In conditions of economic uncertainty, many central banks are beginning to actively invest in gold. This is causing an increase in prices for precious metals, including silver and platinum, which are also becoming more in demand.

Economic experts point to the instability of financial markets due to sharp price fluctuations. Nevertheless, the rise in gold prices benefits Kyrgyzstan, as noted by Doctor of Economics Tolonbek Abdyrov in an interview with IA "Kabar".

According to Abdyrov, the rise in gold prices ensures higher foreign currency earnings from exports, which is critically important for the country, as it depends on imports of machinery, fuel, and medicines. Increased foreign currency inflows facilitate the payment for foreign supplies and contribute to the stability of the Kyrgyz som exchange rate.

In 2024, the total export volume of goods from Kyrgyzstan was approximately $5 billion, of which $2.5 billion came from gold sales. This means that about half of the total commodity exports consist of precious metals,” the economist added.

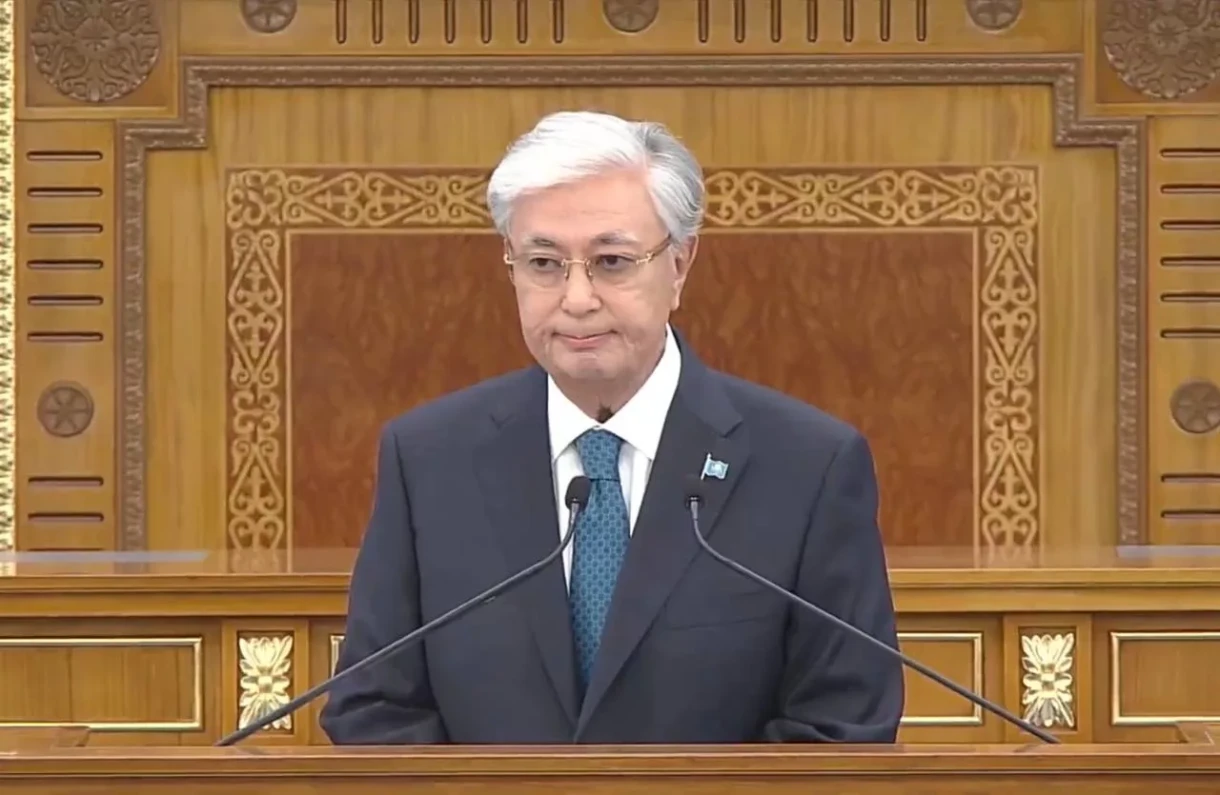

An important factor is the control that the government, under the leadership of Sadyr Japarov, has gained over the Kumtor deposit. Currently, the mine operates in the interests of the country, increasing tax revenues and gold and foreign currency reserves, as well as ensuring the export of precious metals.

“According to international organizations, Kumtor's contribution to state revenue has significantly increased, as confirmed by IMF reports,” the expert explained.

One of the important consequences of rising gold prices is the increased resilience of the economy. More foreign currency coming from the export of precious metals allows the government to maintain international reserves, which protects the economy from external shocks, such as price spikes for imported goods and logistical problems.

“We can expect that gold prices will continue to rise. The country's president has taken important measures to control Kumtor, which has become a significant support for economic growth,” emphasizes Tolonbek Abdyrov.

Investors are sensitive to changes in the global economy and typically seek to invest in reliable assets, such as gold, which is not subject to inflationary risks during critical moments. Precious metals remain a benchmark of stability, even when the value of currencies fluctuates.

Ulugbek Yereshev, an expert in international relations, notes that global crises have always led to an increase in demand for gold, and the current price spike is unique in its scale. This creates additional opportunities for Kyrgyzstan in the form of increased budget revenues and improved economic indicators.

“However, it is not advisable to make long-term bets on this situation. It may be wise to keep some gold in the country while financial markets remain unstable. Although it can be sold profitably, further price increases make foreign currencies less attractive,” he added.

The state demonstrates effective management, and selling precious metals at high prices can positively impact the economy. However, gold remains not only a liquid asset but also a reliable means of payment in international trade, which creates a foundation for further growth.