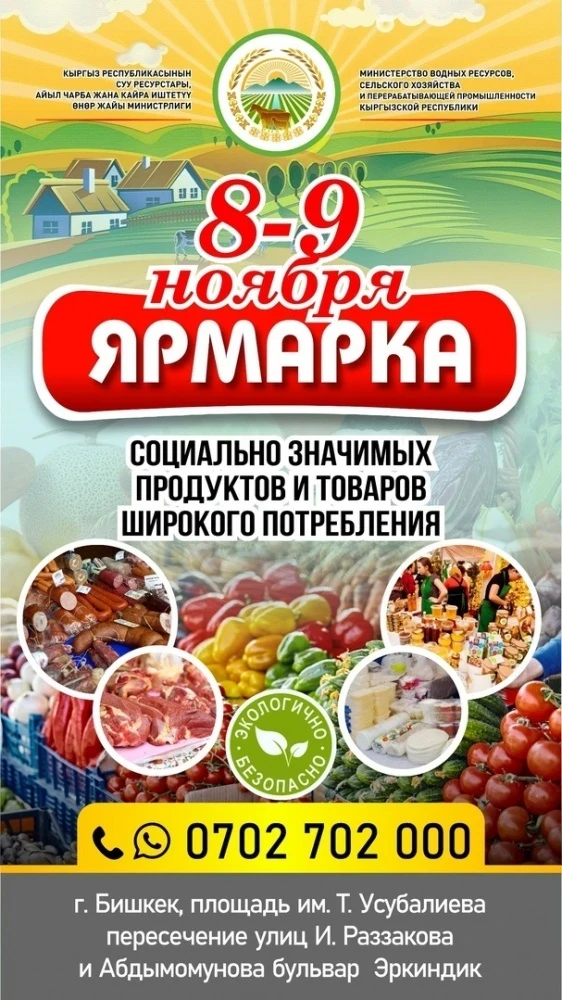

On January 10, the first day of the 2026 fair, the team from the State Tax Service attended the event to answer participants' questions. The tax service specialists provided clarifications on-site to farmers, artisans, and sellers of agricultural products.

An information platform was created near the trade area, where representatives of government agencies and NGOs were invited to explain the new conditions and provide useful information to fair participants. On this day, the tax service employees detailed the tax changes for 2026 and answered numerous questions.

As noted by Aibek Mamatov, head of the methodology department of the tax service, such dialogue proved to be very relevant and in demand.

- We came to the fair to answer questions from farmers, sellers, and processors, as well as to explain how to legally conduct activities when selling their own products or goods purchased from producers. We informed who needs to register as an individual entrepreneur, which categories of entrepreneurs can use patents, and for what periods they are issued, - he reported.

The tax officials emphasized the importance of a new requirement that came into effect on January 1, 2026: the use of personal QR codes of individuals for commercial activities is prohibited.

- Now, the use of a personal QR code linked to an individual in business activities can lead to a fine. One needs to contact a bank, open a settlement account for the individual entrepreneur, and obtain a separate QR code that will be linked specifically to this account. This QR code can be used both at fairs and in other retail outlets, - Mamatov explained.

Additionally, fair participants were informed about how online registration for individual entrepreneurs and patent issuance works. Representatives of the tax service noted that these procedures are available in electronic format with an email address and internet access.

Many questions concerned the taxation of agricultural producers.

- Agricultural producers engaged in growing their own products are exempt from taxes. This norm has been in effect for many years. The state, as an agrarian country, supports farmers, livestock breeders, and beekeepers, - Mamatov noted.

Discussing reporting, beekeepers were interested in whether reports need to be submitted during work at apiaries in the mountains.

- If there is no activity, zero reports are not required. Reporting and patents are issued only for periods of actual entrepreneurial activity. While a person is engaged in growing products, this is not considered entrepreneurship. It begins at the moment of sale, - explained the representative of the tax service.

Taxes are paid at the place of activity. For example, the fair at the Turdakun Usubaliev Square belongs to the Pervomaisky District, while the fair in the Vostok-5 microdistrict belongs to the Sverdlovsky District.

For additional information, tax officials advised contacting the tax service call center at 116, as well as using the information posted on the official website of the service, where a list of types of entrepreneurial activities is available.