GNS: Tax Rate on Transactions Reduced

These changes have been made to the Tax Code of the country in accordance with the Law of the Kyrgyz Republic "On Amendments to Certain Legislative Acts of the Kyrgyz Republic in the Field of Taxation, Social Insurance, and Non-Tax Revenues," adopted on December 31, 2025.

It should be reminded that this tax was established by the Law of the Kyrgyz Republic dated July 31, 2025. It represents a special tax regime that pertains to operations for the transfer of funds received only from the account of a foreign bank through the taxpayer's account opened in a bank of the Kyrgyz Republic to an account in a foreign bank.

The bank where the account is opened acts as a tax agent and withholds the tax, which is then transferred to the budget when the taxpayer conducts the transactional operation.

Organizations and individuals engaged in such transactions must exclusively use the special tax regime "transaction tax." They need to submit an application for the application of this regime at their tax registration location by February 1, 2026.

It is important to note that taxpayers using this tax are not allowed to engage in other entrepreneurial activities on the territory of the Kyrgyz Republic.

If a taxpayer decides to combine transactional activities with others, they will need to register a separate limited liability company or individual entrepreneur to carry out such activities.

Read also:

The GNS reminded about the reduction of tax on transactions through foreign banks.

In accordance with the changes made to the Tax Code of the Kyrgyz Republic, the tax rate on...

Ibraev proposed to the Chinese to invest in the construction of the power lines "Kemin-Torugart" and "Barskoon-Bedel"

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Liquidation of Individual Entrepreneurs: Legal Nuances You Should Know

The State Tax Service of the Kyrgyz Republic has announced the start of the procedure for the...

The exhibition "Kyrgyzstan EXPO 2025" started today in Bishkek.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Personal QR codes for business are banned. Banks are blocking accounts, cash is requested at the market.

Since 2020, there has been a rise in cashless payments in Kyrgyzstan. According to the National...

Reduced rate of the single tax for activities conducted outside the territory of the country

The State Tax Service of the Kyrgyz Republic has announced a reduction in the unified tax rate for...

When the taxpayer must enter purchase data into the EFS system themselves

The State Tax Service reminds that taxpayers using electronic invoices must independently enter...

Bakyt Torobaev familiarized himself with the activities of the Potato Farming Development Center "Tyup"

On November 24, 2025, the Minister of Water Resources, Agriculture, and Processing Industry, Bakyt...

Who Should Use KKM, ETTN, and ESF. Clarification from the GNS

The State Tax Service has provided clarifications on the use of the electronic waybill (EWT),...

In Bishkek, the best exporters of the country were awarded

On December 24, 2025, the final of the national competition "Best Exporter of the Kyrgyz...

In Kyrgyzstan, the single tax rate for working abroad has been reduced

The rate has been reduced to 0.1 percent According to information from the State Tax Service, the...

The GNS reduced the tax to 0.1% for entrepreneurs working abroad

The State Tax Service of the Kyrgyz Republic has made an official statement regarding a...

Products of Batken gardeners enter new markets thanks to a new enterprise

In the Batken region, in the village of Samarkandek, a new enterprise has opened that processes...

In the capital, the pilot delivery of solid waste to the new waste processing plant has begun

In the capital, the first stage of the delivery of solid household waste (SHW) to the new waste...

Good news for Kyrgyz citizens. Changes have been made to the tax laws.

President Sadyr Japarov signed a new law concerning changes to the country's tax system,...

A new update in the "taxpayer's cabinet" was presented at the State Tax Service

The State Institution "Tax Service" announces the implementation of new functionality in...

At the GNS, issues of export and re-export were discussed

Kubanychbek Isabekov, Deputy Chairman of the State Tax Service under the Government of the Kyrgyz...

Why Are Merchants Afraid of QR Payments? - Interview with the Deputy Head of the State Tax Service

In light of discussions on social platforms and in the media about how many sellers at markets...

Historical Maximum: The State Tax Service Exceeded the Tax Plan by 46.5 Billion Soms

At the hardware meeting led by Almambet Shykmamatov, the chairman of the State Tax Service, the...

The President signed a law on tax and administrative benefits for businesses and citizens

The document introduces the cancellation and reduction of a number of tax obligations, as well as...

From January 18, new rules for the detention of cash will be implemented at the EAEU border.

Starting from January 18, 2026, Kazakhstan will introduce new rules regarding the detention of...

The tax authorities explained why businesses cannot accept payments to personal electronic wallets

Banks have the right to block accounts, and violations may lead to penalties. The State Tax...

The Roads of Independent Kyrgyzstan: Major Infrastructure Projects Funded by the State Budget

In recent years, there has been active development of road infrastructure in Kyrgyzstan, funded by...

