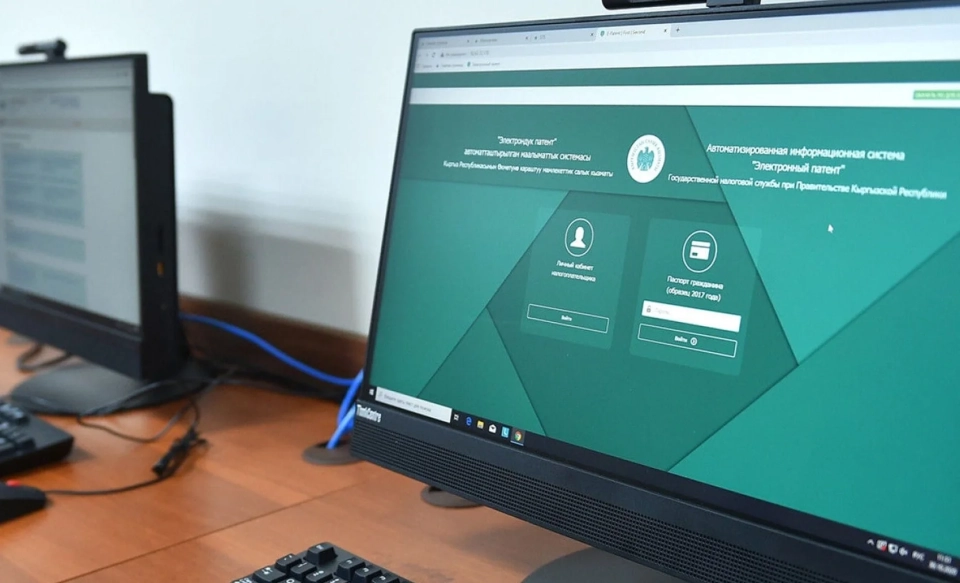

As of December 16, 2025, the State Tax Service of Kyrgyzstan reported that 1 million 521.6 thousand taxpayers have connected to the electronic service "Taxpayer's Cabinet." Of these, 98,507 are legal entities, and 1 million 423,152 are individuals.

Since the beginning of the year, the number of users has increased by 180,405 people.

Among them, 77.6 thousand taxpayers use the mobile application Salyk.kg to access the "Taxpayer's Cabinet."

The expansion of the service's functionality has made it and its mobile version universal tools for remote interaction. Users can submit reports, pay taxes online, and obtain certificates, reconciliation acts, and a range of other services without leaving their homes.

Over the past year, 15 new online services and improvements have been implemented in the "Taxpayer's Cabinet," including:

– a new online service for the reconciliation act of mutual settlements for insurance contributions and an updated module for reconciliation acts;

– an improved assistant for filling out the income tax and social insurance report (STI-161);

– automated creation of the NSP report;

– a new assistant for filling out the indirect tax report (FORM STI-123_5);

– an updated form for the indirect tax report (FORM STI-123_6);

– a service for obtaining certificates on taxpayer status (forms STI-024 and STI-025);

– automation of the issuance of residency certificates;

– launch of a service for the automatic generation of tax reports for individual entrepreneurs and legal entities under the unified tax;

– implementation of automatic property tax assessment;

– automatic formation of the payment amount based on data from the electronic report journal;

– online submission of notifications is available in the "EAEU" module;

– an online re-registration service for individual entrepreneurs has been implemented;

– launch of the "Set-off, Refund" module for accepting applications for the return of overpaid or mistakenly paid taxes;

– implementation of online registration for individuals through integration with the state registration authority;

– since July 1, all taxes and contributions are paid only through QR codes or payment codes, eliminating errors and manual intervention in the crediting of funds;

Additional projects in the field of fiscalization of tax procedures

As part of the fiscalization of tax procedures, the following projects have also been implemented:

– the implementation of fiscal software (FSO) has begun, which ensures the real-time transmission of data on cash receipts;

– a SMS notification system for citizens regarding tax debts has been launched;

– a feedback system "Pikirler" has been introduced, allowing taxpayers to assess the quality of service online;

– a pilot project for the implementation of the electronic system "Bazar" at the "Dordoy" market has been conducted.

The tax service plans to continue expanding online services, making them more accessible and simplifying the fulfillment of tax obligations for citizens.