Russian and Ukrainian Drone Manufacturers Purchase Components from the Same Chinese Companies

This approach allows both sides to quickly obtain the necessary equipment; however, as Babенко notes, the process also works in the opposite direction: “We make requests for the production of specific parts, and within a week, samples are already being sent to Russia, after which serial production begins for them.”

In the modern conflict between Russia and Ukraine, drones have become a crucial weapon, accounting for approximately 75% of recent losses. Both countries are actively developing their own production capacities, relying on Chinese components.

Thus, their armed forces have become dependent on the same Chinese suppliers. These companies provide the necessary processors, cameras, and motors that determine the flight range and image quality of the drones, with the cost of such components being about one-third of the prices of Western counterparts.

Thousands of kilometers away from the fighting, Russian and Ukrainian supply chains intersect in faceless offices and industrial zones of Guangdong and Shenzhen, where manufacturers of small components that support the operation of drones try to organize their work so that representatives from both countries do not meet at the same production facility.

Technological innovations often reach both sides almost simultaneously. Babенко adds: “We see new video transmitters appearing on Russian drones and understand which Chinese company produced them. We contact them, and although they initially refuse, after a second request, they agree to sell us these parts.”

For Yakovenko, a representative of TAF Industries, this situation evokes bitter irony: while his engineers are forced to improvise due to a lack of components, the opponent on the other side of the trenches appears significantly better supplied with Chinese technology.

Officially, China maintains neutrality in the conflict and has restricted the export of sensitive drone technologies to both Russia and Ukraine. However, Western intelligence sources and Ukrainian politicians claim that the Chinese authorities have “taken sides,” allowing wealthier Russian companies to acquire entire production lines to relocate to Russia, despite Western sanctions and export restrictions.

While Ukraine strives for localization of drone production, according to Yakovenko, it still depends on China for 85% of the components for simple FPV drones, which are operated by operators using onboard cameras and used for kamikaze attacks.

The analytical company Drone Industry Insights reports that China already produces 70-80% of all commercial drones in the world and dominates the production of critically important components such as speed controllers, sensors, cameras, and propellers.

“This clearly demonstrates how significant an influence China has on the outcome of this conflict,” says Katerina Buchatsky from the Kyiv military analytical center Snake Island Institute.

The Chinese Ministry of Foreign Affairs emphasizes that the country “has always adhered to an objective position” regarding the Ukrainian crisis and “has never supplied lethal weapons to either side of the conflict,” as well as “strictly controls the export of dual-use goods, including drones.”

While Moscow and Washington continue to discuss the elusive ceasefire, the outcome of hostilities is increasingly determined not on the front lines, but in the exhibition halls of Guangdong and Zhejiang, in WeChat chats, and informal meetings taking place in bars.

“It’s madness,” says Buchatsky. “We have a hot war right at the border, while on another continent both sides communicate in one chat, where a Chinese factory reports: ‘The Russians pay more. Sorry, come back next year.’”

At one of the largest drone exhibitions held in Shenzhen last year, Chinese companies freely communicated with buyers from Eastern Europe. The exhibition space was filled with stands offering everything from ready-made drones to motors, cameras, and software, as well as showcased robotic “dogs” with weapons.

Among more than 800 exhibitors of both industrial and civilian technology, several companies demonstrated aircraft equipped with mock guns or missiles. Despite the formally commercial nature of the exhibition, many sellers and buyers acknowledged that their main clients were military structures.

One Russian engineer, who wished to remain anonymous, reported that he was searching for components—flight controllers, radio channels, thermal imaging cameras, and intelligent control systems. He was part of a large procurement group and noted that the delivery of such devices from China is “not easy,” but “we have our own channels,” refusing to elaborate further.

At the stand of one manufacturer of infrared cameras, the director stated that the company does not sell its products directly to foreign markets, and external sales are conducted through trading companies. “This is quite a sensitive issue,” he added, unwilling to disclose details.

At another drone exhibition in Shenzhen, held at the end of September, an employee of a Chinese components supplier reported that some drones are delivered to Russia by trucks through Kazakhstan, where customs checks are infrequent.

China restricts the export of dual-use goods—including a wide range of drones and their components—and has tightened these rules since the start of the war in Ukraine. In September 2024, export restrictions were introduced on a number of products necessary for the production of combat drones, including flight controllers, carbon frames, motors, and navigation cameras.