The GNS answered farmers' questions at the fair in Bishkek

An article titled "Participants of the fair in Bishkek are waiting for clarifications and...

The GNS clarified who is required to use KKM, ETTN, and ESF

“These tools create a fair and effective tax system” The State Tax Service of the Kyrgyz Republic...

New Benefits for the Sewing and Textile Industry Have Emerged

The State Tax Service of the Kyrgyz Republic informs that in accordance with the Law of the Kyrgyz...

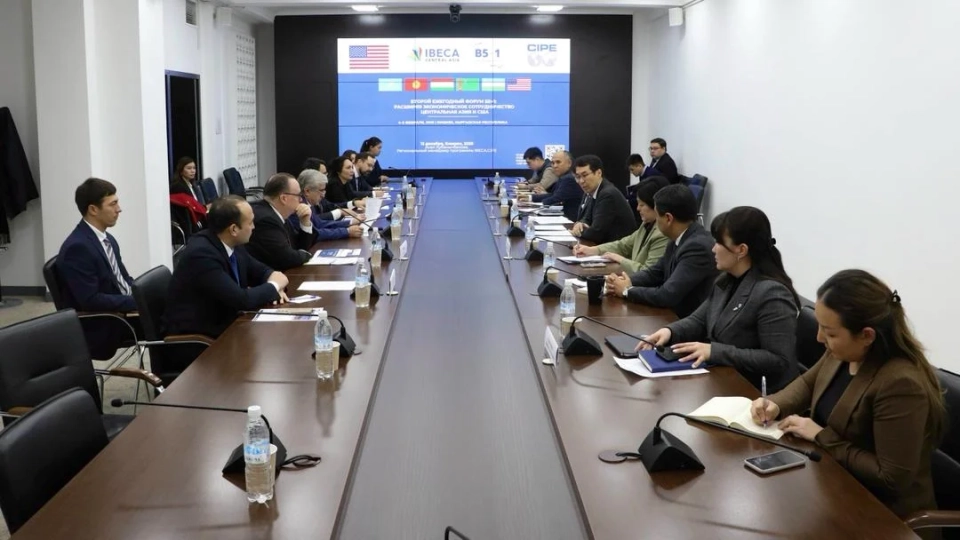

Kyrgyzstan Presented Key Directions of the "B5+1" Forum to the Diplomatic Corps

Today, a joint briefing organized by the Ministry of Foreign Affairs and the Ministry of Economy...

Implementation of the "Bazar" System: 727 Million Soms in Taxes Collected in 10 Months

The State Tax Service of the Kyrgyz Republic has summarized the results of the implementation of...

How Commercial Banks Will Operate During the New Year Holidays

The New Year holiday period should not distract you from addressing important financial matters. If...

Launched updated hydro units of Toktogul and Uch-Kurgan hydropower plants

In the Jalal-Abad region, the Minister of Energy of Kyrgyzstan, Talaybek Ibraev, conducted a...

The Russian-Kyrgyz Development Fund invested $1 billion in the economy of Kyrgyzstan

For a successful business start, financial assistance is essential. The Russian-Kyrgyz Development...

The National Bank of the Kyrgyz Republic has raised the discount rate to 11 percent

On November 24, the Board of the National Bank of the Kyrgyz Republic made a decision to raise the...

SFS: "The Taxpayer's Cabinet" is used by 1 million 521.6 thousand people

As of December 16, 2025, the Tax Service of the Kyrgyz Republic reported that 1 million 521.6...

The State Tax Service Implements Automated Property Tax Assessment

The State Tax Service (GNS) is launching a new project for the automated calculation of property...

In Kyrgyzstan, there are plans to regulate artificial intelligence. What is behind this?

With the development of artificial intelligence, numerous questions arise regarding its regulation....

In the online taxpayer cabinet, the submission of reports "not in one's district" has been excluded.

According to the updated features of the taxpayer's cabinet, reports will now only be accepted...

Beans as a Brand of Kyrgyzstan: A Processing Plant is Proposed to be Built in Talas

Beans are an important agricultural crop grown not only in Kyrgyzstan but also in China, India,...

The State Duma supported amendments exempting certain categories of entrepreneurs from taxes

On December 24, the deputies of the Jogorku Kenesh approved amendments to the draft law concerning...

300,000 companies may close in Kazakhstan due to tax reform. Consequences for the KR

A large-scale tax reform in Kazakhstan is already causing significant concern among representatives...

Kyrgyzstan will increase cargo transportation volume to 110 million tons by 2030 — Sydykov

Currently, the second day of the Central Asian Regional Economic Cooperation (CAREC) business...

"Alamedin Zone"

Alamedin Zone is located 25 km from Bishkek in the valley of the same name and the surrounding...