Independence of Kyrgyzstan"

When: August 28 at 10:00 AM...

World Economic Forum 2014-2015: Kyrgyzstan Improved Its Position by 3 Places in the GDP Ranking

Kyrgyzstan ranked 128th in terms of gross domestic product among 144 countries with $7.2 billion...

In the village of Ak-Korgon, Talas region, a 225-seat school will be built for 238 million soms.

In the village of Ak-Korgon, located in the Talas region, a tender has been launched again for the...

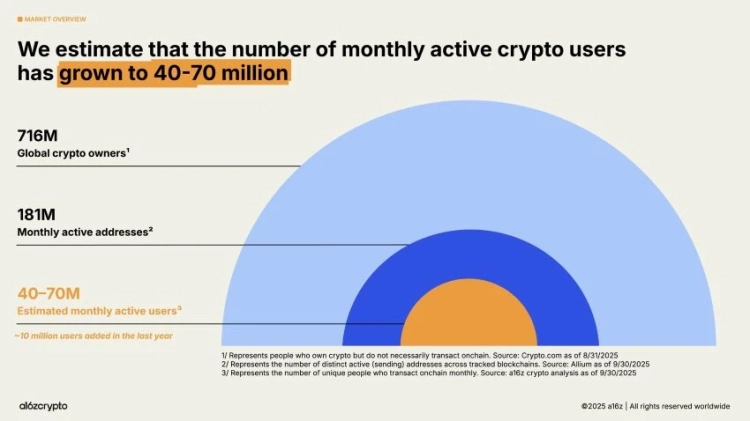

The volume of transactions with stablecoins worldwide exceeded $46 trillion in a year

According to the annual report State of Crypto 2025, prepared by the venture capital firm...

In France, Five Museums Were Robbed in a Week

A recent robbery occurred at the "House of Enlightenment Denis Diderot"...

A Man Reported Fraud by Car Dealership Employees. They Cannot Be Found

Takhir Tashirov, a resident of the village of Iskra in the Chuy region, demands that law...

Fuel prices may soar by 15 percent - authorities discuss emergency measures

According to information received from the Antimonopoly Regulation Service, a 15% increase in fuel...

Russians Have Started Buying More Kyrgyz Goods

In six months, exports of goods from Kyrgyzstan to Russia increased by 40%, while imports from...

In Kyrgyzstan, 400 deposits are being developed

Over 1,000 deposits registered in the republic Currently, more than 1,000 deposits belonging to 51...

The portfolio of PPP projects in Kyrgyzstan exceeded 434 billion soms

The IV International Conference dedicated to public-private partnership was held in Bishkek. The...

Balcony glazing in Bishkek can only be done after approval from the Ministry of Construction and neighbors.

In the capital of Kyrgyzstan, Bishkek, new rules regarding glazing, increasing space, and...

The composition of the board of directors has changed at "Capital Bank"

- The composition of the Board of Directors of OJSC "Capital Bank of Central Asia" has...

Construction of a high-rise building in Bishkek suspended after residents' complaint

Violations were detected at the construction site A complaint was received by the ministry...

Ukrainian Drones Attacked Enterprises in Dagestan and Mordovia

According to his statement, there is currently no information about casualties or victims, and...

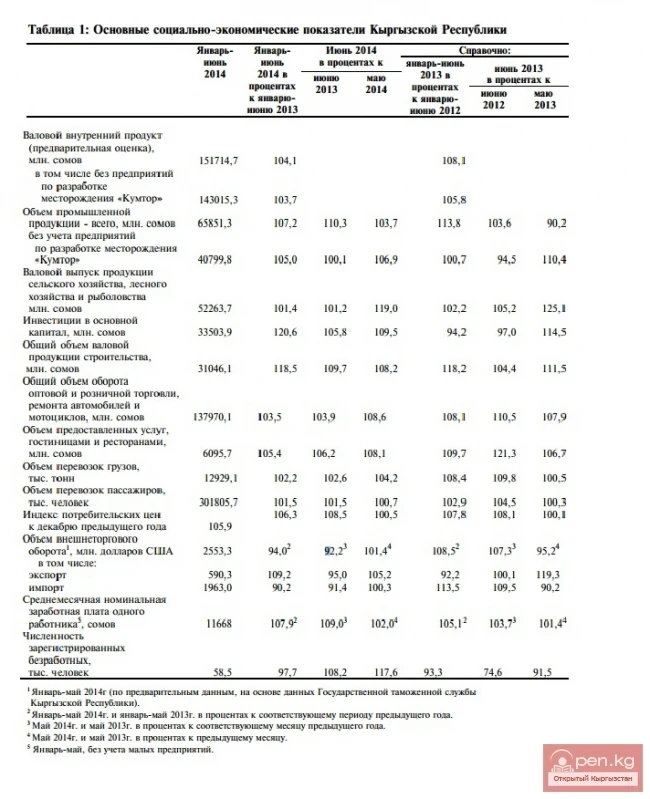

Key Socio-Economic Indicators of the Kyrgyz Republic for the First Half of 2014

Main Socio-Economic Indicators of the Kyrgyz Republic The socio-economic situation of the Kyrgyz...

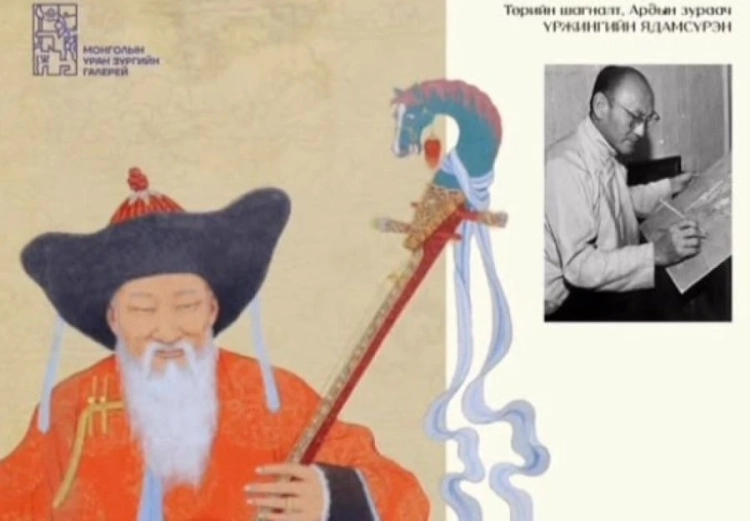

An exhibition opens at the Art Gallery to celebrate the 120th anniversary of the birth of the artist Urjingiin Yadamsuren

The exhibition "Amar Bayasgalan" will feature rare works of art from the collection of...

North Korea conducted tests of hypersonic weapons on its territory

During the tests, two hypersonic vehicles were launched from the Ryokpho area in the capital...

The Beautiful Country Known as Kyrgyzstan

Kyrgyzstan is a small country bordering Uzbekistan, Kazakhstan, and Russia. The main attractions...