Warner Bros. Discovery has abandoned the sale of the Paramount holding for $108.4 billion

In a letter to shareholders, the WBD board of directors labeled the deal as too risky. Moreover, Paramount has been accused of spreading misinformation — the company claimed that the deal was backed by the financial resources of its CEO David Ellison's family, but “this is not true.” The board strongly recommended that shareholders not sell their shares and support the previously approved agreement with Netflix.

The Paramount proposal was deemed too risky, and the WBD board pointed out deficiencies in the documents provided by the company, which, in the board's opinion, threaten the interests of shareholders and the company as a whole.

According to WBD, the Ellison family does not provide reliable financial guarantees, instead relying on “an opaque revocable trust for financing” the deal. The board indicated that such an approach cannot replace the obligations of the controlling shareholder.

After Warner Bros. Discovery's rejection, Paramount issued a statement urging shareholders to show their support by offering their shares for buyback. The statement also mentioned that the terms of the deal are more favorable, including 100% cash payments, and that the financing is secured by $41 billion in new equity from the Ellison family and RedBird Capital, as well as $54 billion in debt from major banks.

Paramount's CEO David Ellison noted that the company still considers merging with Warner Bros. relevant. In turn, Netflix expressed satisfaction with WBD's rejection of Paramount's offer and confirmed its readiness to distribute Warner Bros. films in theaters.

According to Axios, it remains unclear whether Paramount is willing to improve its offer after losing Affinity Partners, Trump’s son-in-law Jared Kushner, as an investor on December 16. Sources claim that Affinity Partners' involvement in the proposal was not significant but could have created the illusion of a possibility to bypass regulatory scrutiny.

Paramount's tender offer will be valid until January 8, 2025. If the company can convince 51% of WBD shareholders to sell their shares, it will gain control over the organization.

On December 5, 2025, Netflix announced the acquisition of Warner Bros. at a price of $27.75 per share, totaling $82.7 billion in assets. The announcement mentioned that Netflix is also acquiring the streaming platforms HBO and HBO Max. However, the next day, the WSJ reported that the deal requires approval from the Trump administration, which maintains ties with David Ellison. The newspaper also reported that the U.S. president may attempt to pressure antitrust authorities to block the deal in favor of Paramount.

Financial Times later noted that there are concerns in Hollywood about potential budget cuts and job losses due to the deal, and the Writers Guild of America joined in criticizing Netflix for its reluctance to release films widely, demanding that the deal be blocked.

Read also:

Warner Bros. rejected Paramount's offer. The company wants a deal with Netflix.

Warner Bros. has decided to reject Paramount's offer, which valued the assets at $108 billion....

Paramount vs. Netflix: $108 Billion Offer for Warner Bros. Discovery

The proposal from Paramount emerged just a few days after Warner Bros. agreed to a deal with...

Apple, Amazon, Netflix, and Paramount Compete to Acquire Warner Bros.

According to a Bloomberg report, Warner Bros. Discovery has announced its intention to sell the...

Netflix to Acquire Warner Bros. for $83 Billion

The American streaming giant Netflix has issued a press release announcing its intention to...

Netflix announced the acquisition of Warner Bros.

The streaming platform Netflix has announced the acquisition of Warner Bros. for a sum of $82.7...

Netflix buys Warner Bros. studio for $82.7 billion

In a press release, Netflix announced: “Today we are excited to announce the signing of a...

Trump warns that Warner Bros' purchase of Netflix could create problems

Trump also added that antitrust authorities may express their disagreement with the merger of the...

Netflix buys Warner Bros. Discovery

Netflix, as reported in an official press release, will add to its already extensive content such...

The composition of the board of directors has changed at "Capital Bank"

- The composition of the Board of Directors of OJSC "Capital Bank of Central Asia" has...

The GIC placed shares for recapitalization worth $1 billion

Today, November 12, an additional issue of shares of the State Mortgage Company was placed on the...

Sergey Brin donated $1 billion in stock to the Parkinson's disease research fund

Sergey Brin, billionaire and one of the founders of Google, made a significant donation by...

At "Kapital Bank," two members of the board of directors have been changed.

Recent changes in "Capital Bank" concern the composition of the board of directors, as...

Elon Musk received shareholder approval for a compensation package of up to $1 trillion

Photo from the internet At a recent Tesla shareholder meeting in Austin, a decision was made to...

Elon Musk to Receive an Award of Nearly $1 Trillion. Tesla Investors Approved the Payout

At the Tesla shareholders' meeting, a decision was made to grant Elon Musk a compensation...

