The State Tax Service (GNS) is launching a new project for the automated calculation of property tax, made possible by changes in tax legislation.

According to the updates made to the Tax Code, property tax will now be calculated and paid directly by the tax authorities at the location of the relevant property or land plot.

To successfully implement these norms, the GNS is conducting extensive work on the technical setup of the automated calculation system.

This initiative aims to simplify the property tax calculation process, reduce the administrative burden on taxpayers, and improve the accuracy of calculations.

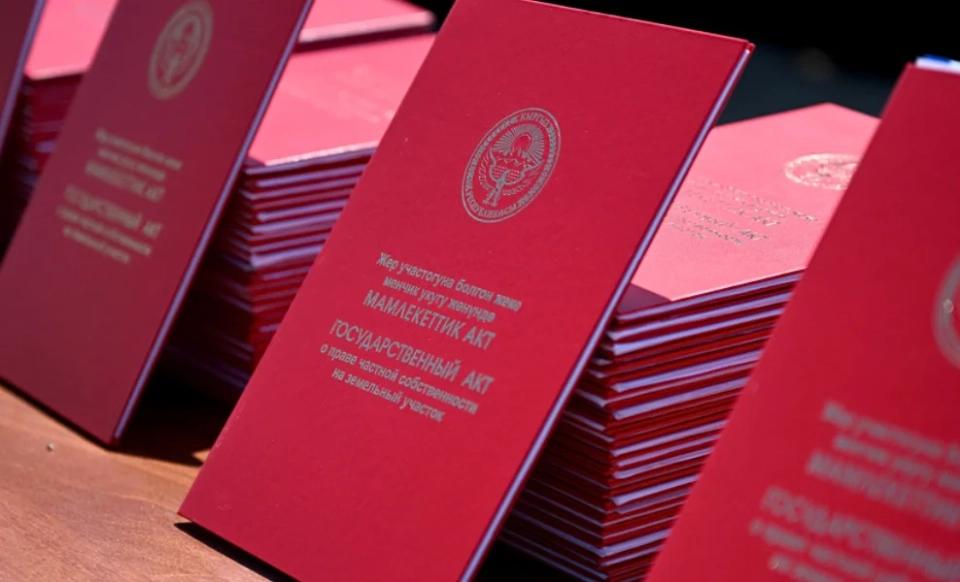

In anticipation of the formation of tax obligations for 2026, the Tax Service strongly recommends that both individuals and legal entities conduct a preliminary verification of the data contained in the ownership documents against the information provided by the State Agency for Land Resources, Cadastre, Geodesy, and Cartography under the Cabinet of Ministers of the Kyrgyz Republic (GU "Cadastre").

It is recommended to check the accuracy of the following data:

- Tax Identification Number (TIN) of the owner;

- last name, first name, patronymic or name of the legal entity;

- area of real estate and land plots;

- purpose of the properties;

- ownership shares;

- registration dates and other parameters specified in the ownership documents.