The tax service proposed to integrate the databases of organizations and citizens.

This document was developed to implement Article 152 of the Tax Code and defines the procedure for exchanging information between the Tax Service and those who possess data about individuals and organizations.

The proposal includes the approval of a unified procedure for the technical and informational integration of systems with the databases of the Tax Service. This innovation will enable systematic information exchange, increase transparency in tax administration, and avoid data duplication.

After approval, the draft order will be published on the official website of the Tax Service and communicated to all structural divisions of the central office, as well as territorial administrations and the state institution "Salyk Service."

Read also:

The VAT Project Presented for Discussion: Who Will Fall Under the "Risk Indicators"

The Ministry of Economy and Commerce of the Kyrgyz Republic has completed the revision of the draft...

The authorities made changes to the decree on support for small businesses and tax control

The President of the Kyrgyz Republic, Sadyr Japarov, has signed a new decree that amends the...

The State Tax Service Implements Automated Property Tax Assessment

As part of the updates to the tax legislation, the State Tax Service of the Kyrgyz Republic is...

The Ministry of Economic Development proposes to adjust the rules for calculating the "risk base" for VAT on imports from the EAEU.

The Ministry of Economy presented a draft amendment to the Cabinet of Ministers' Resolution...

The GNS asks taxpayers to verify their data

The State Tax Service (STS) is appealing to citizens to check the data on their real estate in...

In Kyrgyzstan, penalties and fines will be calculated automatically

A new law has been adopted in Kyrgyzstan, amending the provisions of the Tax Code. Now, the accrual...

History of the Tax Service of the Kyrgyz Republic

The strength of the state lies in its budget. This postulate is indisputable. The main task of tax...

The tax service has updated the list of goods with signs of VAT risk.

The press service of the State Tax Service of the Kyrgyz Republic has announced a revision of the...

The new procedure for collecting tax debts will come into effect from 2026.

Starting from January 1, 2026, important changes will come into effect in the Tax Code of...

The authorities propose to approve unified rules for the courts of elders.

The draft order for the establishment of regulations for the Council of Elders' Courts has...

The Tax Service of Kyrgyzstan will begin forced deregistration of inactive legal entities and individual entrepreneurs.

The Kyrgyz Republic has published a list of legal entities and individual entrepreneurs that are...

GNS: Citizens Need to Check Themselves After Automatic Property Tax Assessment

The service called for data verification The State Tax Service of the Kyrgyz Republic has begun...

GNS Employees Exchanged Experience with Swiss Company SICPA

The State Tax Service of Kyrgyzstan is exploring the implementation of SICPA technologies Led by...

The State Tax Service Implements Automated Property Tax Assessment

The State Tax Service (GNS) is launching a new project for the automated calculation of property...

Pilot implementation of navigation seals for the transportation of goods between the Kyrgyz Republic and the Republic of Kazakhstan is launched.

A pilot project is being launched in the Kyrgyz Republic related to the use of navigation seals...

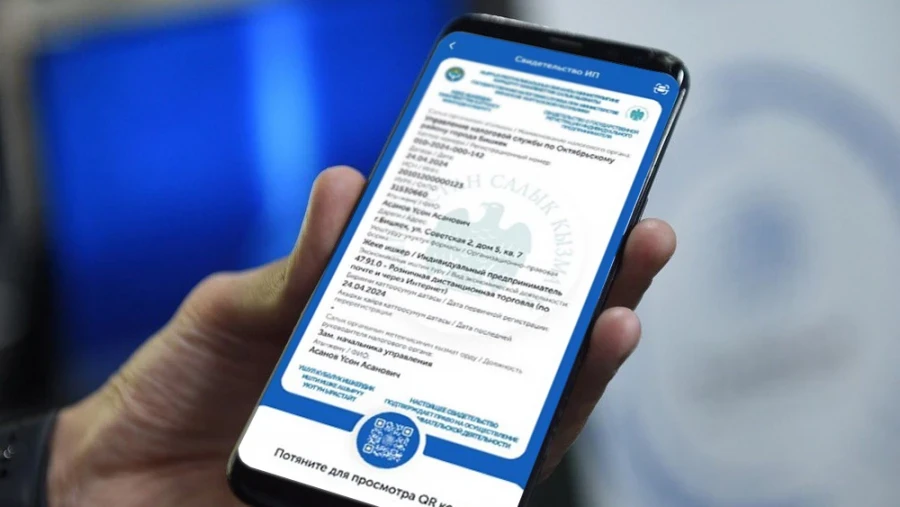

Digitalization of the State Registration Service: Online Re-registration Service for Individual Entrepreneurs Launched

Individual entrepreneurs no longer need to visit the tax office in person The State Tax Service of...

