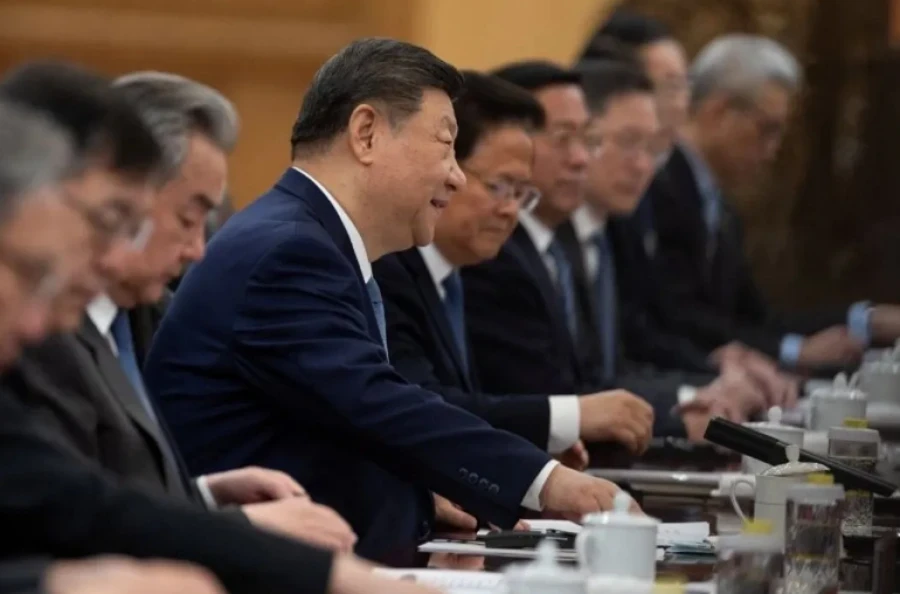

Important statements by Xi Jinping regarding the requirements for a "strong currency" and its financial foundation have become extremely relevant against the backdrop of global changes.

Xi Jinping stated that the yuan should become a global reserve currency, which is critically important for strengthening China's financial power. The question of whether China can reduce its dependence on the US dollar has been analyzed by the publication "TRT in Russian."

The need for a "strong currency" for China

Xi Jinping emphasizes that the yuan should be actively used in international trade, investments, and currency markets, and he aims to elevate its status in global settlements and reserves.

These ambitious plans were articulated by the Chinese leader in the official journal of the Communist Party, Qiushi.

In his opinion, to achieve these goals, China needs a "powerful central bank" capable of effectively managing financial flows, as well as competitive financial institutions that can attract international investments and influence global pricing.

The Chinese authorities have been working for a long time on the internationalization of the yuan, and now Xi Jinping's words about a "strong currency" and the necessary financial foundation have become particularly relevant.

Initially, these statements were addressed to high-ranking officials back in 2024, but they were only published at the end of January 2026.

The article appeared against the backdrop of growing uncertainty in global markets. Kevin Lam, an economist from Pantheon Macroeconomics, noted that "China feels that the shift in the world order has become more real than ever."

It is no coincidence that central banks around the world have begun actively purchasing gold, preferring it to the dollar.

In 2015, the dollar accounted for about 59% of their reserves, while gold made up only 10%. Today, the dollar accounts for 41%, while gold has risen to 28%.

As experts explain, this is influenced by the weakening of the dollar and the pressure that Donald Trump exerted on the US Federal Reserve. A change in leadership at this regulator is expected this year.

Geopolitical tensions and trade wars are also prompting a reassessment of attitudes toward the dollar. Xi Jinping's heightened attention to the yuan reflects changes on the international stage.

China's financial strategy

The Chinese are known for their long-term strategy, and it is not surprising that they began seeking alternatives to the dollar 17 years ago.

The 2008-2009 crisis was a turning point when the Chinese authorities first allowed international settlements in yuan, but only at a special exchange rate set by the People's Bank of China (PBoC).

Since then, the yuan has gradually been transforming into a global reserve currency, although this process has been slow and not always successful.

"The yuan is gradually strengthening its position in international settlements, especially in trade with Asia, the Middle East, and Africa. Bilateral currency agreements are being established, and the infrastructure for cross-border payments is developing," explained investment advisor Yulia Kuznetsova.

According to Zhu Hexin, deputy chairman of the PBoC, in 2024, about 30% of China's foreign economic payments were made in yuan. For example, payments with Russia are conducted in both yuan and rubles, and by the end of 2025, the share of such operations exceeded 99%.

However, experts believe that it is too early to talk about the real chances of the yuan becoming a global reserve currency. According to SWIFT, it ranks only fifth or sixth in the world in terms of the volume of transnational banking operations, with a share of 2.5-3.5%. It lags behind not only the dollar and euro but also the British pound and Japanese yen. In global gold and currency reserves, the yuan accounts for no more than 2.5%.

Obstacles for the yuan

These figures are significantly lower than what would correspond to the scale of the Chinese economy, which constitutes about 19-20% of the global economy and approximately 15% of world trade.

Moreover, the yuan does not meet the main criteria for the status of a global reserve currency. It is not freely convertible, as the PBoC continues to control it, and a special exchange rate different from the domestic one is used for foreign economic settlements. Additionally, China has a closed capital market.

"The status of a reserve currency has its downsides. High demand for it leads to an appreciation of the exchange rate, which is generally good for importing economies. However, for China, which is export-oriented, a strong currency does not align with growth objectives," explained Yan Pinchuk, deputy head of the trading department at WhiteBird.

No real chances

Despite all the efforts of the Chinese authorities, the yuan is not yet capable of taking the place of a global reserve currency. However, China continues to reduce its dependence on the dollar in international trade, expand settlements in yuan, accumulate gold, and diversify its currency reserves.

"In the foreseeable future, China will not be able to completely abandon the dollar, which remains the key currency in global trade and finance," added Yulia Kuznetsova.

She also noted that no other currency has a chance of replacing it. For example, although the euro ranks second, its position is limited by the internal fragmentation of the European Union's financial policy.

The statements of the Chinese authorities are part of a long-term strategy to strengthen financial sovereignty, and a sharp change in the situation should not be expected.

Experts believe that the future is not about a "new dollar," but a multipolar currency system in which the dollar will maintain its dominant position, but its share will gradually decrease in favor of regional currencies, gold, and alternative settlement mechanisms.

Photo www