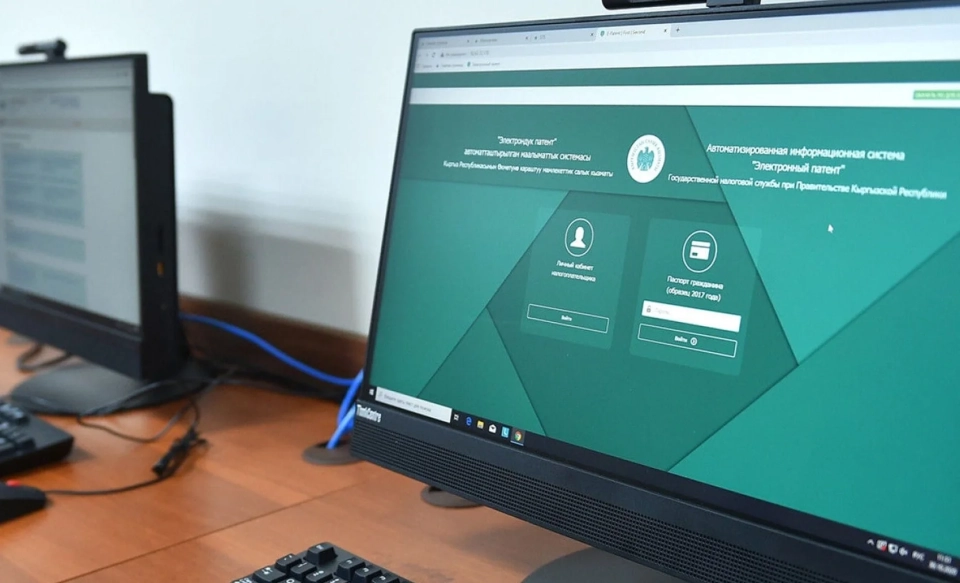

In its report on activities since its establishment, the institution noted that over four years, numerous digital solutions have been implemented, such as the digitization of all types of tax reporting and the ability to pay taxes remotely through the platform cabinet.salyk.kg and the Salyk mobile application.

In 2025, the system was enhanced with a data analysis tool called "Kezet," which significantly improved the quality and efficiency of processing tax data.

Plans for 2026 include expanding the use of AI for automating tax audits, which should increase the transparency of the work of tax inspectors.Shamshybek Kachkynbay uulu, the director of the institution, noted that the main problems for taxpayers were the long time spent on filing declarations and the need for personal visits to tax authorities to make payments.

He emphasized: "The tax service has set itself the task of eliminating these difficulties. We are confident that citizens are already noticing the benefits of digitalization, which help them save time and resources in fulfilling their tax obligations."

Additionally, the State Tax Service reported that, according to World Bank data, in 2025, the process of paying taxes in Kyrgyzstan became the fastest among all forms of tax administration. From 2012 to 2023, the time required to calculate taxes exceeded the time spent on making payments by seven times, which is a significant achievement for the tax service.