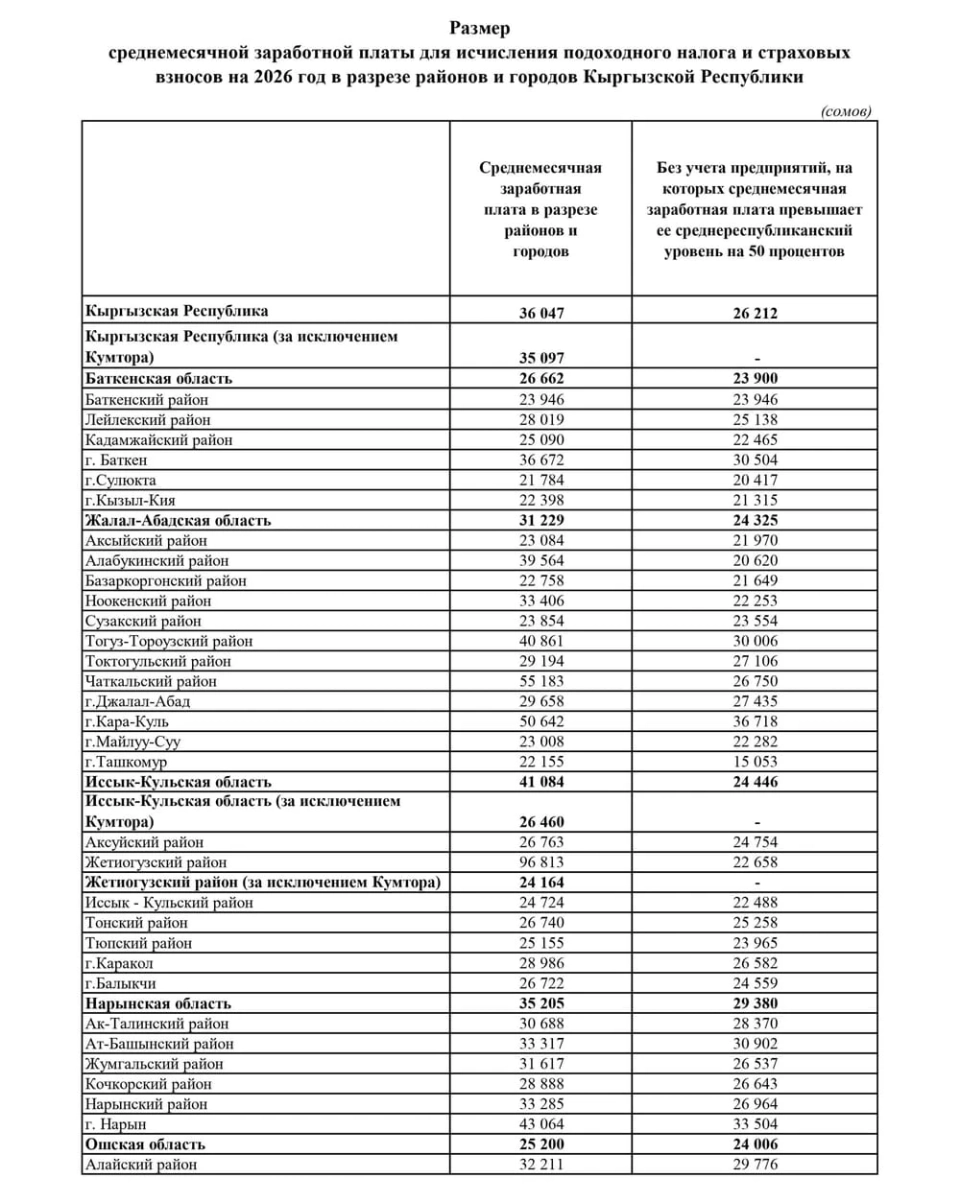

The innovations introduced in the Tax Code imply that property tax will be calculated and paid by tax authorities at the location of real estate objects or land plots.

To successfully implement these changes, the STS is conducting extensive technical work to configure the automated property tax calculation system.

According to information from the STS, this innovation is expected to significantly simplify the process of calculating property tax, reduce administrative costs for taxpayers, and increase the accuracy of assessments.

In order to correctly form tax liabilities for 2026, the tax service strongly recommends that all individuals and legal entities conduct a preliminary verification of the data contained in the title documents against the information provided by the State Agency for Land Resources, Cadastre, Geodesy, and Cartography (State Enterprise "Cadastre").

It is important to pay attention to the accuracy of the following data:

- Tax Identification Number (TIN) of the owner;

- Full name or name of the legal entity;

- Area of real estate objects and land plots;

- Purpose of the objects;

- Ownership shares;

- Registration dates and other parameters specified in the title documents.