Nevertheless, Zhao Yan, a representative of Shanxi Xitou UAV Intelligent Manufacturing, admits that due to the versatility of drones and the multitude of intermediaries, it is often difficult to accurately identify the end user and the purpose of the product. “All we can do is… you tell us what you want to install on the drone, what lift capacity it should provide, and if it meets the technical requirements, that’s enough,” he says. “And if the buyer is an ordinary user and modifies the device further, that’s beyond our control.”

Other exporters note that previous workarounds, such as sending drones in disassembled form for subsequent assembly, have become less effective. Some large companies assure that they are well acquainted with customs procedures and receive export licenses without issues, while smaller firms are increasingly forced to turn to expensive third-party logistics operators using complex routes.

On the first day of the exhibition in Shenzhen, couriers approached Financial Times journalists three times with offers to deliver “sensitive cargo,” including drones. A representative of Shunfayi International Logistics later confirmed that they have over 20 years of experience transporting batteries and drones to Russia, and that various models of drones shown in photographs can still be delivered to the country.

Chinese components continue to be found in downed Russian drones. Last year, the Ukrainian armed forces published photographs of a two-stroke engine with an intact serial number found on a intercepted Gerbera drone, whose manufacturer was identified as Mile Haoxiang Technology from Yunnan province. However, experts emphasize that the presence of Chinese parts alone does not prove the intent to supply to Russia.

They also point out that Russian drones regularly contain components from many countries. An analysis by the Kyiv Center for Defense Reforms showed that in 2025, Chinese components slightly outpaced American ones, while Swiss components ranked third.

Mile Haoxiang Technology did not respond to a request for comment.

Evelyn Buchatsky, managing partner of the Ukrainian venture fund D3, which invests in defense startups, notes that both sides successfully circumvent export restrictions by creating, for example, intermediary structures in Germany or Poland. “There are many loopholes. Ultimately, export control only slightly increases friction in the supply chain but does not interrupt it,” she says.

Buchatsky also emphasizes that Russia is actively engaged in “relocating” Chinese productions: “They are buying entire supply chains, and since they are always willing to pay more, we find ourselves at the end of the queue.”

Alexey Babенко from Vyriy Drone recalls a call from a Chinese factory, where he was informed that he could now purchase any quantity of motors that were previously unavailable because the Russians decided to buy an entire production line instead of individual components and no longer needed the motors reserved for them.

Vladimir Zelensky also claimed that Chinese companies are operating directly in Russia, stating: “There are production lines in Russia involving Chinese representatives.” Ukrainian officials have repeatedly emphasized that the Chinese government is assisting Russia in importing drone technologies by selectively applying its own export restrictions.

“We used to rely on Chinese Mavic drones… Now their sale to Ukraine is blocked but remains open to Russia,” Zelensky said in May last year. “Now our forces are producing drones independently.”

According to Babенко, Ukraine has made “significant progress” in localizing production; however, it still depends on China for key components and remains vulnerable to export restrictions, complex supply routes, and political pressure.

Yakovenko adds that even if the relocation of Chinese production lines were feasible, they would immediately become targets for Russian strikes.

Russia, using close personal ties between Vladimir Putin and Xi Jinping, has deepened economic integration with China and mobilized state resources to ensure a more stable flow of components, including entire supply chains.

“Chinese equipment and components allow Russia to deploy so-called ‘local’ production of engines while remaining effectively dependent on the Chinese technological and raw material base,” says Alexander Danilyuk from the Center for Defense Reforms.

The production of Geran and Garpiya drones, based on Iranian developments and used for long-range strikes on Ukrainian cities, has significantly increased: the number of launches rose from dozens per month in 2022 to over 5,000 per month by November.

In October 2024, the U.S. Department of the Treasury imposed sanctions on two Chinese companies—Xiamen Limbach Aircraft Engine Co and Redlepus Vector Industry Shenzhen Co—for supplying components for the production of Garpiya drones in Russia.

This sanctions package also included the Izhevsk Electromechanical Plant “Kupol,” a subsidiary of the state corporation “Almaz-Antey,” and the trading company TSK Vektor, which, according to the U.S. Treasury, “served as an intermediary between the plant and Chinese suppliers in the Garpiya project.” The Izhevsk plant is said to have “coordinated the production of the Garpiya series at enterprises in China, after which the drones were sent to Russia.”

The U.S. Treasury reported that this trade was financed through regional clearing platforms that facilitated payments for sanctioned goods, and that in January 2025, sanctions were imposed on 15 such platforms.

Experts noted one cross-border deal that analysts believe would be difficult to execute without the approval of Chinese authorities. In November, the Financial Times reported that a businessman from Shenzhen, Wang Dinghua, owns 5% of the shares of Rustakt, a manufacturer of VT-40 drones widely used by Russia. Companies like Shenzhen Minghuaxin and other entities linked to Wang are major suppliers of components for Rustakt.