Media: Without a $1 Trillion Payout, Elon Musk May Leave Tesla

According to information provided by CNBC News, Elon Musk, the CEO of Tesla, may consider leaving...

"Kazakhmys" relocated from the Netherlands to Astana amid upcoming sale

The company "Kazakhmys Corporation," engaged in copper mining, no longer has ties with...

In Kyrgyzstan, the agricultural financing project worth 4 billion soms has been completed

- The Ministry of Agriculture has announced the completion of the initiative "Agricultural...

UFC 324: The Star-Studded Card for the January Tournament Unveiled

UFC President Dana White announced the lineup for UFC 324, scheduled for January 24 in Las Vegas...

Forbes: Trump lost $1.1 billion in wealth due to the decline in shares of his family business

According to information from Forbes, Trump's net worth has decreased from $7.3 billion to...

Tesla shareholders approved a payment of 1 trillion dollars to Elon Musk

Last Thursday, Tesla shareholders voted in favor of a compensation package that could make Elon...

NBKR proposes to expand the powers of the "Financial Company of Credit Unions"

- The National Bank of the Kyrgyz Republic is proposing for discussion a draft of amendments to...

Bank assets exceeded one trillion soms

- As of September 30, 2025, the total assets of the banking sector increased by 38%, reaching 1...

In Kazakhstan, the external debt of banks rose to $15.6 billion by mid-2025

- According to information provided by the EAEU statistics department, the external debt of...

The volume of Islamic financing in Kyrgyzstan reached 16.5 billion soms

compared to the end of 2024, having increased by 7.5 billion soms. This data was published by the...

The Forum of School Leaders of Kyrgyzstan will be held in Bishkek

The III Forum of School Directors of Kyrgyzstan will be held in Bishkek, gathering more than 300...

In Bishkek, a three-day Forum of School Directors of Kyrgyzstan has begun

In Bishkek, on October 29, the third Forum dedicated to the heads of educational institutions in...

Banking Statistics: How Much Funds Were Held by Banks in Correspondent Accounts at the NBKR on October 23?

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

In Kyrgyzstan, mineral resources worth 56.9 billion soms were extracted in 10 months

- According to statistical data, from January to October 2025, the republic extracted minerals...

The Bank of Russia has lowered the key rate to 16.5% per annum

At the meeting held on October 24, 2025, the Board of Directors of the Bank of Russia made the...

External management at Kum-Shagyl JSC has been extended again

The Cabinet of Ministers has approved a new extension of external management at Kum-Shagyl OJSC....

Elon Musk became the first person in the world with a net worth of $600 billion

According to Forbes, in early December, SpaceX conducted a tender offer, resulting in its valuation...

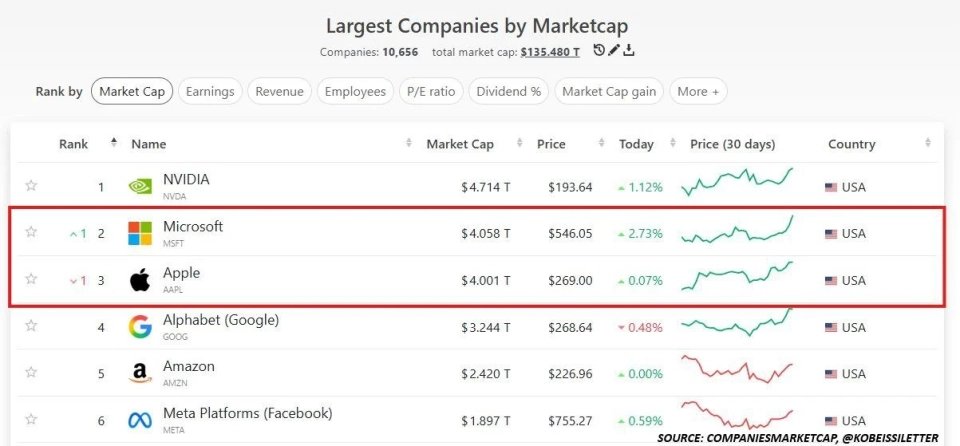

Apple became the third company in history with a market capitalization of $4 trillion

Apple has become the third company in world history to reach a market capitalization of $4...

"The greatness is not measured by money." Warren Buffett published a farewell letter.

Warren Buffett, the renowned investor, wrote a farewell letter to the shareholders of Berkshire...

Trade between Kyrgyzstan and China has already exceeded last year's total figures.

According to data published by the General Administration of Customs of China, the trade turnover...

