Starting from January 1 of this year, such taxpayers are required to apply the simplified taxation system based on a single tax at a rate of 0.1%.

The message states that in order to take advantage of this system, an application must be submitted to the tax authorities at the place of registration by February 1, 2026.

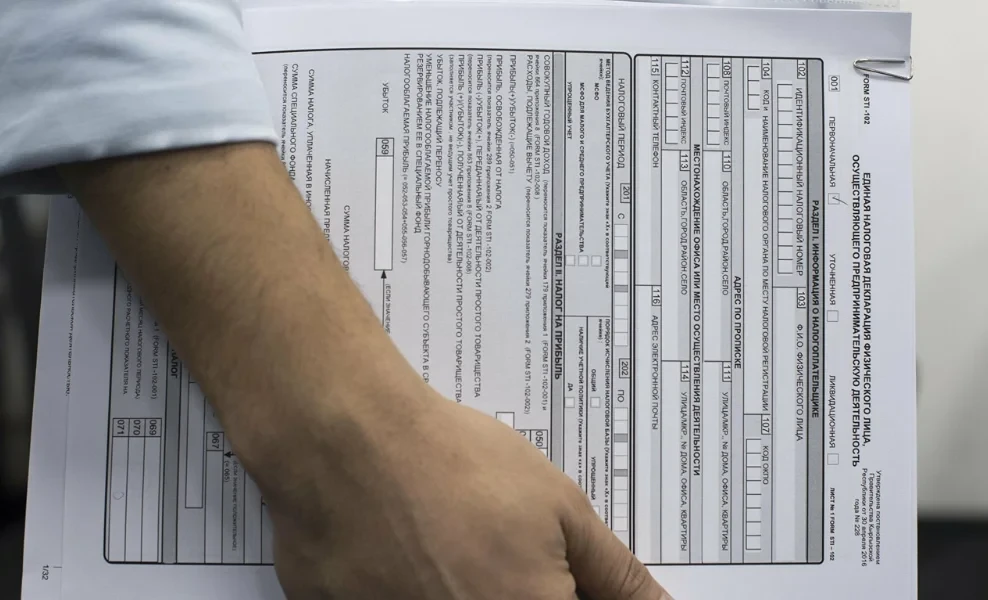

Considering the requests from taxpayers, the deadline for submitting applications for transitioning to the simplified taxation system has been extended to March 1, 2026.Taxpayers must contact the territorial tax authorities with an application for transitioning to a special tax regime based on a single tax.