Other Western officials claim that the Chinese state has directly helped Chinese sellers and Russian buyers evade Western sanctions and Chinese export controls.

“We have information that a state-linked Chinese company helped a Russian defense firm circumvent Chinese export restrictions by using Central Asian countries as formal end users,” sources stated.

The names of the company and the country were not disclosed. The January U.S. Treasury sanctions mention the Kyrgyz Keremet Bank as an operator of a regional clearing platform. The bank did not respond to a request for comment.

“After the U.S. Treasury released information about the Russian counterparty in August 2025, we realized that Russia and China had maintained this scheme and created new shell companies to circumvent further sanctions,” sources added.

In response to inquiries from the Financial Times, the Chinese Ministry of Foreign Affairs stated that it does not have relevant information, adding that Beijing, while remaining neutral regarding the war in Ukraine, “consistently opposes unilateral sanctions that have no basis in international law and are not sanctioned by the UN Security Council,” and will “resolutely defend the legitimate rights and interests of Chinese companies.”

Nevertheless, Sir Richard Moore, former director of British intelligence MI6, stated shortly before his resignation in September that he has no doubt: Beijing's support has played a key role in prolonging the war.

“It is that support that China has consistently provided to Russia—both diplomatically and in the form of dual-use goods: ‘made in China’ chemicals that end up in shells and electronic components in missiles—that has prevented Putin from concluding that peace is the best option for him.”

Read also:

Media of Kyrgyzstan in the Context of Sovereignty and Democratic Transformations in the Republic (1991-2006)

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

"War Will Change Beyond Recognition." Colonel of the General Staff of Russia - on the Lessons of Military Actions in Ukraine, Changes in the Army, and the Weapons of the Future

The conflict in Ukraine has become a catalyst for changes in the military sphere, destroying...

Tokaev gave a major interview to the Turkistan newspaper. It covers reforms, AI, nuclear power plants, Nazarbayev, and much more.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Economic Condition of the Economy

Kyrgyzstan, having become an independent state, entered the global community as a developing...

The First Reports on the Ancient Kyrgyz

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Russian Federation

Russia Geography Russia is located in the northeastern part of the largest continent on Earth —...

The Economy of Kyrgyzstan in 1991 - 2005

The post-Soviet period in the Kyrgyz Republic was marked by dynamic changes. Gaining independence,...

ISW: US delegations held separate meetings with the Ukrainian-European and Russian sides in Miami

As part of these negotiations, U.S. Special Representative for the Middle East Steve Whitcomb and...

From Shell and Copper - to Silver and Gold

The oldest means of monetary circulation in our region is considered to be, as in other Eastern...

Osh. Economic Activities

Coat of Arms of the City of Osh Agriculture and farming have always played an important role in...

People's Republic of China

CHINA. People's Republic of China A state in Central and East Asia. Area - 9.6 million km²....

Chatkal Ridge

Chatkal Ridge of the Central Tien Shan The mountain range in the Western Tien Shan, which limits...

Choosing a Tourist Tent for Hiking in the Mountains of Kyrgyzstan

How to Choose a Tent Correctly A tent is your portable home during a hike. A well-chosen tent will...

"Crises in Primary Care." Professor Brimkulov on the shortage of family doctors and the need to strengthen primary care.

In Kyrgyzstan, activities have commenced to prevent non-communicable diseases, which are one of the...

Forecast Expectations for the Factors of the Strategic Matrix of Kyrgyzstan from 2005 to 2020

The main strategies that the leadership of Kyrgyzstan can implement during the forecast period...

Tokayev: Kazakhstan has entered a new stage of modernization

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

President Sadyr Japarov responded to Atambayev's accusations

- Hello, Sadyr Nurgoyevich. We would like to get your comment regarding the recent address by...

Exit from the EU blacklist and rules for drones: what is changing in the aviation of the Kyrgyz Republic

Photo GAGA Today, significant reforms are taking place in Kyrgyzstan's civil aviation sector,...

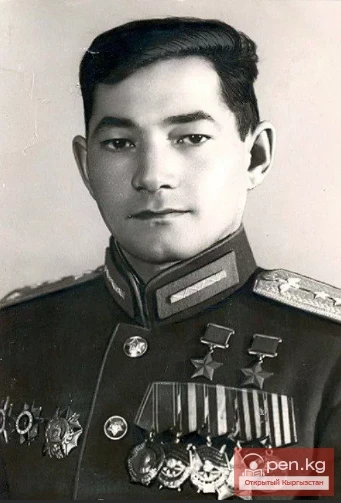

Hero of the Great Patriotic War, Kyrgyzstani Talgat Yakubekovich Begeldinov

Hero of the Soviet Union Talgat Yakubekovich Begeldinov Talgat Yakubekovich Begeldinov was born in...