The Second Stage of Tax Service Reforms: How the KEZET System Will Replace Inspectors

Photo from the internet. Almambet Shykmamatov, Chairman of the Tax Service A year ago, the...

A meeting with entrepreneurs on the latest changes in tax legislation was held at the State Tax Service

The meeting discussed in detail the changes in tax legislation, as well as the digitalization of...

Tax Service of the Kyrgyz Republic: Online Re-registration Service for Individual Entrepreneurs Launched

Now individual entrepreneurs have the opportunity to submit applications for re-registration at...

All NGOs and parties are required to publish their income and assets online

Sadyr Japarov, the President of the Kyrgyz Republic, has signed a law concerning reporting for a...

In the Kyrgyz Republic, permissible load standards for women and workers under 18 years old have been approved.

The updated standards for maximum permissible physical loads for women and workers under 18 years...

In the jewelry sector, numerous problems have accumulated, including a high share of shadow turnover, - GNS

- Recently, President Sadyr Japarov approved the Decree "On Measures to Support Certain...

Kyrgyzstan and Kazakhstan Launch Pilot Project on Navigation Seals for Road Transportation

From December 1, 2025, to January 15, 2026, a pilot project initiated by the Tax Service of...

The GNS reminded candidates for deputies about the norms of tax legislation

The State Tax Service of the Kyrgyz Republic has reminded candidates for deputies of the Jogorku...

Special Zone and Unified Wallet of the EAS. What Will Change in the Tax Sphere in 2026

Starting from 2026, significant changes are expected in the tax sphere, affecting various...

Expanded list of NGOs required to submit consolidated information to the Tax Service

The State Tax Service of the Kyrgyz Republic has announced a significant expansion of the list of...

About 1.5 million citizens of Kyrgyzstan use the "Taxpayer's Cabinet"

The press service of the State Tax Service (STS) reported a significant increase in the number of...

The taxpayer's cabinet is used by 1 million 521.6 thousand taxpayers – GNS KR

According to the State Tax Service, as of December 16, 2025, 1 million 521.6 thousand taxpayers...

How the national digital ecosystem will work, specialists explained

The draft resolution "On Approving the Regulations for the National Digital Ecosystem"...

In Kyrgyzstan, taxpayers on a patent are exempt from visiting the GNS.

The State Tax Service of the Kyrgyz Republic has announced the simplification of the tax...

Business and Almambet Shykmamatov Discussed Tax Changes and Digitalization

In a recent meeting with business representatives, the head of the Tax Service, Alambet...

Navigation seals will be used for cargo transportation between the Kyrgyz Republic and the Republic of Kazakhstan. Currently in pilot phase.

According to the press service of the State Tax Service of the Kyrgyz Republic, this pilot project...

The Cabinet proposes to introduce new fees for actuaries and insurance brokers

The Cabinet of Ministers has presented for public discussion a draft resolution that provides for...

Nearly 21 billion soms in tax and insurance contribution debts collected in the Kyrgyz Republic

In the 11 months of 2025, Kyrgyzstan collected 20 billion 996.1 million soms in tax and insurance...

The Public Service Agency Plans to Introduce Paid Services for Businesses

The State Agency for Public Service and Local Self-Government plans to introduce paid services for...

When the taxpayer must enter purchase data into the EFS system themselves

The State Tax Service reminds that taxpayers using electronic invoices must independently enter...

The Tax Service of the Kyrgyz Republic clarified who should apply KKM, ETTN, and ESF

The Tax Service of the Kyrgyz Republic has provided information on the rules for the use of cash...

Ministry of Economic Development: The draft resolution on VAT has been revised taking into account the proposals from government agencies and the business community

The work on the project was carried out in coordination with government agencies and discussions...

Kyrgyzstan presented its experience in implementing artificial intelligence in healthcare at the WHO meeting

At the WHO plenary session "Artificial Intelligence for Health: Practical Solutions for a...

In Kyrgyzstan, rules for providing cremation services for deceased bodies have been developed.

For the first time in the history of Kyrgyzstan, a procedure for the operation of crematoria has...

Notaries Who Do Not Use Cash Register Machines May Lose Their Licenses

The President of the Kyrgyz Republic, Sadyr Japarov, has approved a law that amends a number of...

The Tax Service of Kyrgyzstan has implemented an online re-registration service for individual entrepreneurs.

The State Tax Service of Kyrgyzstan has launched a new online service that allows individual...