According to the new rules, starting from January 1, entrepreneurs who conduct their activities outside the country are required to switch to the simplified taxation system using a single tax. A preferential rate of 0.1 percent is provided for this category of taxpayers.

Previously, it was necessary to submit a notification of the transition to the territorial authorities by February 1. However, the State Tax Service received numerous requests from citizens and companies who were unable to complete the necessary procedures within the specified deadlines.

In order to support entrepreneurs and ensure a smoother transition to the new system, the tax authority has decided to extend the application submission deadline.

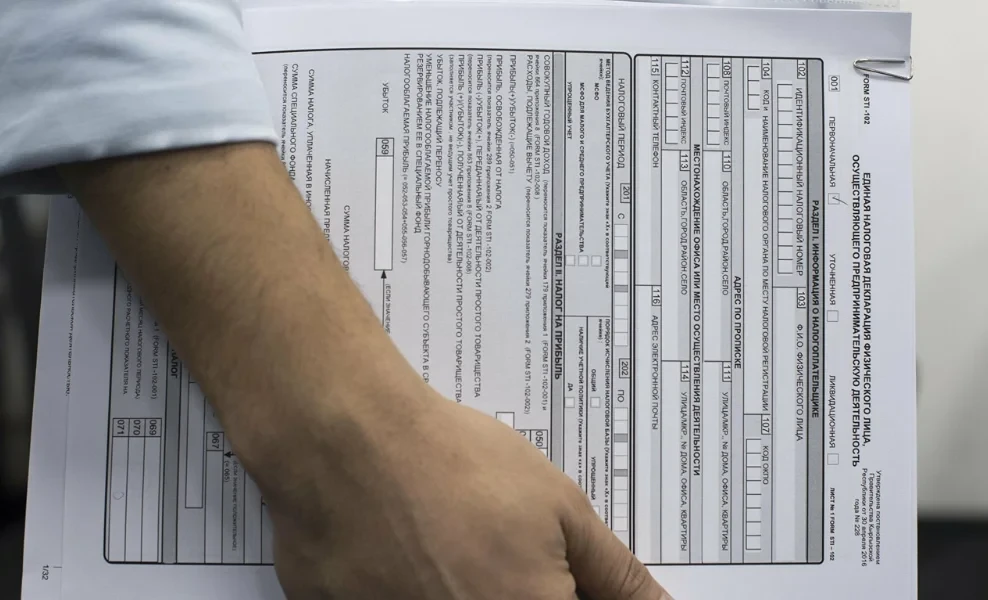

Application Submission Procedure

Applications should be submitted to the tax authorities at the place of registration. GNS employees are ready to provide consultations on the application of the preferential rate of 0.1 percent and assist with filling out the necessary documents.

The transition to the new taxation regime will help legalize activities abroad under the most favorable conditions, the agency noted.