According to the agency, this initiative allows jewelry owners to avoid liability and tax obligations. There are only 16 days left to take advantage of this opportunity.

Reduced rates of assay fees apply to legalized items:

- for gold, platinum, and palladium jewelry, both domestic and foreign production, including used items and those received from individuals or legal entities — 10 soms per unit;

- for silver jewelry of similar origin — 8 soms per unit.

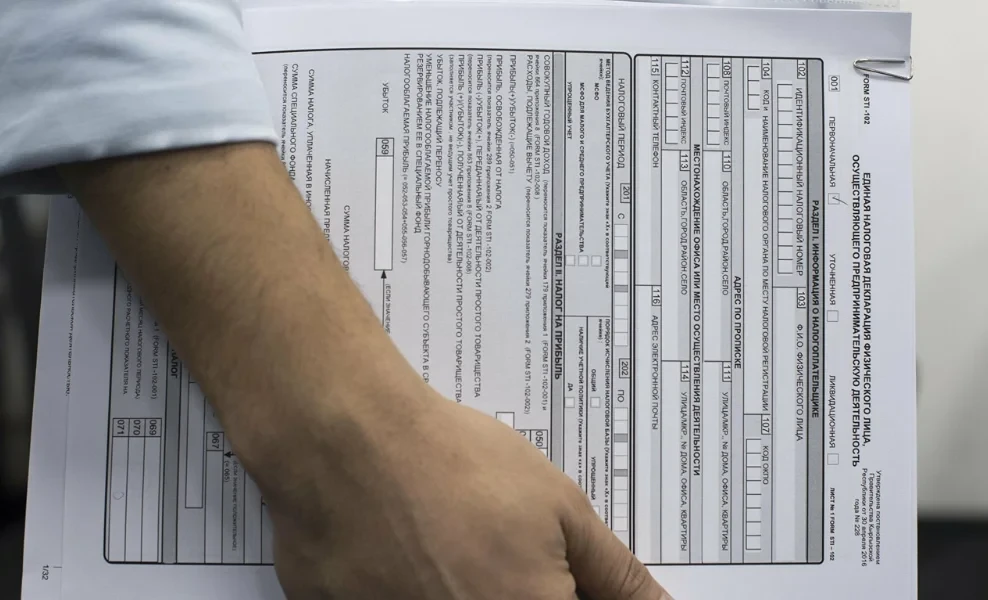

To legalize their items, it is necessary to submit documents through the ESF information system on the website. The form should indicate the name of the item, its assay, weight, quantity, price, and cost. After that, taxpayers must contact the UGN to conduct testing and hallmarking of the jewelry.

It is worth noting that the voluntary patent is no longer valid, and transactions with precious metals are subject to a simplified taxation system at a rate of 0.25 percent using cash register machines.