The Bank of Russia has lowered the key rate to 15.5%

In the Central Bank's release, it is noted that "the economy is gradually returning to balanced growth." January was marked by a significant acceleration in inflation, driven by temporary factors. However, the Bank of Russia believes that the underlying price growth indicators have remained largely unchanged. It is expected that after the temporary factors dissipate, inflation will begin to decrease again.

This reduction was the sixth consecutive one in the current easing cycle, which began on June 6, 2025. At that time, the Central Bank lowered the rate for the first time in three years by 100 basis points, setting it at 20% per annum. This was followed by four more reductions: on July 25, the rate was lowered to 18%, on September 12 to 17%, on October 24 to 16.5%, and on December 19 to 16%. As a result, during this period, the rate decreased by 5.5 percentage points from a record 21% to 15.5%.

At the beginning of January 2026, there was an acceleration in price growth against the backdrop of an increase in VAT from 20% to 22%, but by the end of the month and the beginning of February, the situation began to improve. As of February 2, 2026, the year-on-year inflation rate was 6.45%, according to the Ministry of Economic Development. By February 9, this figure had decreased to 6.37% year-on-year. However, complete monthly data from Rosstat, which the Central Bank relies on, were not yet available at the time of the Board meeting and will be published on the evening of February 13.

The release also points out that at the end of 2025, there were "very low rates of price growth" for certain goods, particularly for fruits and vegetables, which contributed to inflation being lower than expected for the year. It amounted to 5.6%, while expectations were in the range of 6.5–7%.

Nevertheless, at the beginning of 2026, the influence of these factors on price dynamics changed. The increase in VAT, excise taxes, the indexing of regulated prices, and the correction of prices for fruits and vegetables led to a temporary but significant price growth in January. Thus, there was a redistribution of inflation between 2025 and 2026, as emphasized by the Central Bank, adding that the accumulated price growth from November to January aligns with the regulator's expectations.

According to forecasts, stable inflation may decrease to 4% in the second half of 2026; however, due to the "change in price growth," the inflation expectations for the end of the year were revised upward by 0.5 percentage points, now ranging from 4.5% to 5.5%.

Additionally, the Bank of Russia clarified the range of average key rate values for the current year—from 13–15% to 13.5–14.5%.

Read also:

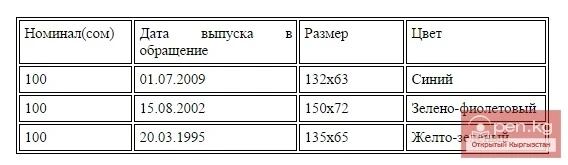

Banknotes with a denomination of 100 som

The 100 som banknote of the 2009 series is made of white paper measuring 132x63 mm. The...

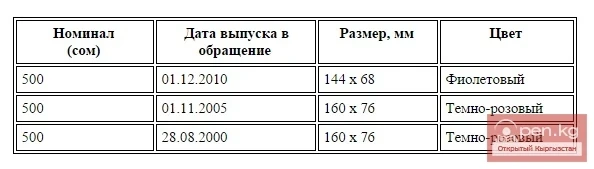

Banknote with a denomination of 500 som

500 som banknote of the 2010 sample is made of white paper measuring 144x68 mm. The predominant...

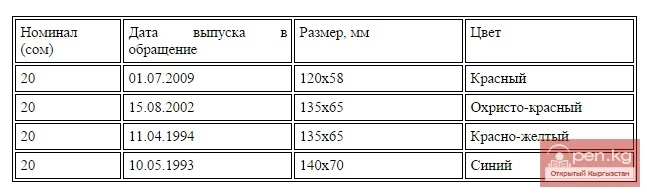

Banknotes with a denomination of 20 som

The 20 som banknote of the 2009 series is made of white paper measuring 120x58 mm. The predominant...

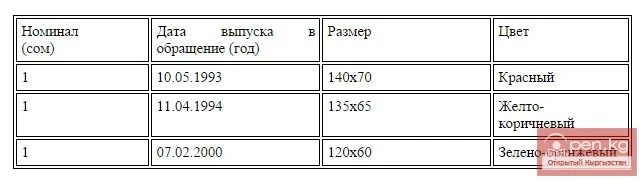

Banknotes with a denomination of 1 som

The 1 som banknote of 1993 is made of white paper measuring 140x70 mm. The predominant color of...

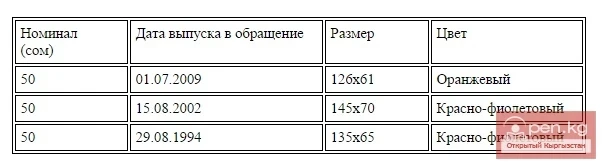

Banknotes with a denomination of 50 som

The 50 som banknote of the 2009 series is printed on white paper measuring 126x61 mm. The...

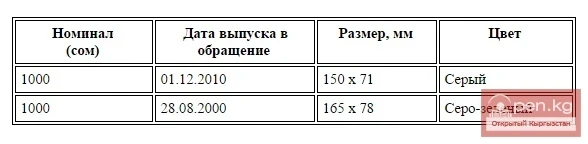

Banknote with a denomination of 1000 som

The 1000 som banknote of the 2010 series is made of white paper measuring 150x71 mm. The...

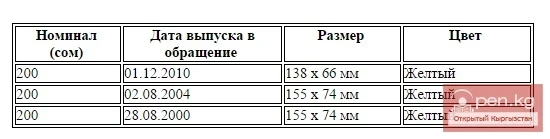

Banknote with a denomination of 200 som

The 200 som banknote of the 2010 sample is made of white paper measuring 138x66 mm. The...

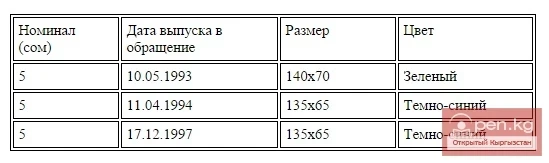

Banknotes with a denomination of 5 som

5 som banknote of 1993 is made of white paper measuring 140x70 mm. The predominant color of the...

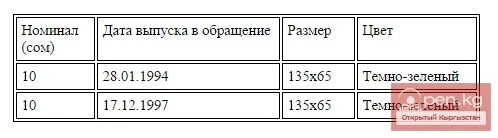

Banknote with a denomination of 10 som

10 som banknote of 1994 is made of white paper measuring 135x65 mm. The predominant color of the...

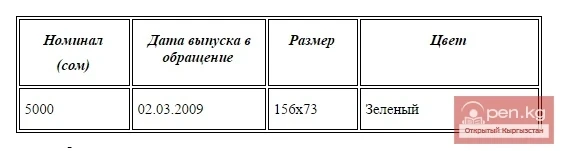

Banknotes with a denomination of 5000 som

The 5000 som banknote of the 2009 series is made of white paper measuring 156x73 mm. The...

Paper banknotes with a denomination of 1 tyiyn

Paper banknotes with a denomination of 1 tyiyn, serving as change coins. The banknote is made of...

Paper banknotes with a denomination of 10 tyiyn

Paper banknotes with a denomination of 10 tyiyn, serving as change coins....

Paper currency notes with a denomination of 50 tyiyn

Paper banknotes with a denomination of 50 tyiyn, serving as change coins. The banknote is made of...