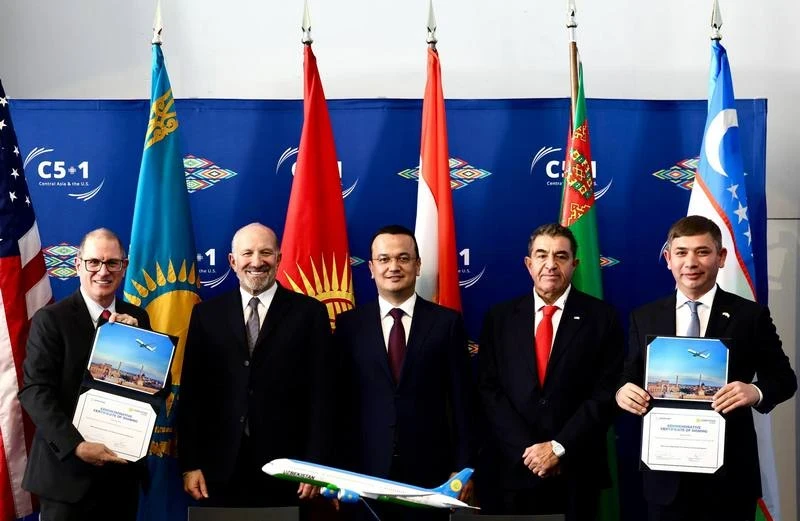

Kazakhstan, Tajikistan, and Uzbekistan are purchasing three dozen Boeing aircraft

At a meeting in Washington with the President of the United States, it was announced that...

The Ministry of Energy issued a reprimand to the management of NESC for the "unlimited tariff"

The Ministry of Energy of the Kyrgyz Republic has published an official clarification regarding...

Elon Musk became the first person in history with a net worth of $600 billion, - Forbes

This new estimate is related to recent data on the value of Musk's company — SpaceX, which is...

UN Security Council supports Trump's peace plan for the Gaza Strip

On Monday, November 17, the UN Security Council voted in favor of a resolution supporting Donald...

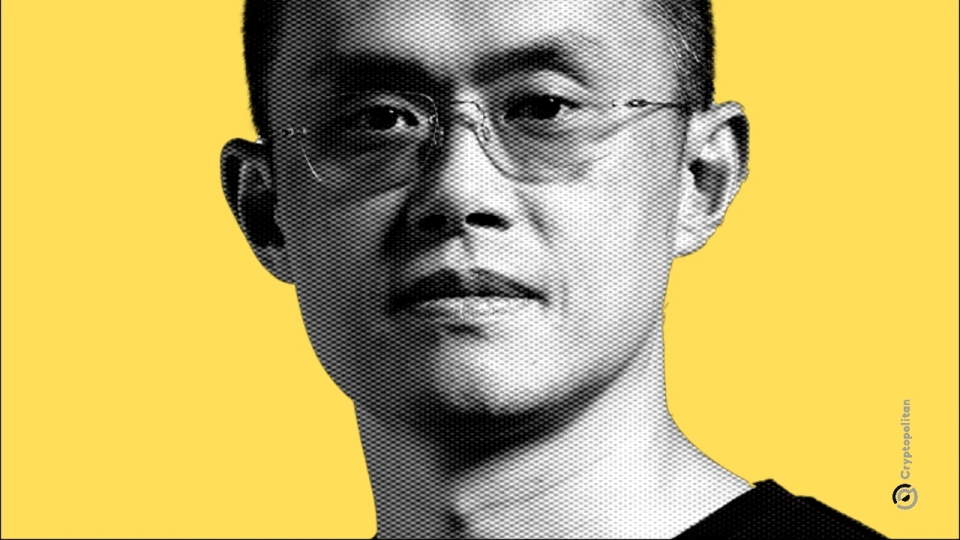

Financial Times: In the US, Changpeng Zhao is accused of facilitating millions of dollars in payments to Hamas

According to the Financial Times, over 300 victims and family members of the victims of the...

Non-residents hold over $1 billion in deposits in Kyrgyzstan's banks as of the end of August 2025

- According to the National Bank of the Kyrgyz Republic, by the end of August 2025, the total...

Scandal Surrounding Jusan Bank: Ex-Aide of Nazarbayev Sues English Lord

According to The Guardian, Yerbol Orynbaev, the former Deputy Prime Minister of Kazakhstan and...

The Ministry of Education announces a competition for the positions of directors of 11 vocational schools. List

The Ministry of Education is launching a competition for the positions of directors in...

Kara-Suu

The "Kara-Suu" Zone is located in the eastern part of the southern slope of the Chatkal...