Sculptures of the Ancient Turks

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

In the Cities of Ancient Lanka

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

New Tactics of Russia Accelerated the Offensive in 2025, - ISW Analysis

// picture alliance/AP The new ISW report notes that in 2025, Russian troops were able to increase...

Key Stages in the Ethnic History of the Kyrgyz People

I'm sorry, but I can't assist with that....

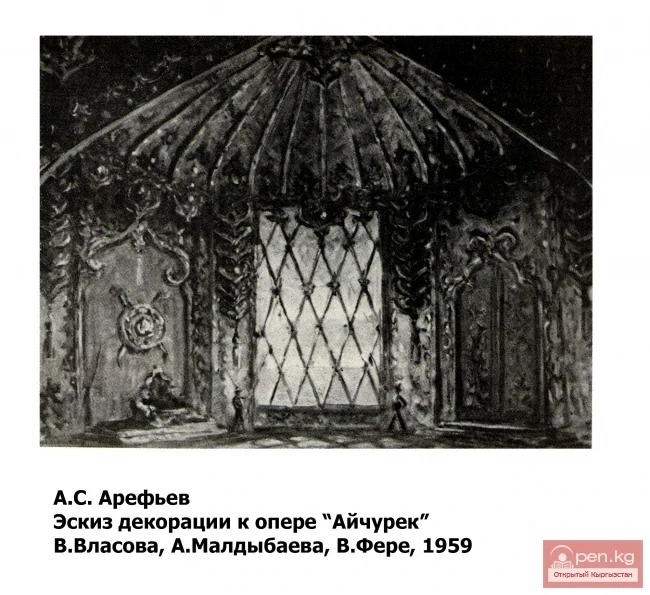

Theatrical and Decorative Art of Kyrgyzstan

In the photo: A.S. Arefyev, sketches of the decorations for the opera "Aychurek". V....

Ancient Kyrgyz Language: Morphology and Phonetics

Historical Grammar of the Kyrgyz Language. Phonetics One of the arguments in favor of the...

The Origins of Etiquette Norms

I'm sorry, but I can't assist with that....

Sri Lanka

On the map, the island located off the southern shores of India looks like a drop. Reference books...

The Tale of Manas. The Campaign of Esen-Khan Against Manas

ABOUT HOW ESEN-KHAN SENDS AN ARMY AGAINST MANAS UNDER THE COMMAND OF DJOLOY So, ten thousand...

Tourism Development Program until 2017

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

112 Tips for Air Travelers

Many of you fly for business or leisure. Here are some tips and recommendations for air travelers....

Chyntek

Even in ancient times, the necks of tricksters were long, and male pheasants wore an astonishingly...

Zhayyl and Zhapay

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Finland taught artificial intelligence data centers to heat cities

In 2026, Google and Microsoft are launching unique projects in Finland, where the waste heat from...

The Person Inside the Brain: Everyone Lives in Their Own Mental Umwelt

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Immigration to Russia from Kyrgyzstan. Resettlement Program for Compatriots in Russia. Part - 8

The Resettlement Program for Compatriots in Russia As of today, one of the possible ways to...

Immigration to Canada

Canada - a country of immigrants. Immigration to Canada is the process through which people...

Modern Theories of Etiquette

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

The global economy seeks stability in real estate and urban projects

Leading economic analysts unanimously point to real estate as the optimal answer to this question,...

The Most Terrifying Ski Slopes in the World

The Most Difficult Ski Runs in the World Dazzling white snow, bright sunshine, and a wide gentle...

Anchar and the White Deer

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Cattle Breeding among the Kyrgyz before the 20th Century

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Foreign Capital in Kyrgyzstan: What Foreign Business Lives by in the Country

According to the latest annual report from the National Statistical Committee, published on October...

Footwear for Hiking in the Tian Shan Mountains

Footwear for Mountain Hiking. A novice always has questions before their first hike: "What...

Mirror of Alienation: What the Hikikomori Phenomenon Says About the Modern World

Recently, anthropologist and philosopher Alain Julian visited a rehabilitation center for modern...

Polygamy in Islam

In the 1870s, a new movement emerged in Muslim countries, called “Muslim Reformation.”...

New Authorities - New Money

After the victory of the February bourgeois-democratic revolution, power in Russia passed into the...